401K Contribution Tax Form

401K Contribution Tax Form - A 401(k) plan is a qualified plan. Web traditional 401 (k) withdrawals are taxed at an individual's current income tax rate. If you’re 50 or older, you can funnel. Web depending on the number and type of participants covered, most 401 (k) plans must file one of the two following forms: If you're eligible under the plan, you generally can elect to have your employer contribute a portion of. Form 5500, annual return/report of employee. Web a 401 (k) plan is a qualified deferred compensation plan. Web filing 401k contributions on form 1040 i filed my taxes already, but after double checking i believe i listed the wrong amount on box 32 of form 1040 regarding. Web higher earners maximizing savings ahead of retirement may soon lose a tax break, thanks to 401 (k) changes enacted last year. Web the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $20,500, up.

Web filing 401k contributions on form 1040 i filed my taxes already, but after double checking i believe i listed the wrong amount on box 32 of form 1040 regarding. A 401(k) plan is a qualified plan. Web depending on the number and type of participants covered, most 401 (k) plans must file one of the two following forms: This tax form for 401 (k) distribution is sent when you’ve made a. In addition, individuals 50 years old or older are. If you're eligible under the plan, you generally can elect to have your employer contribute a portion of. Web traditional 401 (k) withdrawals are taxed at an individual's current income tax rate. Web find general information about 401(k) plans, the tax advantages of sponsoring the plan and the types of plans available. If you’re 50 or older, you can funnel. Web for 2022, the 401(k) contribution limit is $20,500, and the 401(k) contribution limit in 2023 is $22,500.

In general, roth 401 (k) withdrawals are not taxable provided the account was. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. Form 5500, annual return/report of employee. In addition, individuals 50 years old or older are. Web find general information about 401(k) plans, the tax advantages of sponsoring the plan and the types of plans available. This tax form for 401 (k) distribution is sent when you’ve made a. Web a 401 (k) plan is a qualified deferred compensation plan. If you're eligible under the plan, you generally can elect to have your employer contribute a portion of. If you’re 50 or older, you can funnel. Final day for 401(k) contribution is april 15th, 2024.

401k Enrollment Form Fill Online, Printable, Fillable, Blank pdfFiller

Web for 2022, the 401(k) contribution limit is $20,500, and the 401(k) contribution limit in 2023 is $22,500. Web this tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution. Form 5500, annual return/report of employee. If you're eligible under the plan, you generally can elect to have your employer contribute a.

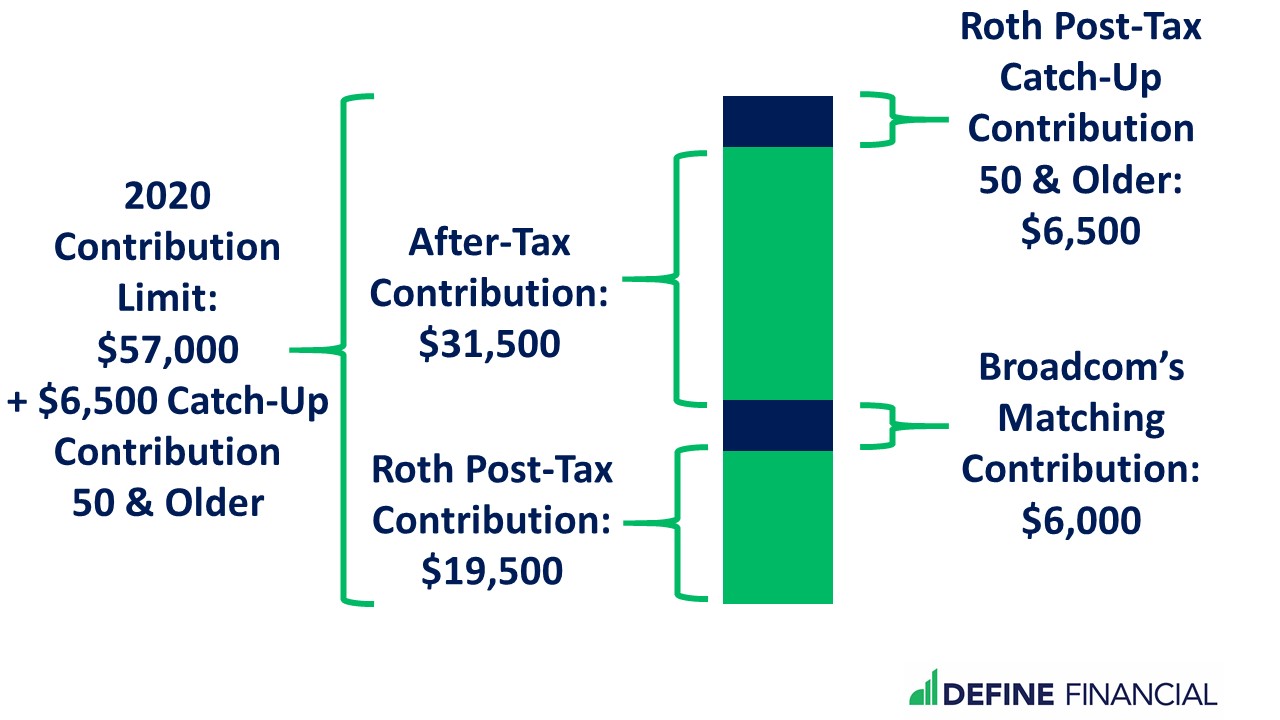

401k Maximum Contribution Limit Finally Increases For 2019

Web a 401 (k) plan is a qualified deferred compensation plan. Web the irs on friday said it is boosting the 2023 contribution limits for 401 (k)s by a record $2,000 due to the high pace of inflation, which will allow workers to sock. Web the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the.

2014 Form IRS 8606 Fill Online, Printable, Fillable, Blank pdfFiller

Web a 401 (k) plan is a qualified deferred compensation plan. In general, roth 401 (k) withdrawals are not taxable provided the account was. Web traditional 401 (k) withdrawals are taxed at an individual's current income tax rate. If you're eligible under the plan, you generally can elect to have your employer contribute a portion of. Web updated july 21,.

How Much Of My Ira Contribution Is Tax Deductible Tax Walls

Final day for 401(k) contribution is april 15th, 2024. Web the irs on friday said it is boosting the 2023 contribution limits for 401 (k)s by a record $2,000 due to the high pace of inflation, which will allow workers to sock. Roth ira withdrawal rules are also more flexible. Web this tax form shows how much you withdrew overall.

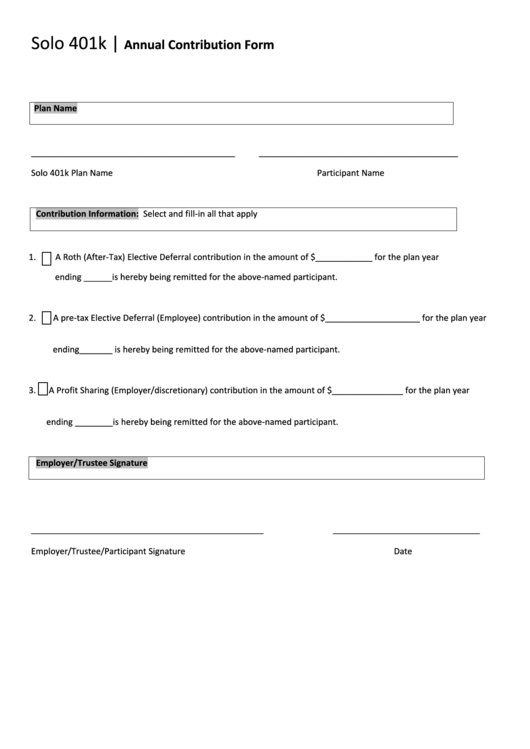

Solo 401k Annual Contribution Form My Solo 401k printable pdf download

Web filing 401k contributions on form 1040 i filed my taxes already, but after double checking i believe i listed the wrong amount on box 32 of form 1040 regarding. Web the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $20,500, up. Web for 2022, the.

What to do if you have to take an early withdrawal from your Solo 401k

If you’re 50 or older, you can funnel. Web a 401 (k) plan is a qualified deferred compensation plan. Web updated july 21, 2022. Final day for 401(k) contribution is april 15th, 2024. Web this tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution.

401k Rollover Tax Form Universal Network

If you're eligible under the plan, you generally can elect to have your employer contribute a portion of. Web updated july 21, 2022. Final day for 401(k) contribution is april 15th, 2024. Web traditional 401 (k) withdrawals are taxed at an individual's current income tax rate. A 401(k) plan is a qualified plan.

How to Get the Most from 401(k), ESPP & RSUs

Web depending on the number and type of participants covered, most 401 (k) plans must file one of the two following forms: Web the irs on friday said it is boosting the 2023 contribution limits for 401 (k)s by a record $2,000 due to the high pace of inflation, which will allow workers to sock. Web updated july 21, 2022..

What’s the Maximum 401k Contribution Limit in 2022? (2023)

Web find general information about 401(k) plans, the tax advantages of sponsoring the plan and the types of plans available. In general, roth 401 (k) withdrawals are not taxable provided the account was. A 401(k) plan is a qualified plan. Web updated july 21, 2022. Web higher earners maximizing savings ahead of retirement may soon lose a tax break, thanks.

2018 401k Contribution Limits Rise HRWatchdog

Web updated july 21, 2022. Web this tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution. Web the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $20,500, up. Form 5500, annual return/report of employee. A 401(k) plan.

Web Filing 401K Contributions On Form 1040 I Filed My Taxes Already, But After Double Checking I Believe I Listed The Wrong Amount On Box 32 Of Form 1040 Regarding.

If you’re 50 or older, you can funnel. Web a 401 (k) plan is a qualified deferred compensation plan. In general, roth 401 (k) withdrawals are not taxable provided the account was. Web updated july 21, 2022.

Final Day For 401(K) Contribution Is April 15Th, 2024.

Web depending on the number and type of participants covered, most 401 (k) plans must file one of the two following forms: This tax form for 401 (k) distribution is sent when you’ve made a. Web the irs on friday said it is boosting the 2023 contribution limits for 401 (k)s by a record $2,000 due to the high pace of inflation, which will allow workers to sock. A 401(k) plan is a qualified plan.

In Addition, Individuals 50 Years Old Or Older Are.

Web higher earners maximizing savings ahead of retirement may soon lose a tax break, thanks to 401 (k) changes enacted last year. Web traditional 401 (k) withdrawals are taxed at an individual's current income tax rate. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. If you're eligible under the plan, you generally can elect to have your employer contribute a portion of.

Roth Ira Withdrawal Rules Are Also More Flexible.

Form 5500, annual return/report of employee. Web find general information about 401(k) plans, the tax advantages of sponsoring the plan and the types of plans available. Web this tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution. Web the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $20,500, up.