3Rd Party Authorization Form

3Rd Party Authorization Form - Web you can grant a third party authorization to help you with federal tax matters. Web the undersigned, on behalf of the third party, represents that: Authorization to disclose personal information to a third party. The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. Instructions for completing the third party letter of authorization (loa) Web completed forms may be sent to the division at: Third party letter of authorization: Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records. Use this form to authorize individuals or companies (such as employers or credential services) to contact the department on your behalf regarding your application. Web if authorized party listed on this form is the result of power of attorney, administrator or executor of an estate, proper documentation establishing the authority must accompany this form when submitted authorized party or organization:

Employers (employee, sole proprietor, partner or director) to authorise outsourced service providers as their ep eservice or wp online eservices administrators or users. Instructions for completing the third party letter of authorization (loa) Name(s) shown on return your social security number you must use this form to authorize the irs to contact a third party on your behalf or to revoke that authorization. Web completed forms may be sent to the division at: Use this form to authorize individuals or companies (such as employers or credential services) to contact the department on your behalf regarding your application. The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. Authorization to disclose personal information to a third party. The form is important to be presented by the representative before any type of transaction and request can be executed. Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records. Web the undersigned, on behalf of the third party, represents that:

Authorization to disclose personal information to a third party. Web the undersigned, on behalf of the third party, represents that: And (ii) the third party information provided above is true and correct. Name(s) shown on return your social security number you must use this form to authorize the irs to contact a third party on your behalf or to revoke that authorization. Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records. Instructions for completing the third party letter of authorization (loa) Web a third party authorization form is a document which is used by an individual to assign and formally acknowledge a third party representative to act on his behalf. Web you can grant a third party authorization to help you with federal tax matters. Use this form to authorize individuals or companies (such as employers or credential services) to contact the department on your behalf regarding your application. Third party letter of authorization:

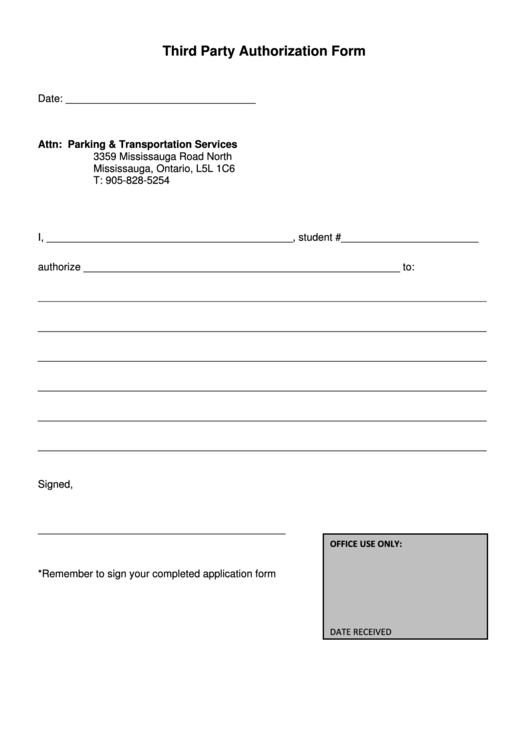

FREE 9+ Sample Third Party Authorization Letter Templates in PDF MS Word

Web completed forms may be sent to the division at: Use this form to authorize individuals or companies (such as employers or credential services) to contact the department on your behalf regarding your application. Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records. Third party letter of authorization: Web the undersigned,.

FREE 9+ Sample Third Party Authorization Letter Templates in PDF MS Word

Employers (employee, sole proprietor, partner or director) to authorise outsourced service providers as their ep eservice or wp online eservices administrators or users. Web a third party authorization form is a document which is used by an individual to assign and formally acknowledge a third party representative to act on his behalf. The form is important to be presented by.

FREE 8+ Third Party Authorization Forms in PDF MS Word

Authorization to disclose personal information to a third party. The form is important to be presented by the representative before any type of transaction and request can be executed. Web the undersigned, on behalf of the third party, represents that: Third party letter of authorization: Web completed forms may be sent to the division at:

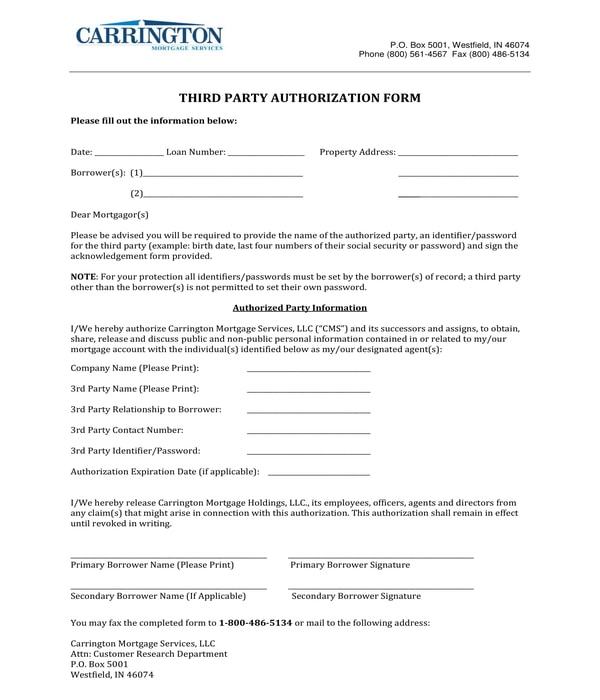

Third Party Authorization Form Sample printable pdf download

Web completed forms may be sent to the division at: Authorization to disclose personal information to a third party. Web if authorized party listed on this form is the result of power of attorney, administrator or executor of an estate, proper documentation establishing the authority must accompany this form when submitted authorized party or organization: Name(s) shown on return your.

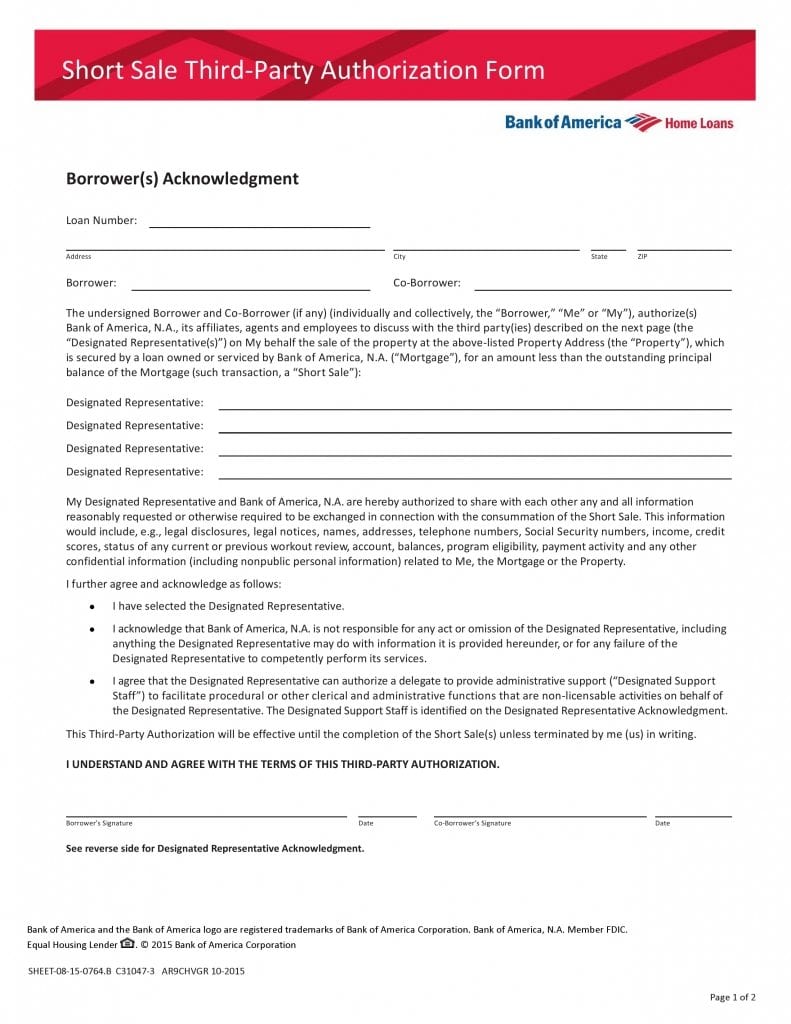

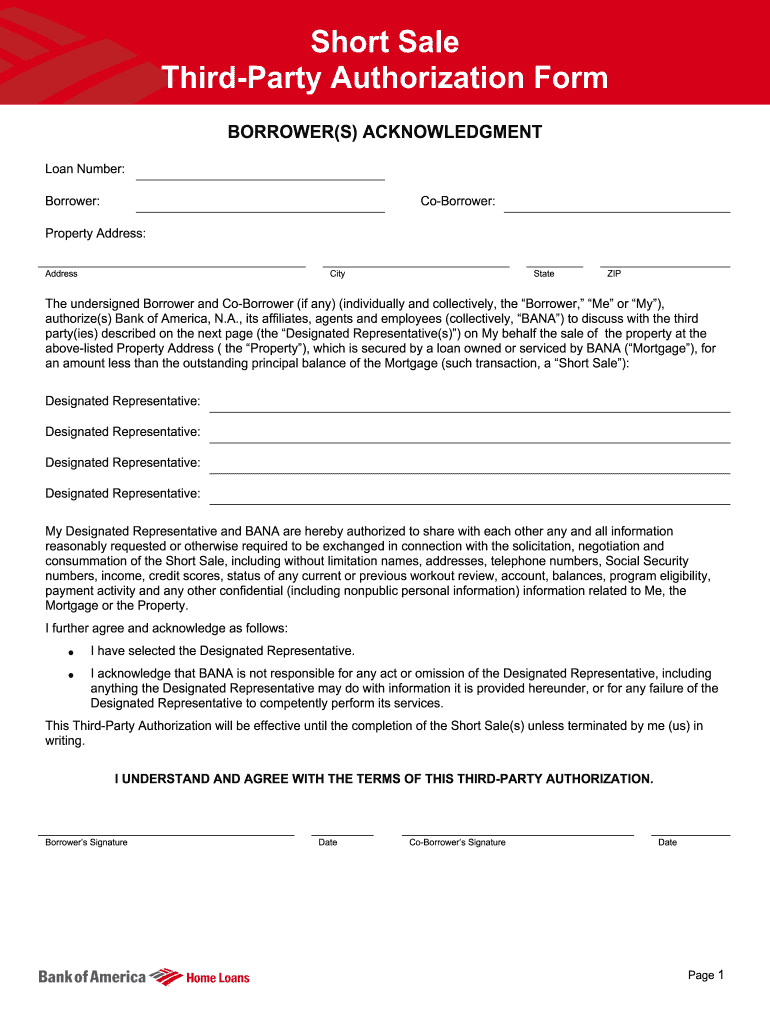

Free Bank of America Third Party Authorization Form PDF Template

Use this form to authorize individuals or companies (such as employers or credential services) to contact the department on your behalf regarding your application. Employers (employee, sole proprietor, partner or director) to authorise outsourced service providers as their ep eservice or wp online eservices administrators or users. Los angeles county dpw land development division 900 south fremont ave, 3rd fl.

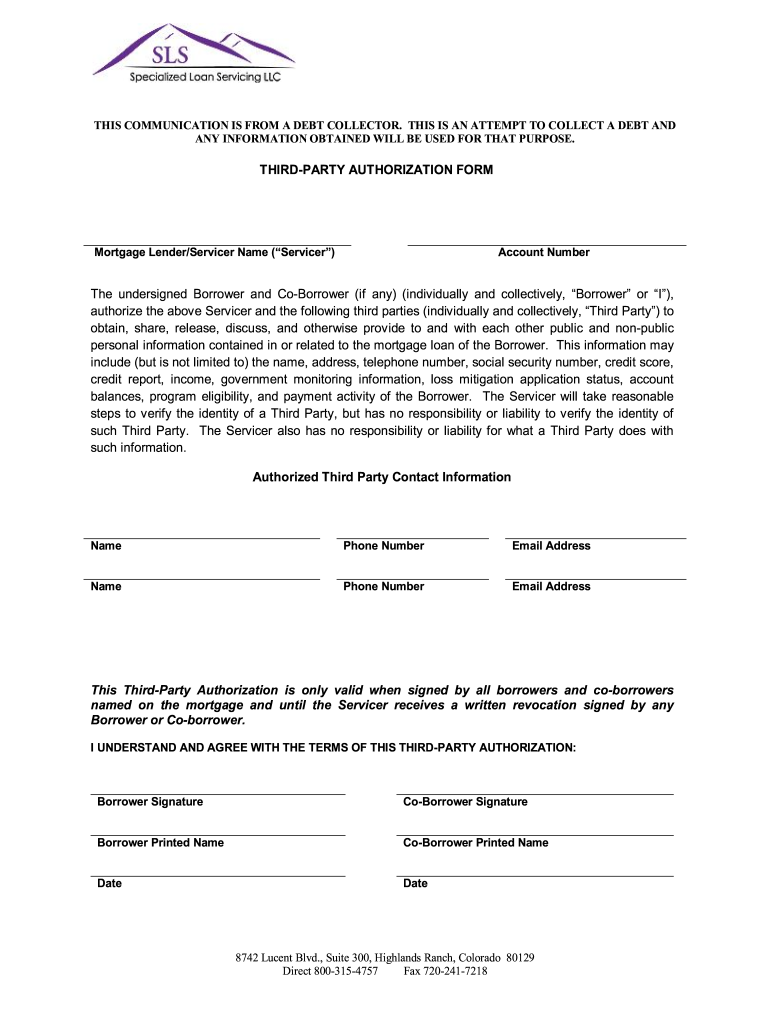

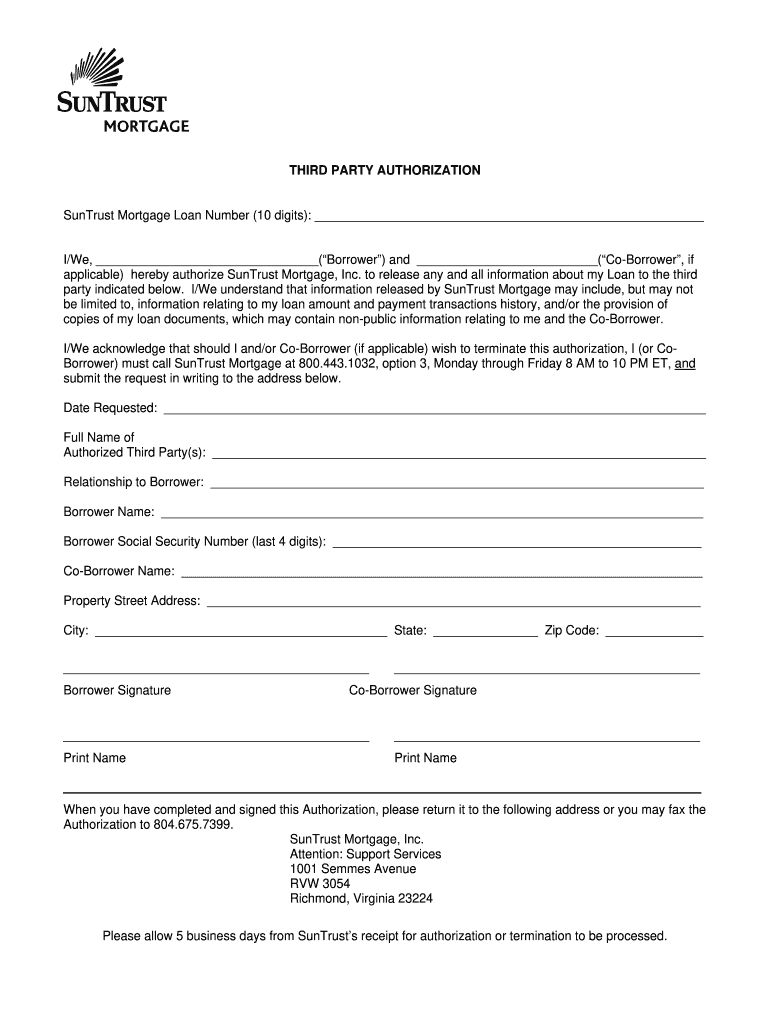

Sls Third Party Authorization Form Fill Online, Printable, Fillable

Instructions for completing the third party letter of authorization (loa) Web the undersigned, on behalf of the third party, represents that: Web a third party authorization form is a document which is used by an individual to assign and formally acknowledge a third party representative to act on his behalf. Name(s) shown on return your social security number you must.

Bank of America Third Party Authorization Form Fill Out and Sign

(i) it is in compliance with regulation o (mortgage assistance relief services), if applicable, and all other applicable laws and regulations; The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. Web completed forms may be sent to the division at: Web if authorized party listed on this form is.

Third Party Authorization Form Fill Out and Sign Printable PDF

Web a third party authorization form is a document which is used by an individual to assign and formally acknowledge a third party representative to act on his behalf. (i) it is in compliance with regulation o (mortgage assistance relief services), if applicable, and all other applicable laws and regulations; Web the undersigned, on behalf of the third party, represents.

Third Authorization Fill Online, Printable, Fillable, Blank pdfFiller

Employers (employee, sole proprietor, partner or director) to authorise outsourced service providers as their ep eservice or wp online eservices administrators or users. Authorization to disclose personal information to a third party. Web you can grant a third party authorization to help you with federal tax matters. The third party can be a family member or friend, a tax professional,.

FREE 9+ Sample Third Party Authorization Letter Templates in PDF MS Word

The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. Name(s) shown on return your social security number you must use this form to authorize the irs to contact a third party on your behalf or to revoke that authorization. Third party letter of authorization: Web the undersigned, on behalf.

Web You Can Grant A Third Party Authorization To Help You With Federal Tax Matters.

Instructions for completing the third party letter of authorization (loa) Authorization to disclose personal information to a third party. Name(s) shown on return your social security number you must use this form to authorize the irs to contact a third party on your behalf or to revoke that authorization. Web if authorized party listed on this form is the result of power of attorney, administrator or executor of an estate, proper documentation establishing the authority must accompany this form when submitted authorized party or organization:

The Third Party Can Be A Family Member Or Friend, A Tax Professional, Attorney Or Business, Depending On The Authorization.

And (ii) the third party information provided above is true and correct. Employers (employee, sole proprietor, partner or director) to authorise outsourced service providers as their ep eservice or wp online eservices administrators or users. Web the undersigned, on behalf of the third party, represents that: Web a third party authorization form is a document which is used by an individual to assign and formally acknowledge a third party representative to act on his behalf.

(I) It Is In Compliance With Regulation O (Mortgage Assistance Relief Services), If Applicable, And All Other Applicable Laws And Regulations;

Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records. The form is important to be presented by the representative before any type of transaction and request can be executed. Los angeles county dpw land development division 900 south fremont ave, 3rd fl alhambra, ca 91803 letter of authorization please be advised that _____(owner/applicant Use this form to authorize individuals or companies (such as employers or credential services) to contact the department on your behalf regarding your application.

Web Completed Forms May Be Sent To The Division At:

Third party letter of authorization: