2290 Form Nc

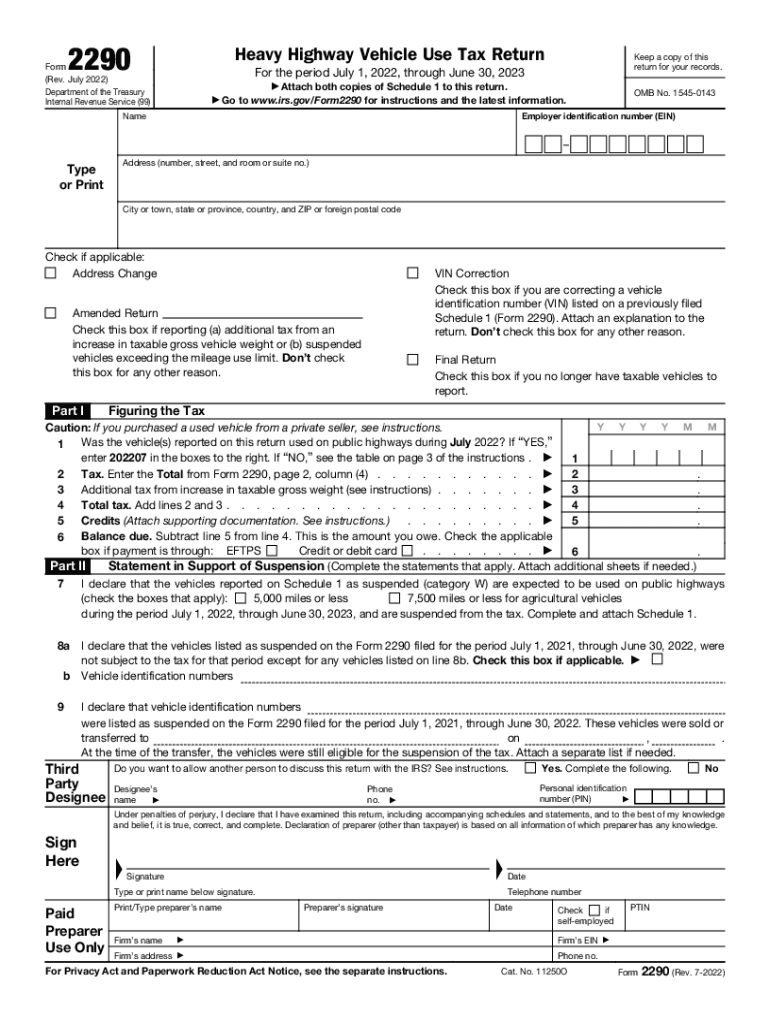

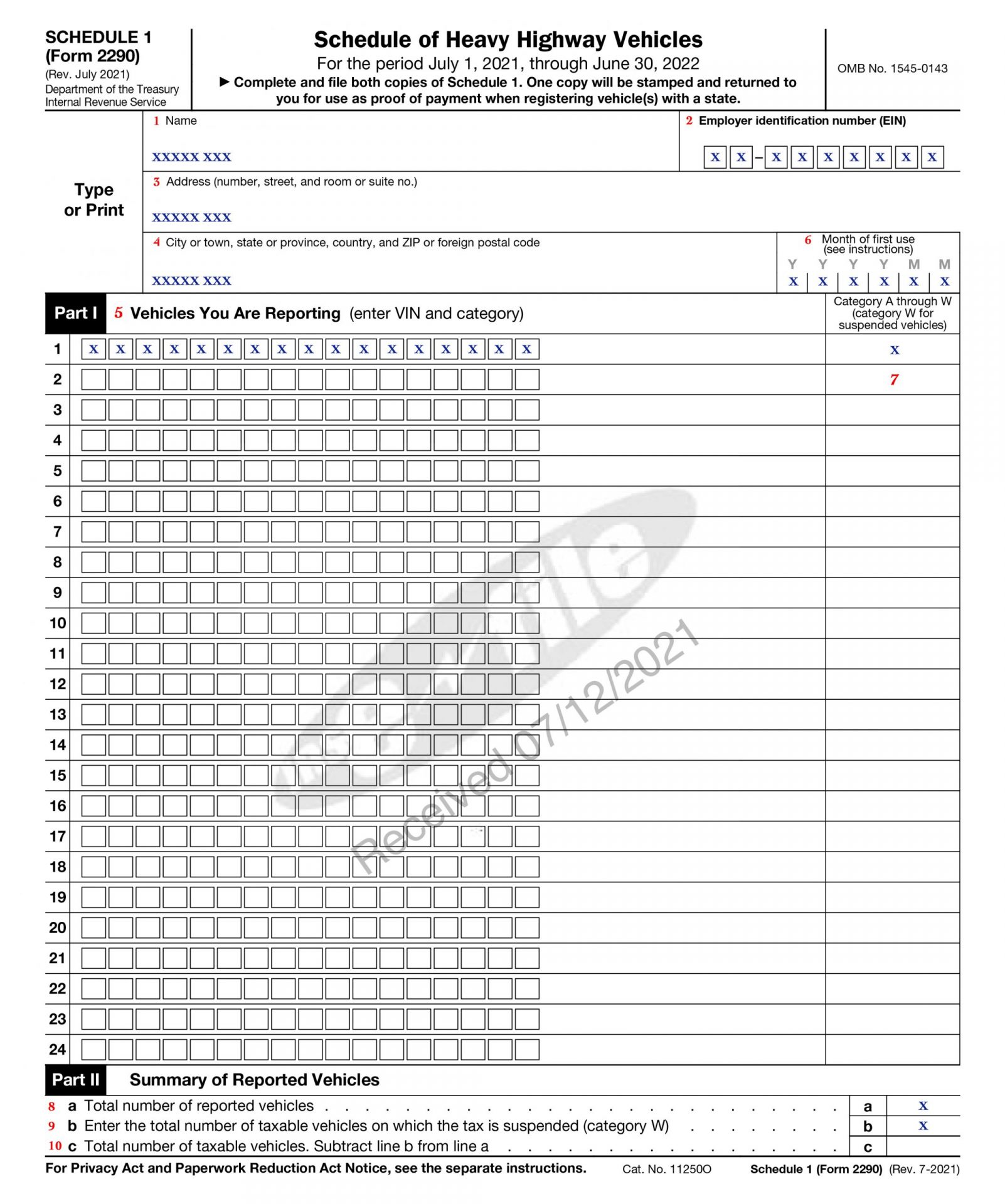

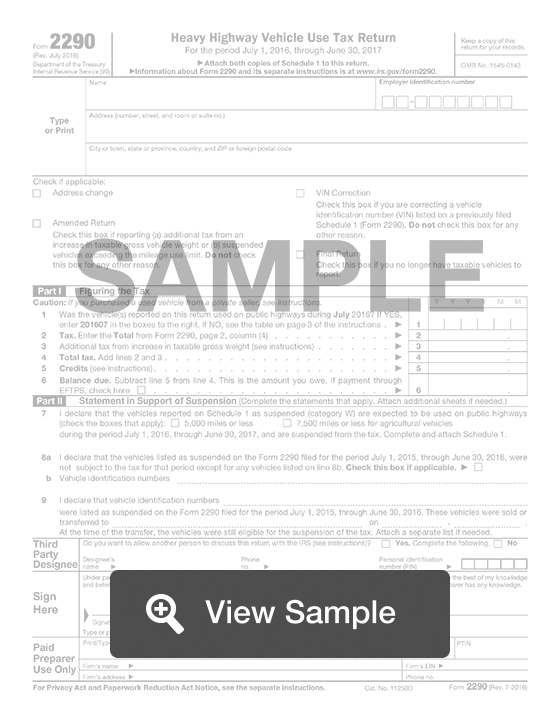

2290 Form Nc - Ad file form 2290 for vehicles weighing 55,000 pounds or more. Web federal heavy vehicle use tax (form 2290) power of attorneys topics tax and tag together changes in cab cards irp office locations irp forms of payment questions. If you are filing a form 2290 paper return: Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay on road. Web find out where to mail your completed form. Use coupon code get20b & get 20% off. The tax year is for july 1, 20xx through june 30, 20xx. Web get schedule 1 in minutes file form 2290 now hvut when vehicles with registered gross weight equal to or exceeding 55,000 pounds use public highways, the owners pay heavy. Web form 2290 filed listing tax suspended vehicles ± category w subsequent form 2290 filed must verify vehicle was used less than 5,000 miles if 5,000 miles exceeded, tax is due. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,.

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered,. Web about form 2290, heavy highway vehicle use tax return. Ad file form 2290 for vehicles weighing 55,000 pounds or more. The tax year is for july 1, 20xx through june 30, 20xx. With full payment and that payment is not drawn from. Web form 2290 filed listing tax suspended vehicles ± category w subsequent form 2290 filed must verify vehicle was used less than 5,000 miles if 5,000 miles exceeded, tax is due. Web federal heavy vehicle use tax (form 2290) power of attorneys topics tax and tag together changes in cab cards irp office locations irp forms of payment questions. We've been in the trucking business for over 67+ years. Ad file form 2290 easily with eform2290.com. • filing is for taxable.

We've been in the trucking business for over 67+ years. Generally the 2290 taxes are reported from july and. • filing is for taxable. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. The tax year is for july 1, 20xx through june 30, 20xx. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay on road. With full payment and that payment is not drawn from. Easy, fast, secure & free to try. Do your truck tax online & have it efiled to the irs! Ad file form 2290 easily with eform2290.com.

Form 2290 Rev July Heavy Highway Vehicle Use Tax Return Fill Out and

Must provide at least 3 from the. • vehicles with a taxable gross weight of 55,000. The tax year is for july 1, 20xx through. We've been in the trucking business for over 67+ years. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the.

20232024 Form 2290 Generator Fill, Create & Download 2290

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Use coupon code get20b & get 20% off. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Ad file form 2290 for vehicles weighing 55,000 pounds or more. With full payment and that payment is not drawn from. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Do your truck tax online & have it efiled to the irs! Generally the 2290 taxes are reported from july and. Ad file form 2290 easily with eform2290.com. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later).

Irs 2290 Form Instructions Form Resume Examples a6YnOeWVBg

Web find out where to mail your completed form. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Use coupon code get20b & get 20% off. We've been in the trucking business for over 67+ years. With.

File 20222023 Form 2290 Electronically 2290 Schedule 1

Must provide at least 3 from the. Web about form 2290, heavy highway vehicle use tax return. Web federal heavy vehicle use tax (form 2290) power of attorneys topics tax and tag together changes in cab cards irp office locations irp forms of payment questions. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs..

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

Ad file form 2290 for vehicles weighing 55,000 pounds or more. Easy, fast, secure & free to try. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. With full payment and that payment is not drawn from..

Ssurvivor Form 2290 Irs

With full payment and that payment is not drawn from. Do your truck tax online & have it efiled to the irs! Use coupon code get20b & get 20% off. Web find out where to mail your completed form. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay.

√99以上 2290 form irs.gov 6319142290 form irs.gov

We've been in the trucking business for over 67+ years. We've been in the trucking business for over 67+ years. With full payment and that payment is not drawn from. Web federal heavy vehicle use tax (form 2290) power of attorneys topics tax and tag together changes in cab cards irp office locations irp forms of payment questions. Web get.

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Ad file form 2290 for vehicles weighing 55,000 pounds or more. Web federal heavy vehicle use tax (form 2290) power of attorneys topics tax and tag together changes in cab cards irp office locations irp.

The Tax Year Is For July 1, 20Xx Through June 30, 20Xx.

Figure and pay the tax due on highway motor vehicles used during the period with a. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web federal heavy vehicle use tax (form 2290) power of attorneys topics tax and tag together changes in cab cards irp office locations irp forms of payment questions. With full payment and that payment is not drawn from.

If You Are Filing A Form 2290 Paper Return:

Ad file form 2290 for vehicles weighing 55,000 pounds or more. Web get schedule 1 in minutes file form 2290 now hvut when vehicles with registered gross weight equal to or exceeding 55,000 pounds use public highways, the owners pay heavy. Web form 2290 filed listing tax suspended vehicles ± category w subsequent form 2290 filed must verify vehicle was used less than 5,000 miles if 5,000 miles exceeded, tax is due. Must provide at least 3 from the.

Web File Form 2290 For Any Taxable Vehicles First Used On A Public Highway During Or After July 2022 By The Last Day Of The Month Following The Month Of First Use.

Ad file form 2290 for vehicles weighing 55,000 pounds or more. The tax year is for july 1, 20xx through. Web about form 2290, heavy highway vehicle use tax return. • filing is for taxable.

Ad Get Schedule 1 In Minutes, Your Form 2290 Is Efiled Directly To The Irs.

Web find out where to mail your completed form. Use coupon code get20b & get 20% off. Web • applicant must be able to demonstrate residency in north carolina or have an. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered,.