2022 Virginia Form 760 Instructions

2022 Virginia Form 760 Instructions - (if $150 or less, you are not required to file form 760f) 3. Schedule adj adjustments to income on form 760. Web file now with turbotax related virginia individual income tax forms: This form is for income earned in tax year 2022, with. Click iat notice to review the details. Web at present, virginia tax does not support international ach transactions (iat). Web form 760pmt is a virginia individual income tax form. Web follow the simple instructions below: Web virginia resident form 760 *va0760120888* individual income tax return. Corporation and pass through entity tax.

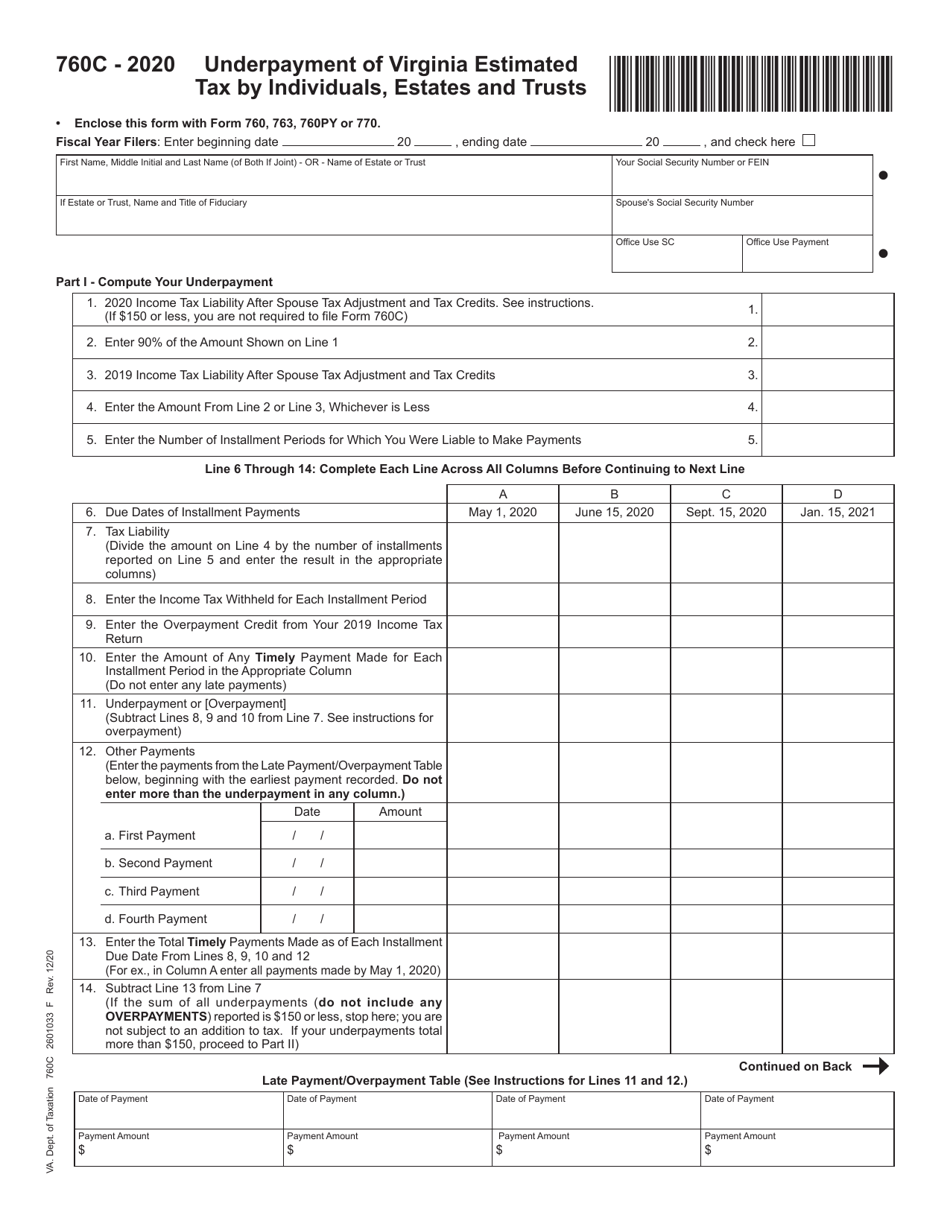

Web visit www.tax.virginia.gov for details. Click iat notice to review the details. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. Web 2022 virginia schedule cr instructions for use with forms 760, 760py, 763, and 765 general information • for information or to obtain forms, visit www.tax.virginia.gov. Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income. Web here's how it works 02. Enter 2021 income tax liability after the spouse. This form is for income earned in tax year 2022, with. Web follow the simple instructions below: If your tax is underpaid as of any installment due date, you.

Web visit www.tax.virginia.gov for details. (if $150 or less, you are not required to file form 760f) 3. Please note, a $35 fee may be assessed if your payment is. Web 4 rows generally, you are required to make payments of estimated income tax if your estimated virginia. Web follow the simple instructions below: Tax blank completion can become a serious challenge and severe headache if no appropriate assistance offered. 07/21 your first name m.i. Share your form with others send. See line 9 and instructions. Web file now with turbotax we last updated virginia form 760 in january 2023 from the virginia department of taxation.

VA 760 Instructions 2017 Fill out Tax Template Online US Legal Forms

Click iat notice to review the details. Corporation and pass through entity tax. Web file now with turbotax we last updated virginia form 760 in january 2023 from the virginia department of taxation. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. If your tax is underpaid as.

VA DoT 760ES 2019 Fill out Tax Template Online US Legal Forms

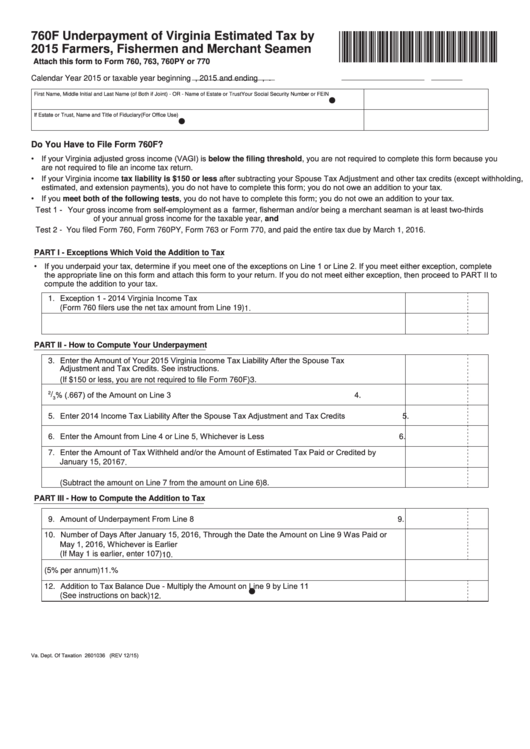

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web file now with turbotax we last updated virginia form 760 in january 2023 from the virginia department of taxation. Enter 66 2/ 3% (.667) of the amount on line 3 4. (if $150 or less, you are not required to.

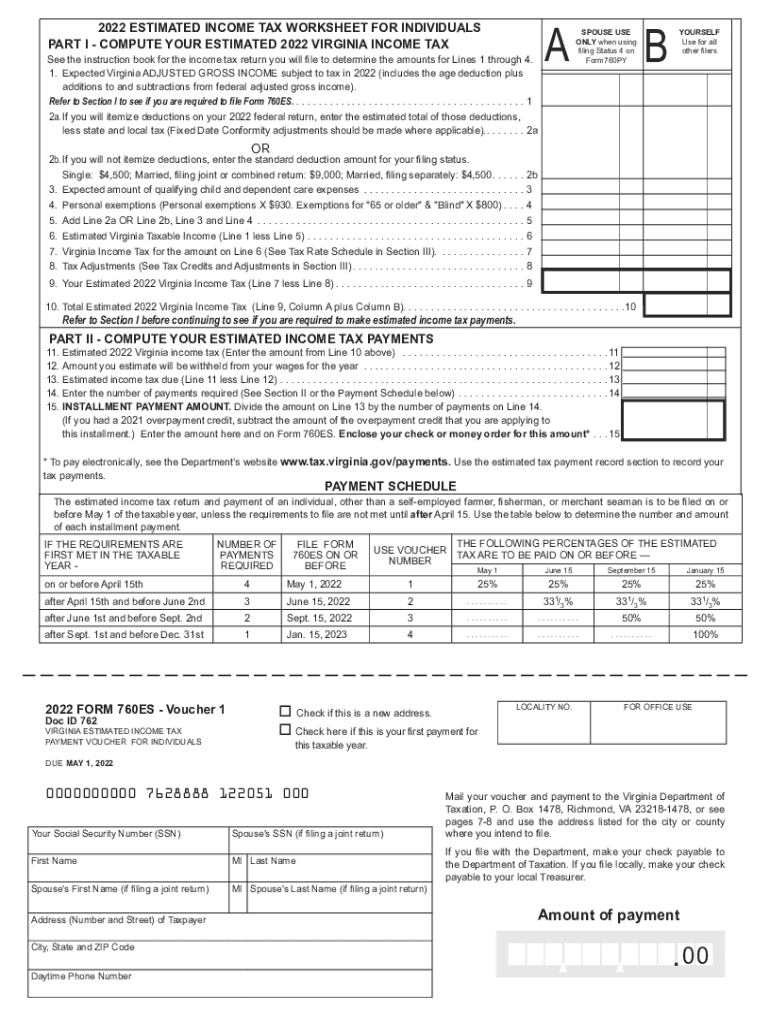

2022 Form VA DoT 760ES Fill Online, Printable, Fillable, Blank pdfFiller

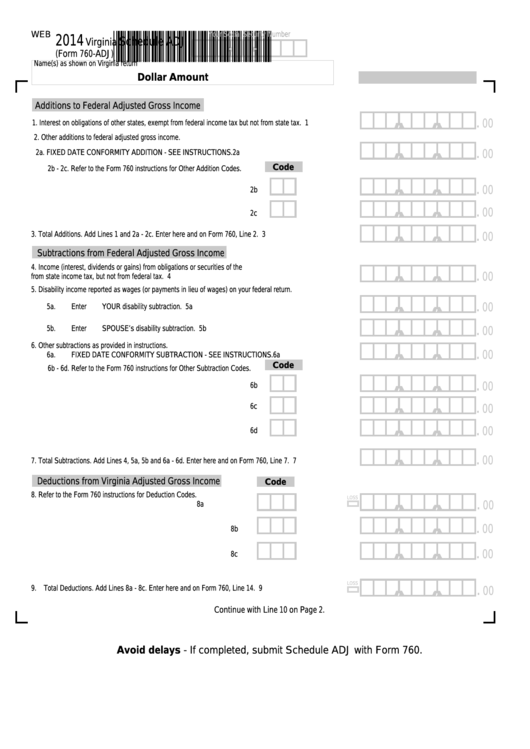

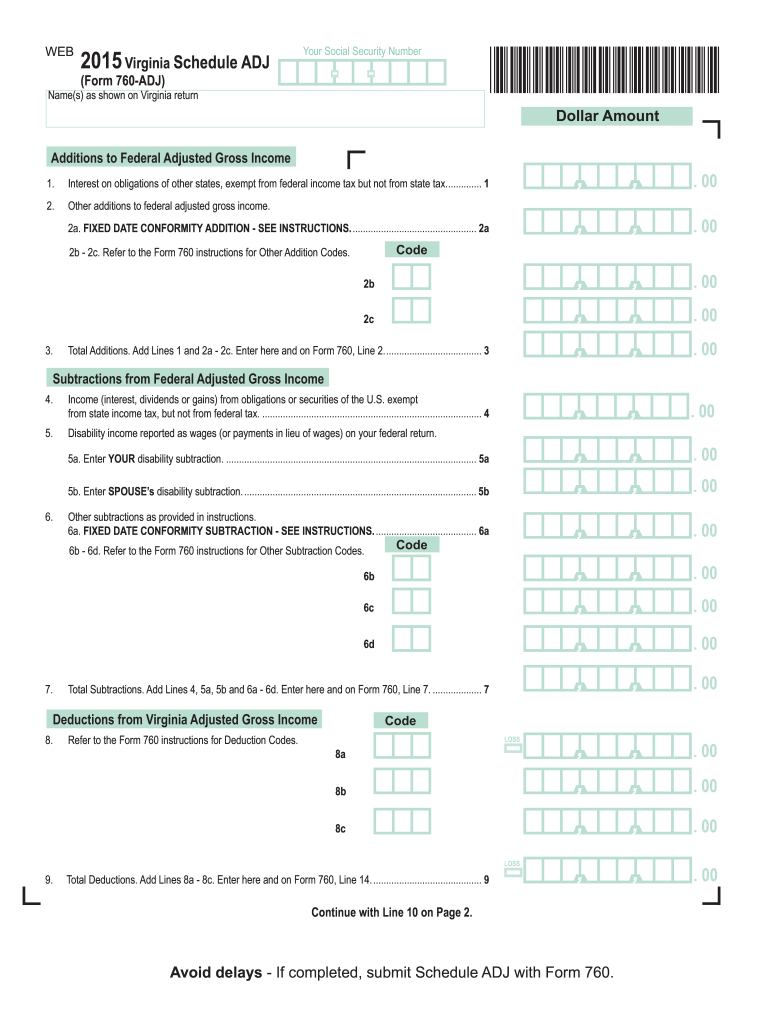

Web find forms & instructions by category. Enter 2021 income tax liability after the spouse. Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. If your tax is underpaid as of any installment due date, you. Web we last updated the virginia income adjustments schedule in january 2023, so this.

Top 22 Virginia Form 760 Templates free to download in PDF format

Web file now with turbotax related virginia individual income tax forms: Enter 2021 income tax liability after the spouse. Web 4 rows generally, you are required to make payments of estimated income tax if your estimated virginia. Please note, a $35 fee may be assessed if your payment is. This form is for income earned in tax year 2022, with.

Fillable Virginia Schedule Adj (Form 760Adj) Federal Adjusted Gross

Web this booklet includes instructions for filling out and filing your form 760 income tax return. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. Web 2022 virginia schedule cr instructions for use with forms 760, 760py, 763, and 765 general information • for information or to obtain.

2015 Form VA 760ADJ Fill Online, Printable, Fillable, Blank pdfFiller

07/21 your first name m.i. Web visit www.tax.virginia.gov for details. Virginia form 760 *va0760122888* resident income tax return. Web at present, virginia tax does not support international ach transactions (iat). If your tax is underpaid as of any installment due date, you.

Virginia Tax Instructions Form Fill Out and Sign Printable PDF

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. See line 9 and instructions. Schedule adj adjustments to income on form 760. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. If your tax is underpaid as of.

Form 760C Download Fillable PDF or Fill Online Underpayment of Virginia

Please note, a $35 fee may be assessed if your payment is. Extension for filing income tax returns: Web 2022 virginia schedule cr instructions for use with forms 760, 760py, 763, and 765 general information • for information or to obtain forms, visit www.tax.virginia.gov. Web find forms & instructions by category. Enter 66 2/ 3% (.667) of the amount on.

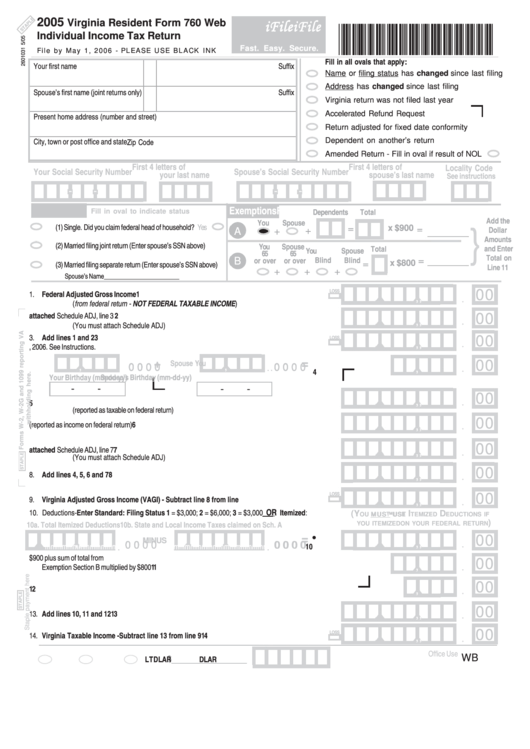

Virginia Resident Form 760 Web Individual Tax Return 2005

Schedule adj adjustments to income on form 760. Extension for filing income tax returns: Please note, a $35 fee may be assessed if your payment is. Web visit www.tax.virginia.gov for details. Web we last updated the virginia income adjustments schedule in january 2023, so this is the latest version of schedule adj, fully updated for tax year 2022.

VA 760 Instructions 20212022 Fill and Sign Printable Template Online

Enter 2021 income tax liability after the spouse. Click iat notice to review the details. Schedule adj adjustments to income on form 760. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. 07/21 your first name m.i.

Extension For Filing Income Tax Returns:

Web form 760pmt is a virginia individual income tax form. Click iat notice to review the details. Web 760 resident individual income tax return. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.

Web Follow The Simple Instructions Below:

Web virginia resident form 760 *va0760120888* individual income tax return. Web find forms & instructions by category. Virginia form 760 *va0760122888* resident income tax return. Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates.

Web At Present, Virginia Tax Does Not Support International Ach Transactions (Iat).

Enter 66 2/ 3% (.667) of the amount on line 3 4. Web we last updated the virginia income adjustments schedule in january 2023, so this is the latest version of schedule adj, fully updated for tax year 2022. Web file now with turbotax we last updated virginia form 760 in january 2023 from the virginia department of taxation. Enter 2021 income tax liability after the spouse.

Web Visit Www.tax.virginia.gov For Details.

Tax blank completion can become a serious challenge and severe headache if no appropriate assistance offered. This form is for income earned in tax year 2022, with. Schedule adj adjustments to income on form 760. Please note, a $35 fee may be assessed if your payment is.