2022 Form 2210

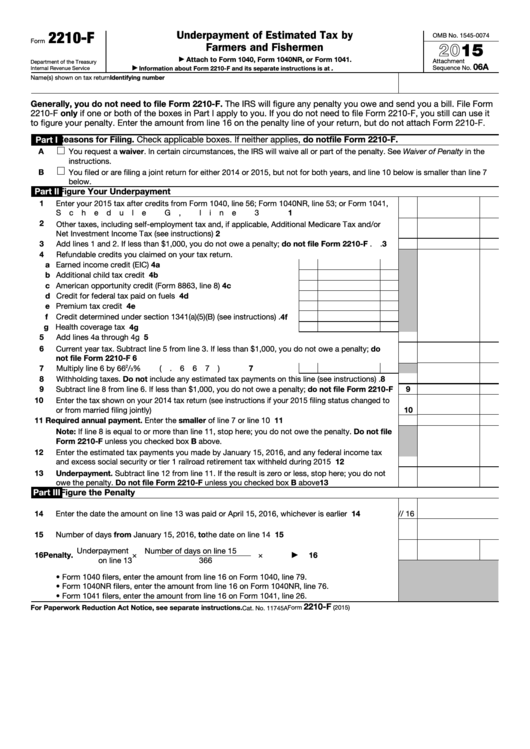

2022 Form 2210 - The irs will generally figure your penalty for you and you should not file form 2210. Web who must file irs form 2210? Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to calculate. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web 2020 attachment sequence no. Underpayment of estimated tax by farmers and fishermen. The top of form 2210 contains a flowchart to help a taxpayer determine if they are required to file the form. Web you only need to file form 2210 if one or more boxes in part ii apply to you. Complete, edit or print tax forms instantly.

1738 w 4th st, brooklyn, ny 11223. According to the flow chart. In order to complete schedule ai in the taxact program, you first need to complete the underpayment. Web sold jun 3, 2022. Underpayment of estimated tax by farmers and fishermen. Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Complete lines 1 through 7 below. Try it for free now!

In order to complete schedule ai in the taxact program, you first need to complete the underpayment. The irs will generally figure your penalty for you and you should not file form 2210. 06 name(s) shown on tax return identifying number do you have to file form 2210? Web nearby homes similar to 23710 22nd st ne have recently sold between $590k to $1m at an average of $385 per square foot. According to the flow chart. Listing by momentum real estate llc. Complete lines 1 through 7 below. Underpayment of estimated tax by farmers and fishermen. Upload, modify or create forms. You may use the short method if:

Ssurvivor Form 2210 Instructions 2020

Try it for free now! Web see waiver of penalty in instructions for form 2210 pdf. Web 2020 attachment sequence no. Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. Complete, edit or print tax forms instantly.

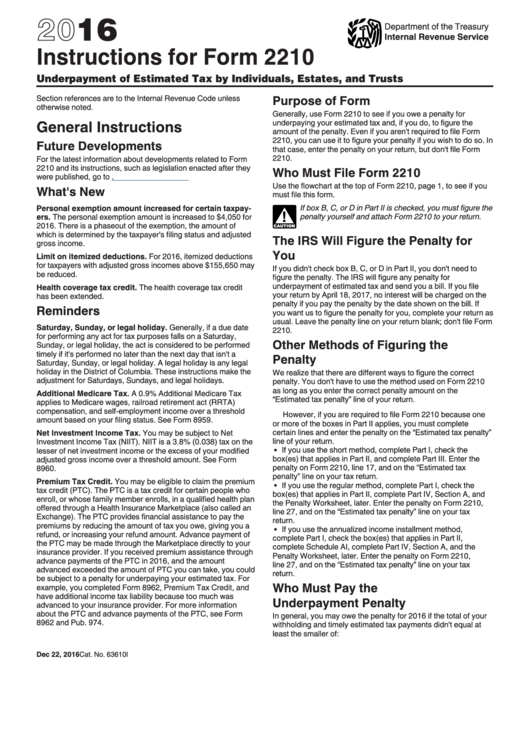

Instructions for IRS Form 2210 Underpayment of Estimated Tax by

The top of form 2210 contains a flowchart to help a taxpayer determine if they are required to file the form. Ad upload, modify or create forms. Department of the treasury internal revenue service. According to the flow chart. Department of the treasury internal revenue service.

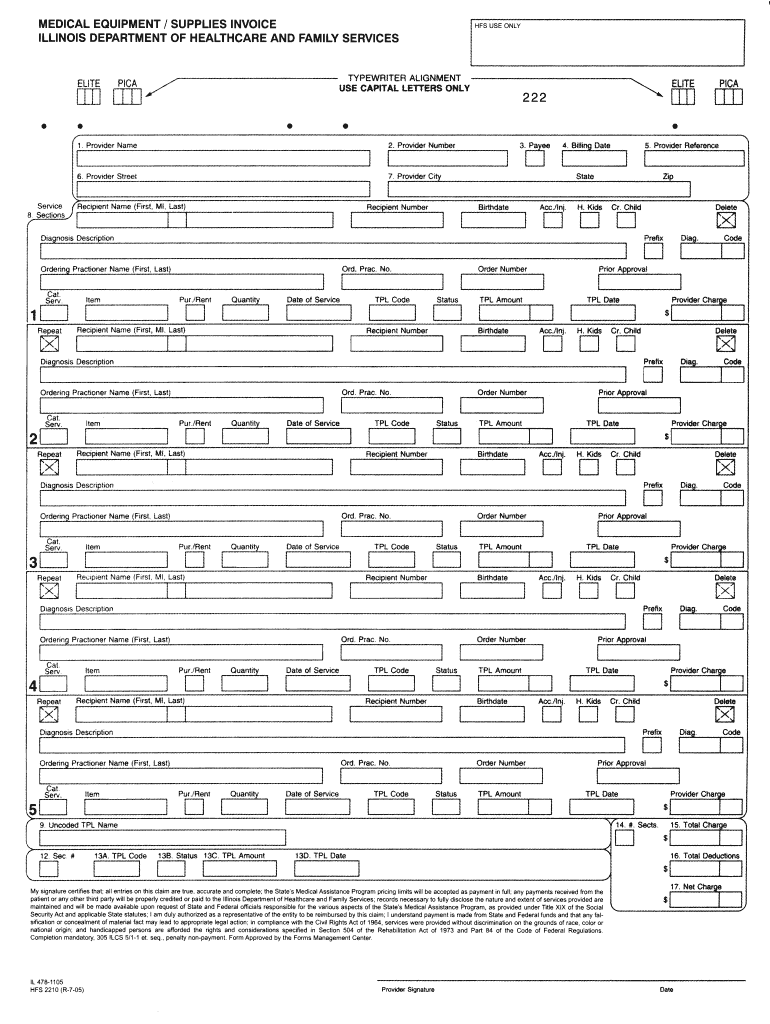

Hfs 2210 Fill Fill Out and Sign Printable PDF Template signNow

Web nearby homes similar to 23710 22nd st ne have recently sold between $590k to $1m at an average of $385 per square foot. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. The irs will calculate your. Underpayment of estimated tax by individuals, estates, and trusts. This form is.

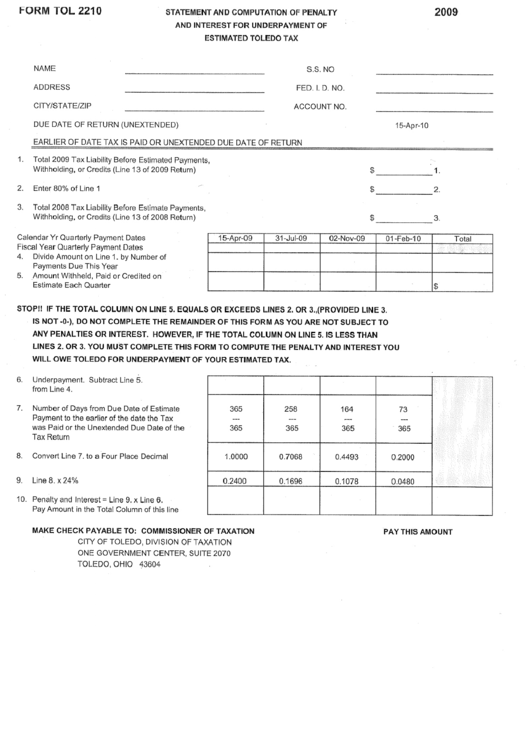

Form Tol 2210 Statement And Computation Of Penalty And Interest

Is line 4 or line 7 less than. If box a or e applies, you do not need to figure your penalty. Web you only need to file form 2210 if one or more boxes in part ii apply to you. 1738 w 4th st, brooklyn, ny 11223. Web nearby homes similar to 23710 22nd st ne have recently sold.

2210 Form 2022 2023

Listing by momentum real estate llc. Web you only need to file form 2210 if one or more boxes in part ii apply to you. Web for form 2210, part iii, section b—figure the penalty), later. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. The irs will generally figure.

Ssurvivor Irs Form 2210 For 2018

Underpayment of estimated tax by individuals, estates, and trusts. The top of form 2210 contains a flowchart to help a taxpayer determine if they are required to file the form. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. Web irs form 2210, underpayment of estimated tax by individuals, estates,.

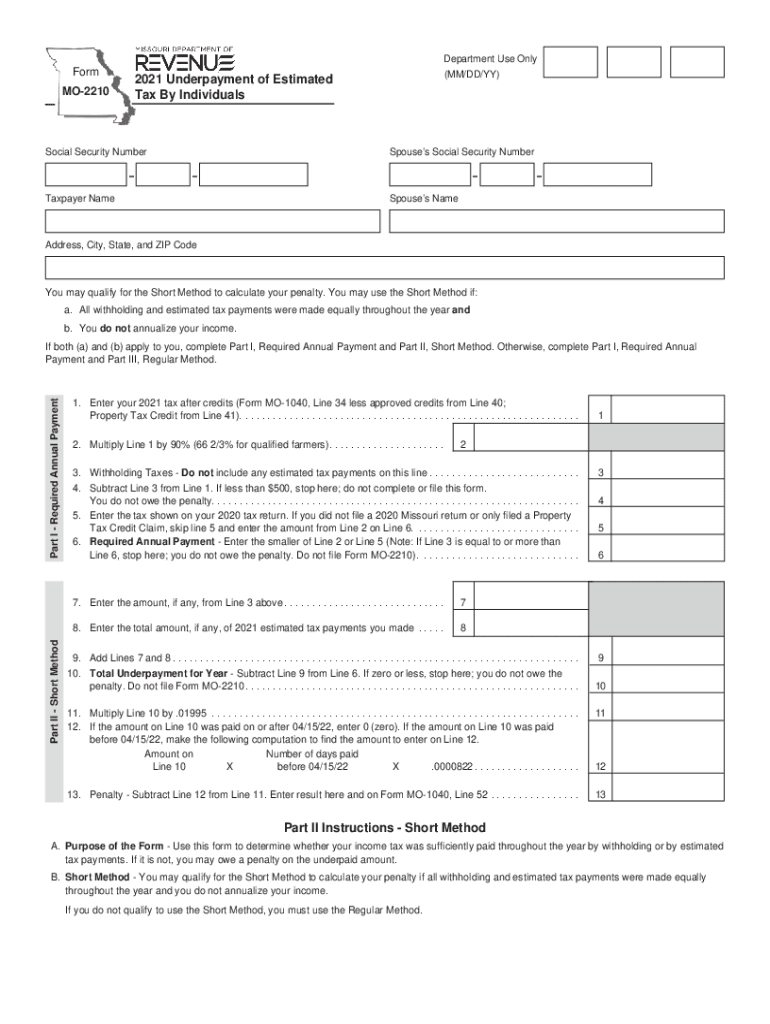

Mo 2210 Fill Out and Sign Printable PDF Template signNow

According to the flow chart. Web see waiver of penalty in instructions for form 2210 pdf. 06 name(s) shown on tax return identifying number do you have to file form 2210? The irs will generally figure your penalty for you and you should not file form 2210. Complete, edit or print tax forms instantly.

Instructions For Form 2210 Underpayment Of Estimated Tax By

Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Upload, modify or.

Ssurvivor Irs Form 2210 Instructions 2020

Is line 4 or line 7 less than. 1722 w 10th st, brooklyn, ny is a single family home that contains 1,448 sq ft and was built in 1915. Web 2020 attachment sequence no. The top of form 2210 contains a flowchart to help a taxpayer determine if they are required to file the form. You may use the short.

Web 2022 Underpayment Of Estimated.

You had most of your income tax withheld early in the year instead of spreading it equally through the. Is line 4 or line 7 less than. Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. 06 name(s) shown on tax return identifying number do you have to file form 2210?

Enter The Penalty On Form 2210, Line 19, And On The “Estimated Tax Penalty” Line On Your Tax Return.

Underpayment of estimated tax by farmers and fishermen. Complete, edit or print tax forms instantly. Web see waiver of penalty in instructions for form 2210 pdf. Web for form 2210, part iii, section b—figure the penalty), later.

You May Qualify For The Short Method To Calculate Your Penalty.

The irs will calculate your. 1722 w 10th st, brooklyn, ny is a single family home that contains 1,448 sq ft and was built in 1915. This form is for income earned in tax year 2022, with tax returns due in april. According to the flow chart.

Try It For Free Now!

Ad upload, modify or create forms. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Web you only need to file form 2210 if one or more boxes in part ii apply to you. You may use the short method if: