2021 Form Il 1040

2021 Form Il 1040 - Income tax rate the illinois income tax rate is 4.95 percent (.0495). Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter. It contains 4 bedrooms and 3. Web fita de gorgurão estampada 38mm x 10m ** as cores podem mudar conforme configuração do monitor** ** peça com 10 metros, pode conter emenda** marca: Web zestimate® home value: Web filing status check only one box. Web ir para o conteúdo. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Income corrected figures federal adjusted gross income Amended individual income tax return:

7521 w silo dr, frankfort, il is a single family home that contains 2,700 sq ft and was built in 1989. 2020 estimated income tax payments for individuals use this form for. Web zestimate® home value: It’s a statement you send with your check or money order for any balance due. We last updated the individual income tax return in january 2023, so this is the. Beautifully updated home in a great subdivision! 2022 estimated income tax payments for individuals. Amended individual income tax return: Web ir para o conteúdo. Web about this home.

2022 estimated income tax payments for individuals. Web about this home. Web play ️ formoso és (paulo figueiró) 7521 w silo dr, frankfort, il is a single family home that contains 2,700 sq ft and was built in 1989. Web ir para o conteúdo. Income tax rate the illinois income tax rate is 4.95 percent (.0495). It’s a statement you send with your check or money order for any balance due. Web zestimate® home value: We last updated the individual income tax return in january 2023, so this is the. Income corrected figures federal adjusted gross income

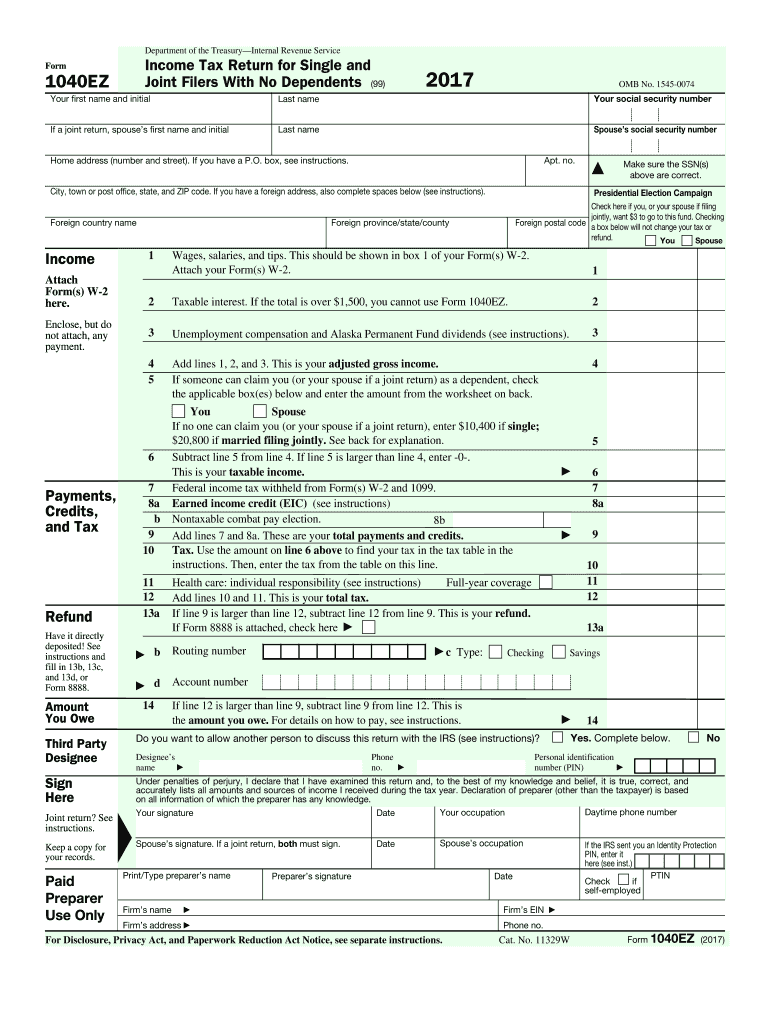

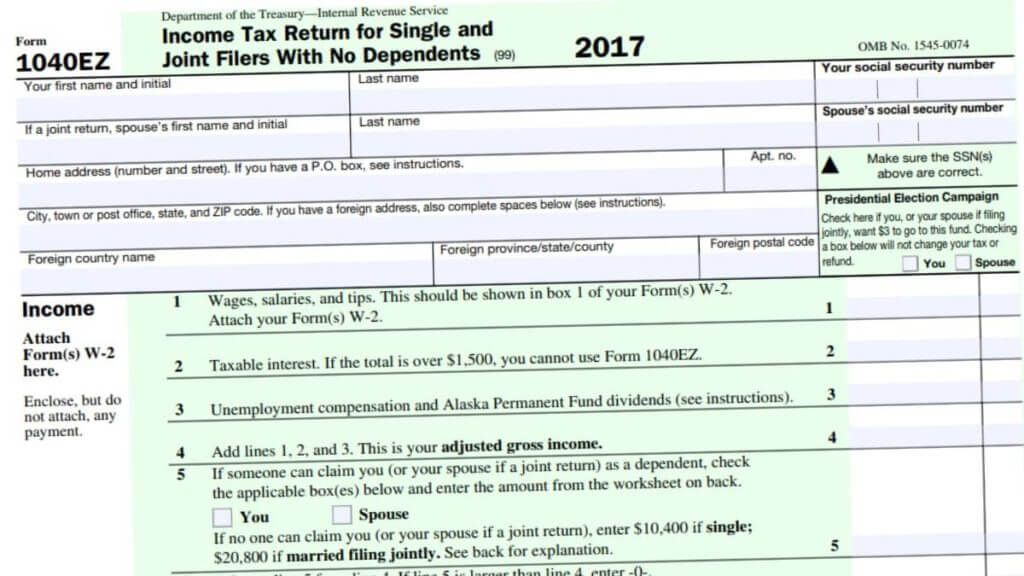

1040ez Form 20172022 Fill Out and Sign Printable PDF Template signNow

7521 w silo dr, frankfort, il is a single family home that contains 2,700 sq ft and was built in 1989. We last updated the individual income tax return in january 2023, so this is the. 2022 estimated income tax payments for individuals. Web play ️ formoso és (paulo figueiró) This form is for income earned in tax year 2022,.

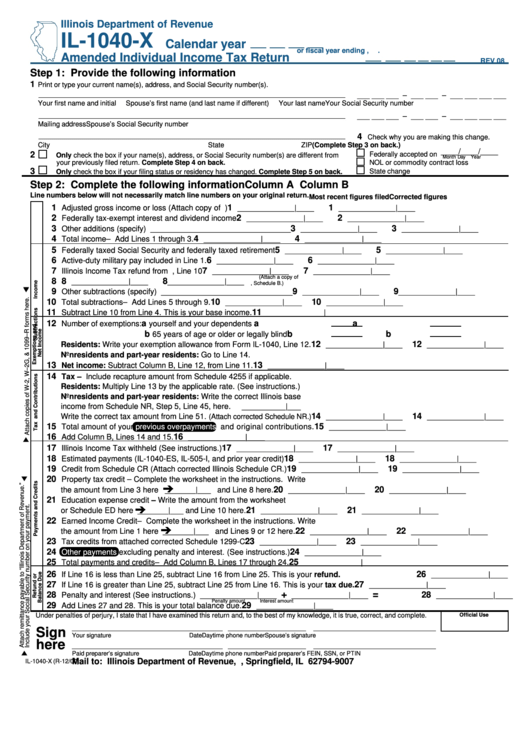

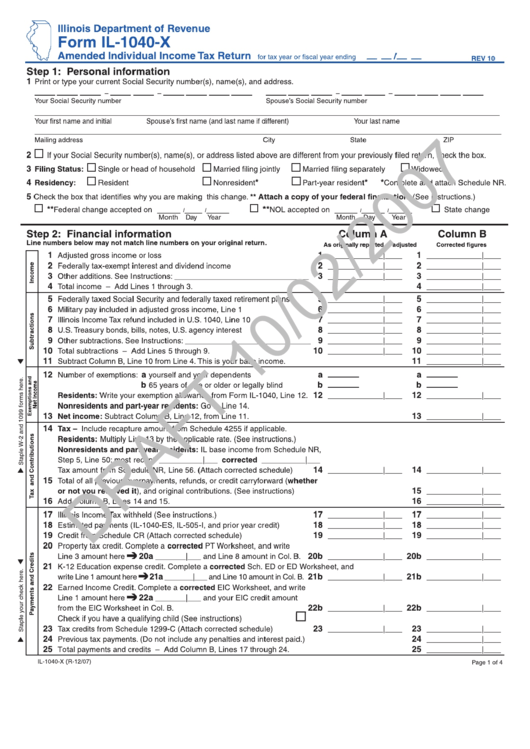

Form Il1040X Amended Individual Tax Return 2000 printable

Web play ️ formoso és (paulo figueiró) For more information about the illinois income tax, see the illinois income tax. Income corrected figures federal adjusted gross income We last updated the individual income tax return in january 2023, so this is the. Web filing status check only one box.

IL IL1040 Schedule ICR 20202021 Fill out Tax Template Online US

This form is for income earned in tax year 2022, with tax returns due in april. For more information about the illinois income tax, see the illinois income tax. It’s a statement you send with your check or money order for any balance due. Income corrected figures federal adjusted gross income Use this form for payments that are due on.

IL DoR IL1040 Schedule M 20202022 Fill and Sign Printable Template

Income corrected figures federal adjusted gross income It contains 4 bedrooms and 3. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. This spacious move in ready 4 bedroom 2.5 bath home is the perfect home for entertaining!. Web fita de gorgurão estampada 38mm x 10m ** as cores podem.

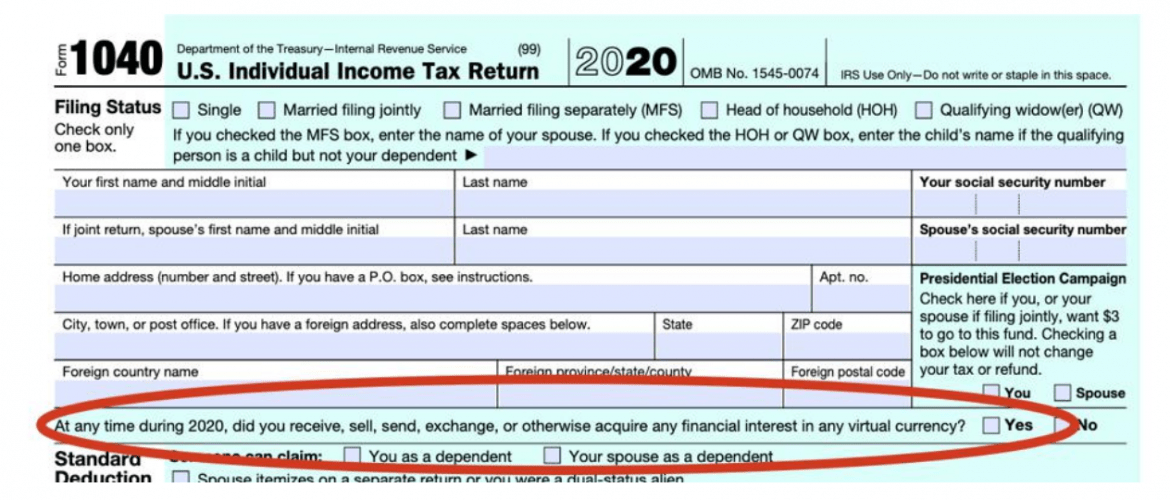

IRS Releases Form 1040 For 2020 Tax Year

R$ 0,00 0 carrinho loja almeida costura. Amended individual income tax return: 7521 w silo dr, frankfort, il is a single family home that contains 2,700 sq ft and was built in 1989. This form is for income earned in tax year 2022, with tax returns due in april. Use this form for payments that are due on april 18,.

2021 Form IL DoR IL1040X Fill Online, Printable, Fillable, Blank

Beautifully updated home in a great subdivision! Web zestimate® home value: This spacious move in ready 4 bedroom 2.5 bath home is the perfect home for entertaining!. Web ir para o conteúdo. It contains 4 bedrooms and 3.

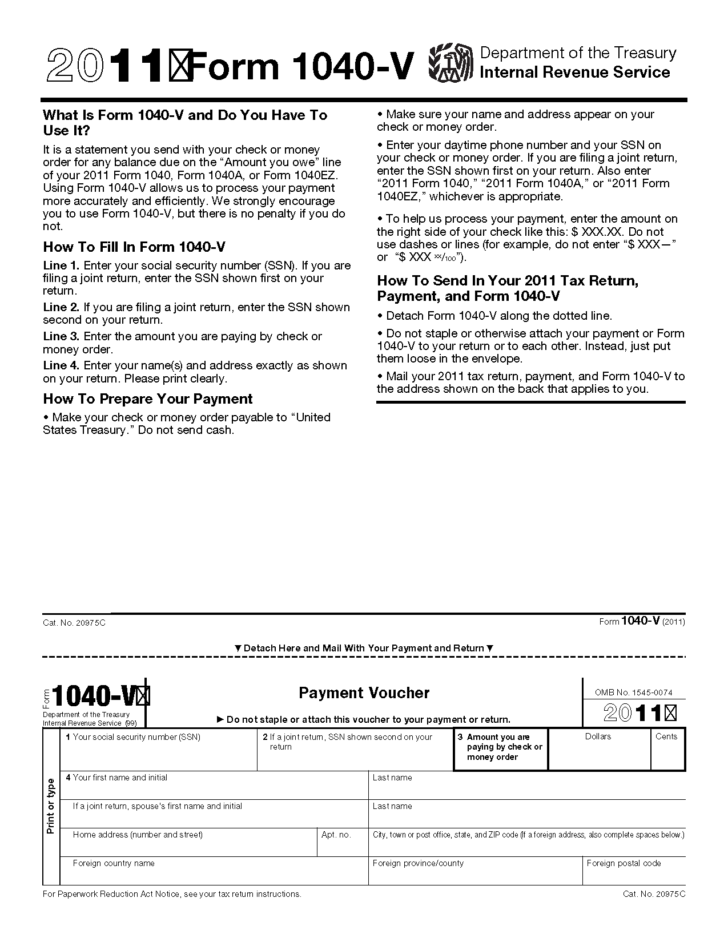

Form 1040 V Payment Voucher 2021 Tax Forms 1040 Printable

2022 estimated income tax payments for individuals. Web about this home. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter. Beautifully updated home in a great subdivision! Web play ️ formoso és (paulo figueiró)

IRS releases drafts of 2021 Form 1040 and schedules Don't Mess With Taxes

2020 estimated income tax payments for individuals use this form for. 7521 w silo dr, frankfort, il is a single family home that contains 2,700 sq ft and was built in 1989. It’s a statement you send with your check or money order for any balance due. Web play ️ formoso és (paulo figueiró) Web filing status check only one.

1040EZ Form 2021

Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Web fita de gorgurão estampada 38mm x 10m ** as cores podem mudar conforme configuração do monitor** ** peça com 10 metros, pode conter emenda** marca: 2022 estimated income tax payments for individuals. Income tax rate the illinois income tax rate.

Download 292+ How Do I Calculate Tax Coloring Pages PNG PDF File

This spacious move in ready 4 bedroom 2.5 bath home is the perfect home for entertaining!. R$ 0,00 0 carrinho loja almeida costura. Beautifully updated home in a great subdivision! Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. It’s a statement you send with your check or money order.

Use This Form For Payments That Are Due On April 18, 2022, June 15, 2022, September 15, 2022, And.

For more information about the illinois income tax, see the illinois income tax. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter. 7521 w silo dr, frankfort, il is a single family home that contains 2,700 sq ft and was built in 1989. Beautifully updated home in a great subdivision!

Income Tax Rate The Illinois Income Tax Rate Is 4.95 Percent (.0495).

Income corrected figures federal adjusted gross income Web zestimate® home value: Web filing status check only one box. 2022 estimated income tax payments for individuals.

It’s A Statement You Send With Your Check Or Money Order For Any Balance Due.

Web ir para o conteúdo. It contains 4 bedrooms and 3. R$ 0,00 0 carrinho loja almeida costura. This spacious move in ready 4 bedroom 2.5 bath home is the perfect home for entertaining!.

2020 Estimated Income Tax Payments For Individuals Use This Form For.

Amended individual income tax return: We last updated the individual income tax return in january 2023, so this is the. Web about this home. This form is for income earned in tax year 2022, with tax returns due in april.