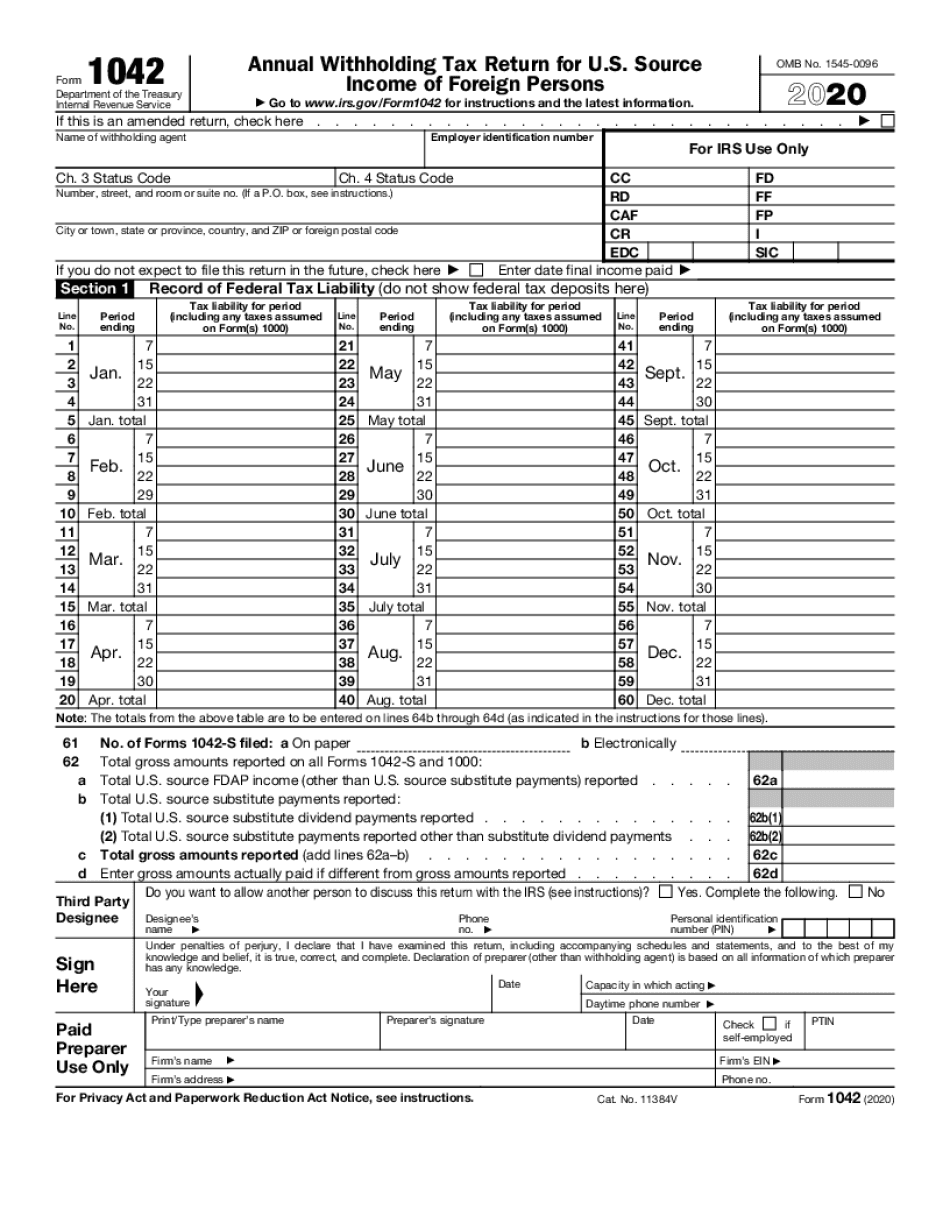

2021 Form 1042

2021 Form 1042 - Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Ad get ready for tax season deadlines by completing any required tax forms today. Ad upload, modify or create forms. Source income of foreign persons. Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. The proposed changes might impact qi reporting moving forward. Source income subject to withholding, were released jan. 15 by the internal revenue service. M requests that the $15 overpayment be credited to its 2022 form 1042 rather. Source income of foreign persons in january 2023, so this is the latest version of form 1042, fully updated for tax.

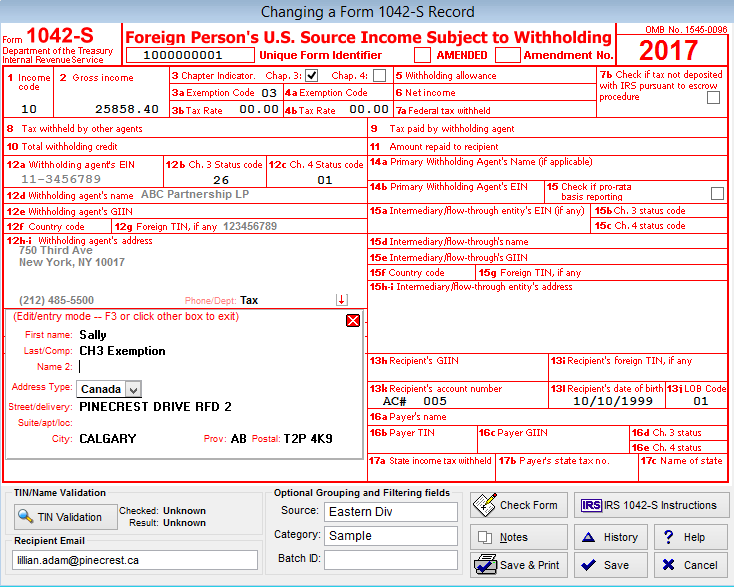

Final sample excel import file: 15 by the internal revenue service. Complete, edit or print tax forms instantly. In addition to dedicating greater. Source income subject to withholding, were released jan. If you have questions about. Web form 1042, annual withholding tax return for u.s. On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding agents to. Source income subject to withholding, to the internal revenue service. Register and subscribe now to work on your irs form 1042 & more fillable forms.

Source income subject to withholding, to the internal revenue service. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Source income subject to withholding If you have questions about. Web april 6, 2021 · 5 minute read. Source income subject to withholding, were released jan. M requests that the $15 overpayment be credited to its 2022 form 1042 rather. Web on its timely filed 2021 form 1042, m reports $15 as its total tax liability and $30 as its total deposits. Source income of foreign persons in january 2023, so this is the latest version of form 1042, fully updated for tax. Ad get ready for tax season deadlines by completing any required tax forms today.

Social Security Award Letter 2021 magiadeverao

15 by the internal revenue service. Source income of foreign persons, is used for that purpose. Web april 6, 2021 · 5 minute read. Web we last updated the annual withholding tax return for u.s. Ad upload, modify or create forms.

IRS Form 1042s What It is & 1042s Instructions Tipalti

Source income of foreign persons, is used for that purpose. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Source income of foreign persons. Web form 1042, annual withholding tax return for u.s. Source income subject to withholding

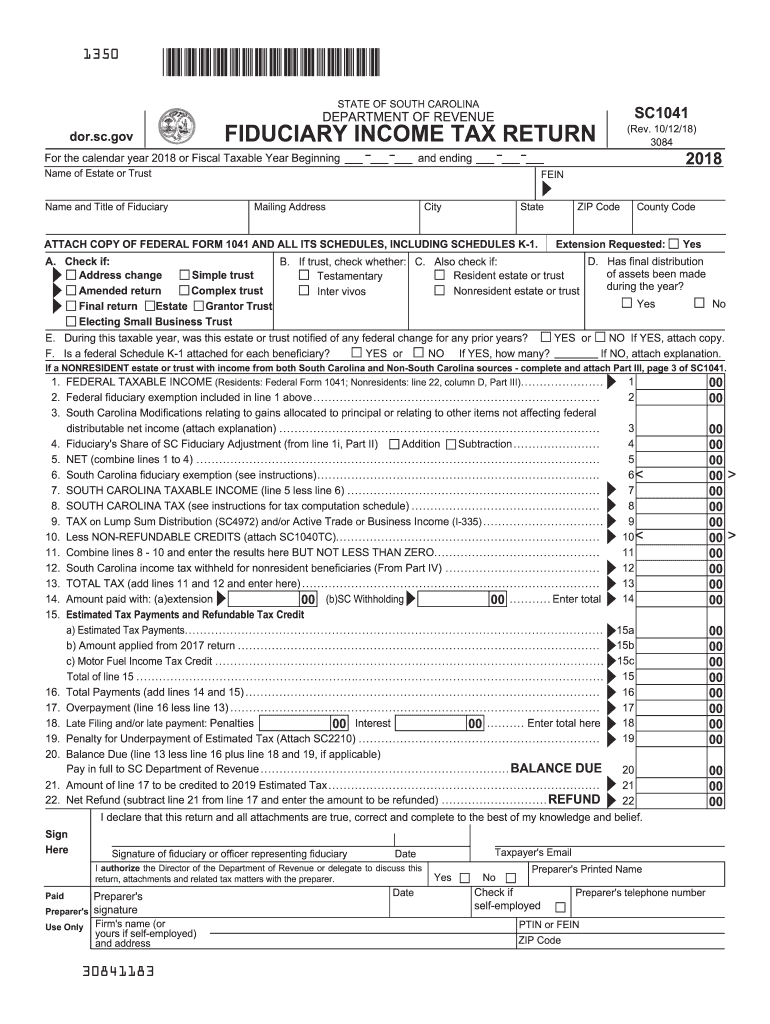

Sc 1041 Fill Out and Sign Printable PDF Template signNow

Web on its timely filed 2021 form 1042, m reports $15 as its total tax liability and $30 as its total deposits. Source income of foreign persons. Ad get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding Web we last updated the annual withholding tax return for u.s.

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Source income subject to withholding, to the internal revenue service. Source income of foreign persons in january 2023, so this is the latest version of form 1042, fully updated for tax. M requests that the $15 overpayment be credited to its 2022 form 1042 rather. On its website, irs has updated its general frequently asked questions (faqs) about the obligations.

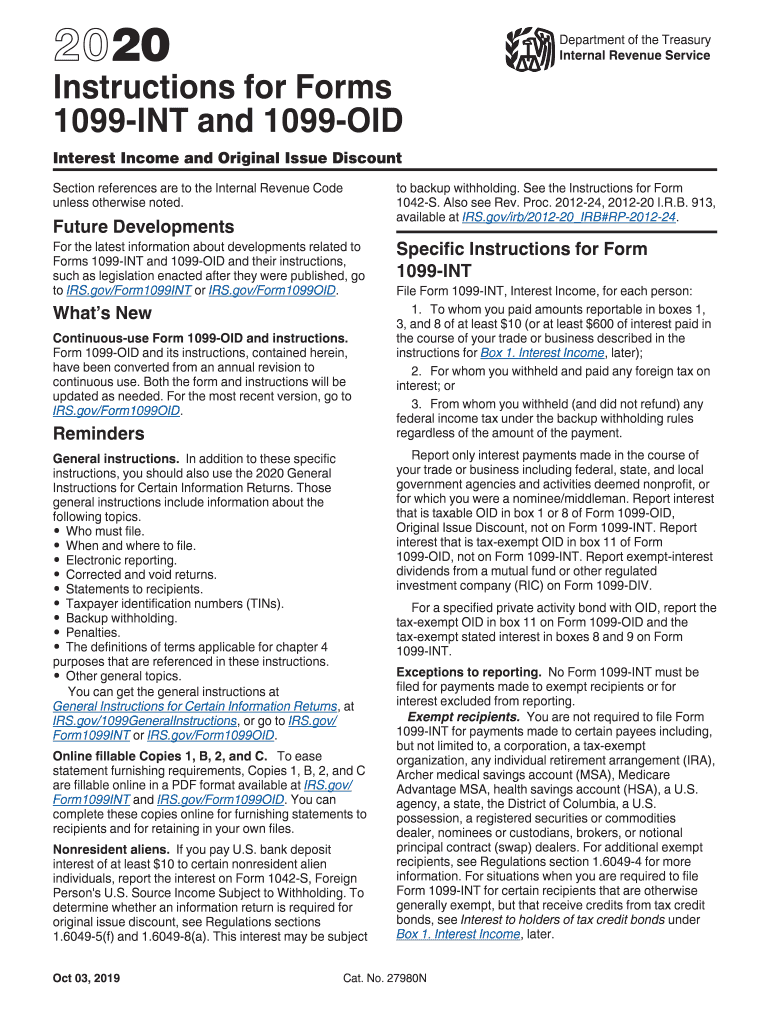

1099 Form 2019 Printable Form Fill Out and Sign Printable PDF

Source income of foreign persons. Web on its timely filed 2021 form 1042, m reports $15 as its total tax liability and $30 as its total deposits. Ad upload, modify or create forms. Web we last updated the annual withholding tax return for u.s. Source income subject to withholding is used to report amounts paid to foreign persons (including persons.

2020 Form 1042 Fill Out and Sign Printable PDF Template signNow

Source income subject to withholding, to the internal revenue service. M requests that the $15 overpayment be credited to its 2022 form 1042 rather. Web form 1042, annual withholding tax return for u.s. Source income of foreign persons in january 2023, so this is the latest version of form 1042, fully updated for tax. Web taxes federal tax forms federal.

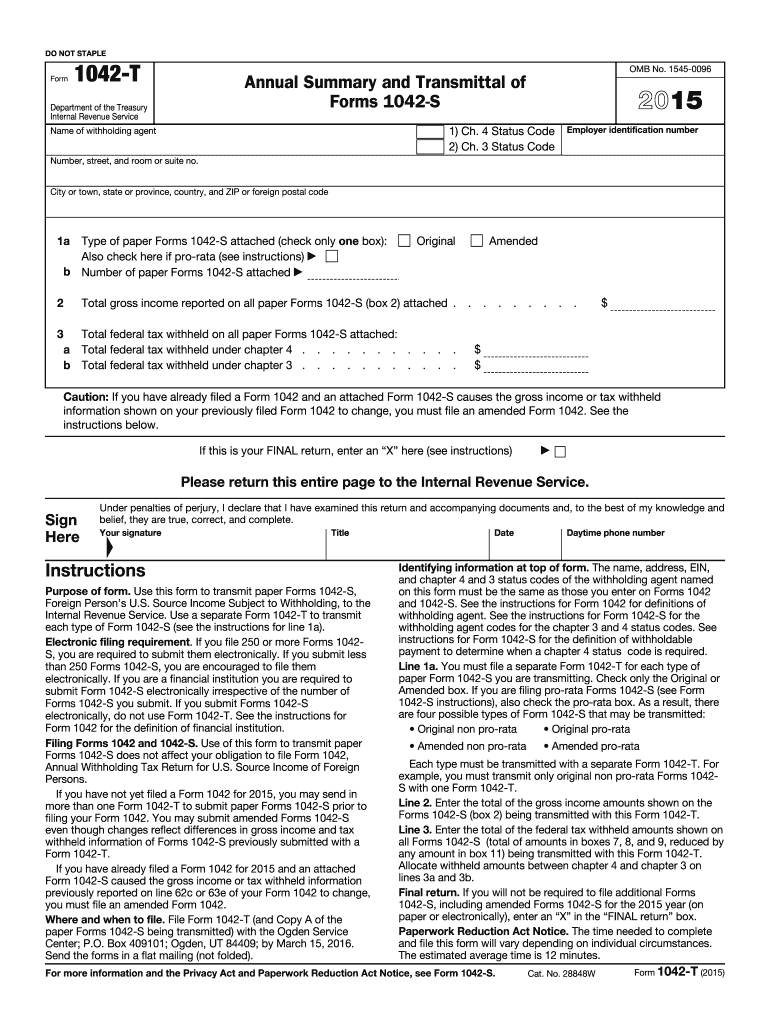

Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs Fill

Web taxes federal tax forms federal tax forms learn how to get tax forms. Source income of foreign persons in january 2023, so this is the latest version of form 1042, fully updated for tax. Complete, edit or print tax forms instantly. Web form 1042, annual withholding tax return for u.s. Web on its timely filed 2021 form 1042, m.

3.21.111 Chapter Three and Chapter Four Withholding Returns Internal

Web april 6, 2021 · 5 minute read. In addition to dedicating greater. On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding agents to. Ad get ready for tax season deadlines by completing any required tax forms today. Ad upload, modify or create forms.

Business Form Cp 00 30 Darrin Kenney's Templates

Ad get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding, were released jan. Register and subscribe now to work on your irs form 1042 & more fillable forms. On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding agents to. Web taxes federal.

In Addition To Dedicating Greater.

Source income of foreign persons. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Web form 1042, annual withholding tax return for u.s. Source income subject to withholding

See Form 1042 And Its Instructions For More.

On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding agents to. Web on its timely filed 2021 form 1042, m reports $15 as its total tax liability and $30 as its total deposits. Source income of foreign persons in january 2023, so this is the latest version of form 1042, fully updated for tax. Try it for free now!

Complete, Edit Or Print Tax Forms Instantly.

Ad upload, modify or create forms. Web april 6, 2021 · 5 minute read. Register and subscribe now to work on your irs form 1042 & more fillable forms. Web taxes federal tax forms federal tax forms learn how to get tax forms.

15 By The Internal Revenue Service.

Source income of foreign persons, is used for that purpose. Final sample excel import file: Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. Source income subject to withholding, were released jan.