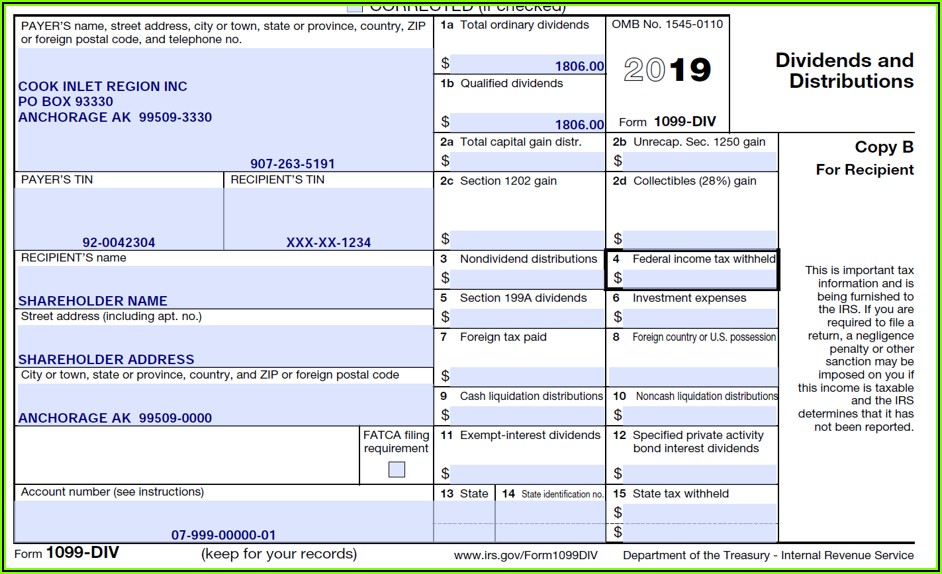

2019 Form 1099

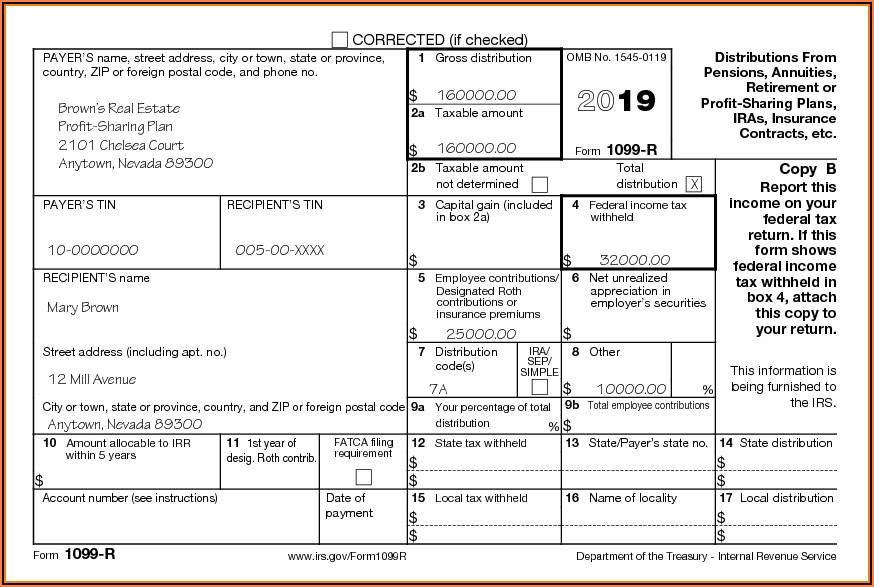

2019 Form 1099 - Get everything done in minutes. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. Those general instructions include information about the following topics. You may also have a filing requirement. No.) employee contributions/ city or town, state or province, country, and zip or foreign postal code 9a $ your percentage of total distribution % for privacy act and paperwork reduction act notice, see the Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). All 1099 forms are available on the irs website, and they can be printed out from home. See form 8828 and pub. When and where to file.

Web printable 1099 form 2019 are widely available. Get everything done in minutes. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. See the instructions for form 8938. Transferor’s taxpayer identification number (tin). Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. All 1099 forms are available on the irs website, and they can be printed out from home. For privacy act and paperwork reduction act notice, see the 2019 general instructions for certain information returns. Those general instructions include information about the following topics. Web you sold or disposed of your home at a gain during the first 9 years after you received the federal mortgage subsidy.

All 1099 forms are available on the irs website, and they can be printed out from home. Your income for the year you sold or disposed of your home was over a specified amount. This will increase your tax. Web you have received this form because you have either (a) accepted payment cards for payments, or (b) received payments through a third party network that exceeded $20,000 in gross total reportable transactions and the aggregate number of those transactions exceeded 200 for the calendar year. In addition to these specific instructions, you also should use the 2019 general instructions for certain information returns. Web you sold or disposed of your home at a gain during the first 9 years after you received the federal mortgage subsidy. No.) employee contributions/ city or town, state or province, country, and zip or foreign postal code 9a $ your percentage of total distribution % for privacy act and paperwork reduction act notice, see the Get everything done in minutes. For privacy act and paperwork reduction act notice, see the 2019 general instructions for certain information returns. This is true for both 2019 and 2018 1099s, even years later.

Fillable Form 1099 For 2019 Form Resume Examples QJ9eqwP9my

You may also have a filing requirement. When and where to file. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. This is true for both 2019 and 2018 1099s, even years later. All 1099 forms are available on the irs website, and they can be printed out from home.

1099 Free Form 2019 Form Resume Examples wRYPp87Y4a

However, it is important to remember that each 1099 filing needs several copies of the form, and not all of them can be printed from home on regular. In addition to these specific instructions, you also should use the 2019 general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the 2019 general instructions for.

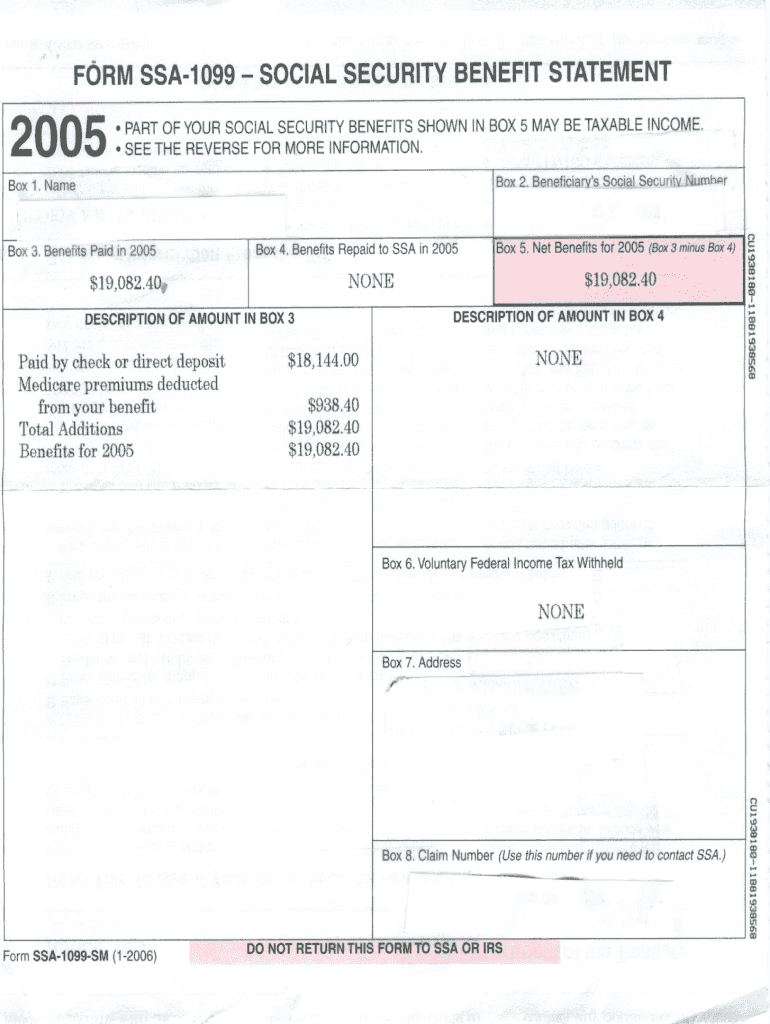

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

Web you sold or disposed of your home at a gain during the first 9 years after you received the federal mortgage subsidy. You may also have a filing requirement. No.) employee contributions/ city or town, state or province, country, and zip or foreign postal code 9a $ your percentage of total distribution % for privacy act and paperwork reduction.

1099 Form 2019 Fill and Sign Printable Template Online US Legal Forms

See the instructions for form 8938. No.) employee contributions/ city or town, state or province, country, and zip or foreign postal code 9a $ your percentage of total distribution % for privacy act and paperwork reduction act notice, see the See form 8828 and pub. Web you sold or disposed of your home at a gain during the first 9.

Irs.gov 1099 Form 2019 Form Resume Examples n49mAOe9Zz

See the instructions for form 8938. When and where to file. No.) employee contributions/ city or town, state or province, country, and zip or foreign postal code 9a $ your percentage of total distribution % for privacy act and paperwork reduction act notice, see the Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of.

9 Form Irs 9 9 Small But Important Things To Observe In 9 Form Irs 9

When and where to file. For privacy act and paperwork reduction act notice, see the 2019 general instructions for certain information returns. See form 8828 and pub. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. Web you have received this form because you have either.

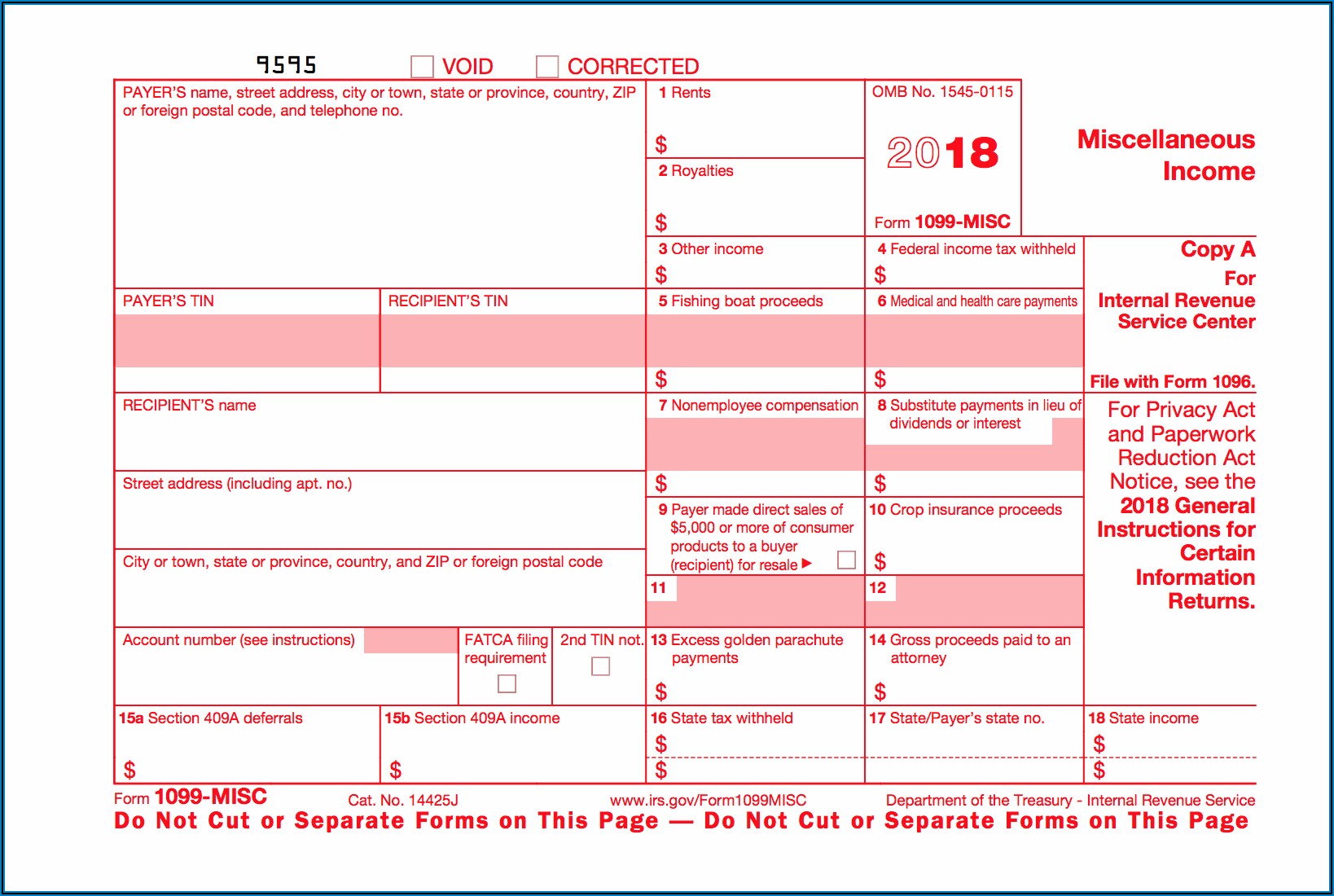

1099MISC or 1099NEC? What You Need to Know about the New IRS

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. This will increase your tax. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Copy a for internal revenue service center 11 state income tax withheld $ $ file with form 1096. Your income for.

Irs.gov 1099 Form 2019 Form Resume Examples n49mAOe9Zz

Web you sold or disposed of your home at a gain during the first 9 years after you received the federal mortgage subsidy. Web you have received this form because you have either (a) accepted payment cards for payments, or (b) received payments through a third party network that exceeded $20,000 in gross total reportable transactions and the aggregate number.

NJ Tax Preparer Admits Conspiring To Commit Tax Fraud Thru False Filing

Web 2019 certain government payments 2nd tin not. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). This will increase your tax. All 1099 forms are available on the irs website, and they can be printed.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

Web you sold or disposed of your home at a gain during the first 9 years after you received the federal mortgage subsidy. See the instructions for form 8938. Web you have received this form because you have either (a) accepted payment cards for payments, or (b) received payments through a third party network that exceeded $20,000 in gross total.

Web Printable 1099 Form 2019 Are Widely Available.

Web 2019 certain government payments 2nd tin not. You may also have a filing requirement. See your tax return instructions for where to report. See form 8828 and pub.

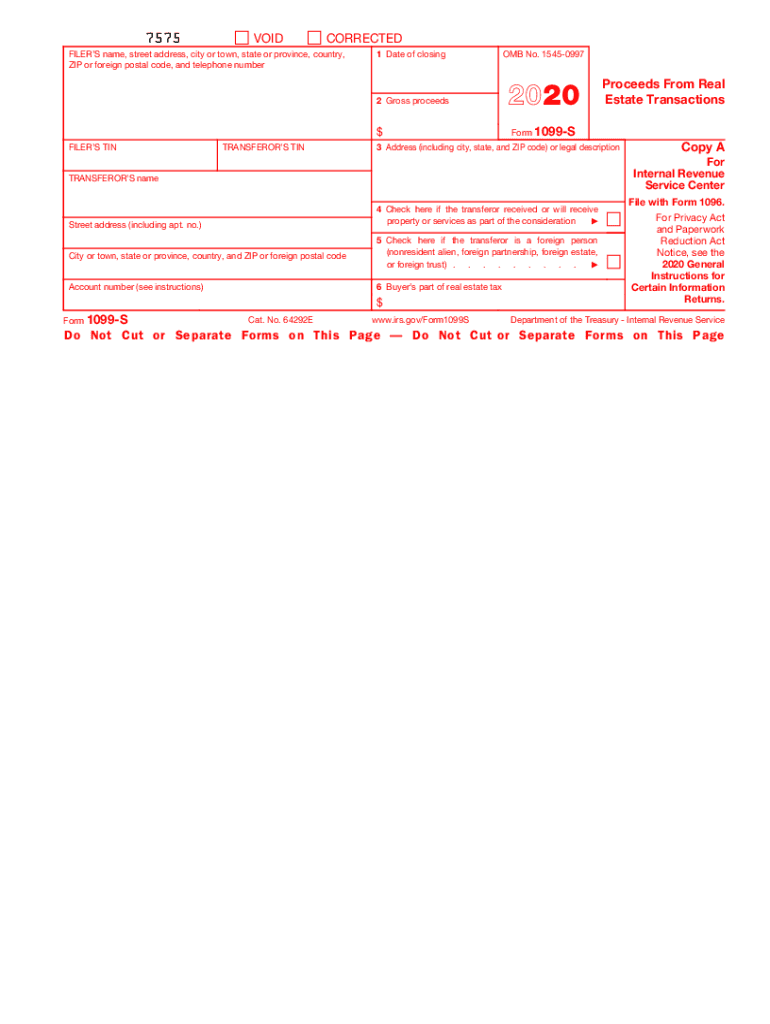

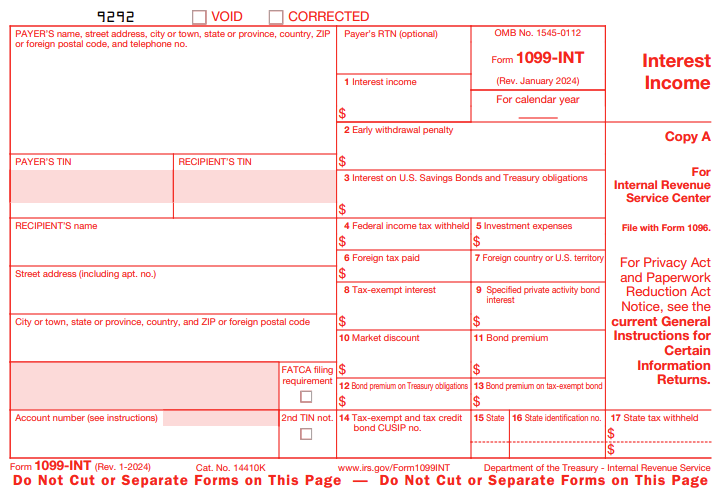

Copy A For Internal Revenue Service Center 11 State Income Tax Withheld $ $ File With Form 1096.

Transferor’s taxpayer identification number (tin). Web you sold or disposed of your home at a gain during the first 9 years after you received the federal mortgage subsidy. Web you have received this form because you have either (a) accepted payment cards for payments, or (b) received payments through a third party network that exceeded $20,000 in gross total reportable transactions and the aggregate number of those transactions exceeded 200 for the calendar year. For privacy act and paperwork reduction act notice, see the 2019 general instructions for certain information returns.

You Can Instantly Download A Printable Copy Of The Tax Form By Logging In To Or Creating A Free My Social Security Account.

See the instructions for form 8938. In addition to these specific instructions, you also should use the 2019 general instructions for certain information returns. This will increase your tax. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code.

For Your Protection, This Form May Show Only The Last Four Digits Of Your Social Security Number (Ssn), Individual Taxpayer Identification Number (Itin), Adoption Taxpayer Identification Number (Atin), Or Employer Identification Number (Ein).

Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Get everything done in minutes. Your income for the year you sold or disposed of your home was over a specified amount. All 1099 forms are available on the irs website, and they can be printed out from home.