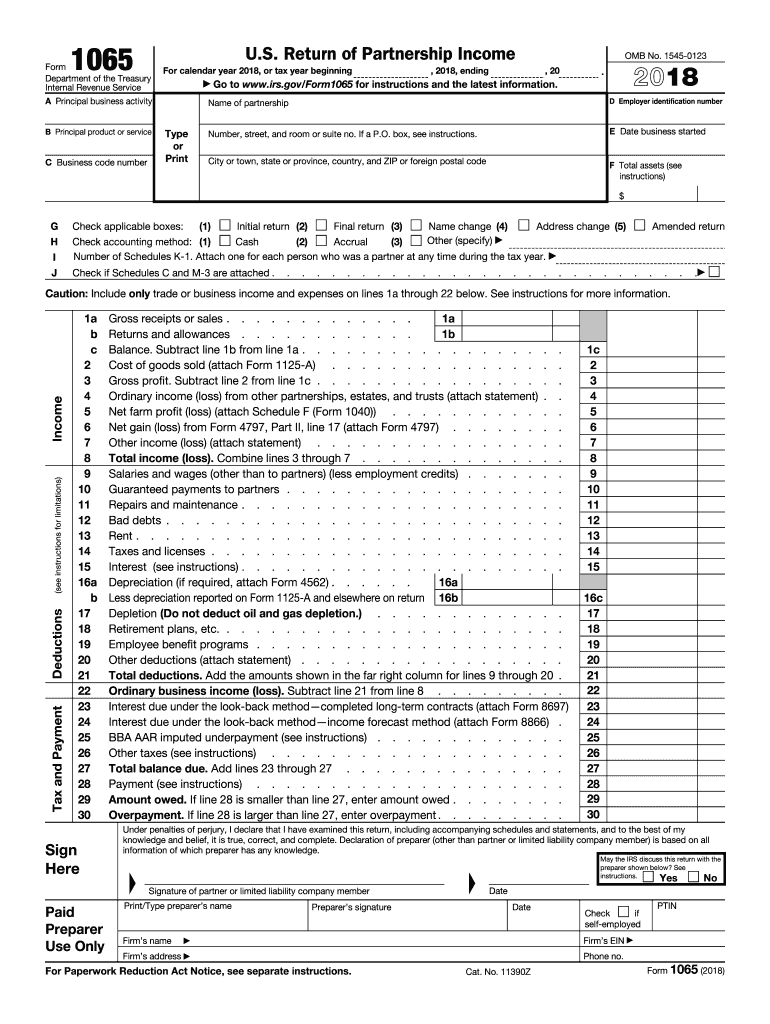

2018 Form 1065

2018 Form 1065 - Essentially, this meant the irs would implement cpar in 2020, which is when 2018. Web bba partnerships under examination, as well as those that already have filed aars for 2018, 2019, or 2020, are eligible to file an amended form 1065 and schedule. 7701 (a) (1)), including an. The irs supports the current year and two prior tax years for regular, superseded, or amended electronic returns. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. An aar by a partnership making an election into the. Web generally speaking, a domestic partnership must file irs form 1065 by the 15 th day of the 3 rd month following the date its tax year ended. Web a 1065 form is the annual us tax return filed by partnerships.

Web the bba dictated that cpar was first mandatory for the 2018 form 1065. Web for example, for tax year 2018, these returns can be electronically filed for tax years 2018, 2017, and 2016. Alabama, district of columbia, kentucky, maine, new jersey,. Web the irs first tightened the requirements with new instructions for reporting negative tax basis capital accounts on the 2018 form 1065. The irs sought to expand. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Web back to news. For example, the due date for form. Essentially, this meant the irs would implement cpar in 2020, which is when 2018.

Web the irs first tightened the requirements with new instructions for reporting negative tax basis capital accounts on the 2018 form 1065. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Alabama, district of columbia, kentucky, maine, new jersey,. Therefore, starting january 2019, you can. 7701 (a) (1)), including an. Or getting income from u.s. 9839), the partnership may designate any person (as defined in sec. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Filed and the partnership has (1) a partner that is a missouri resident. The irs supports the current year and two prior tax years for regular, superseded, or amended electronic returns.

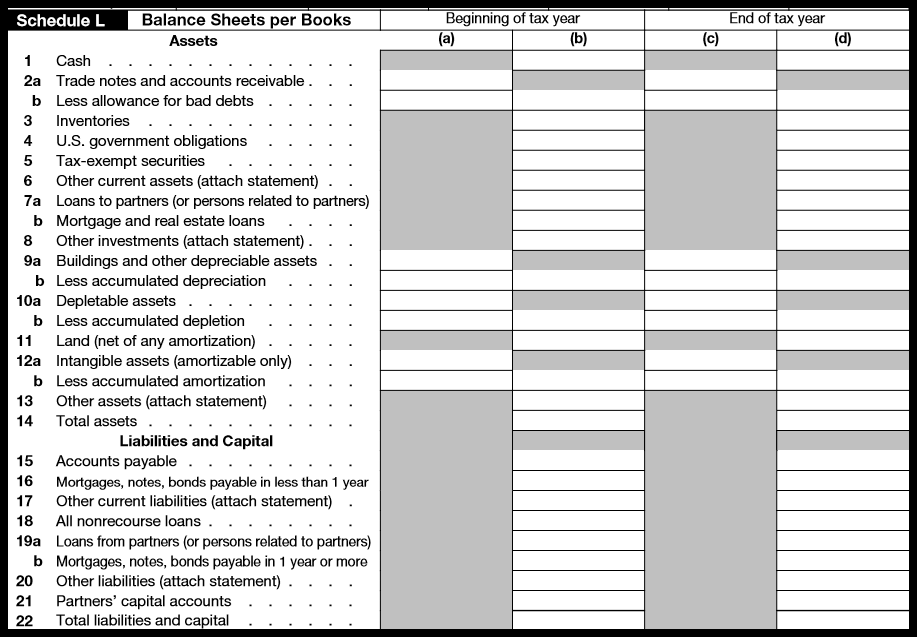

How To Complete Form 1065 With Instructions

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. For example, the due date for form. It is used to report the partnership’s.

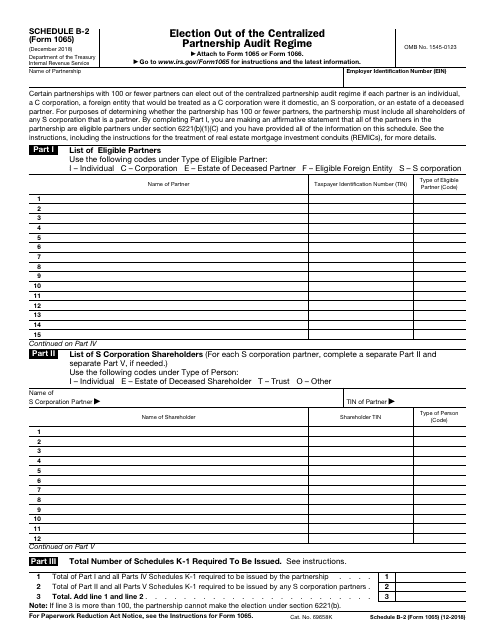

IRS Form 1065 Schedule B2 Download Fillable PDF or Fill Online

An aar by a partnership making an election into the. Filed and the partnership has (1) a partner that is a missouri resident. Essentially, this meant the irs would implement cpar in 2020, which is when 2018. Alabama, district of columbia, kentucky, maine, new jersey,. Web generally speaking, a domestic partnership must file irs form 1065 by the 15 th.

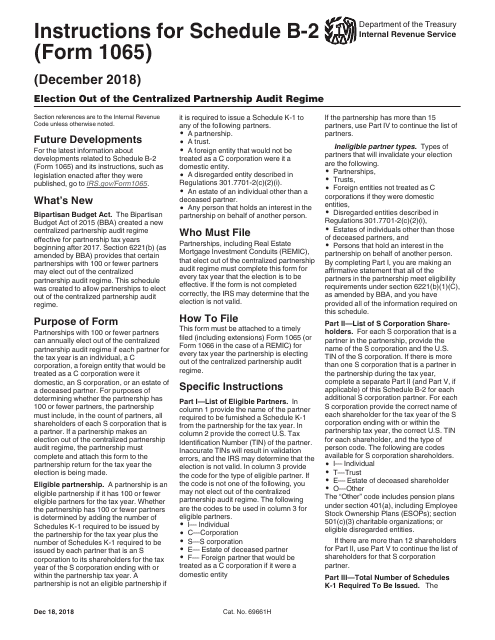

Download Instructions for IRS Form 1065 Schedule B2 Election out of

An aar by a partnership making an election into the. Web form 1065 (1998) page 2 cost of goods sold (see page 14 of the instructions) 1 inventory at beginning of year 1 2 purchases less cost of items withdrawn for personal use 2 3. Web bba partnerships under examination, as well as those that already have filed aars for.

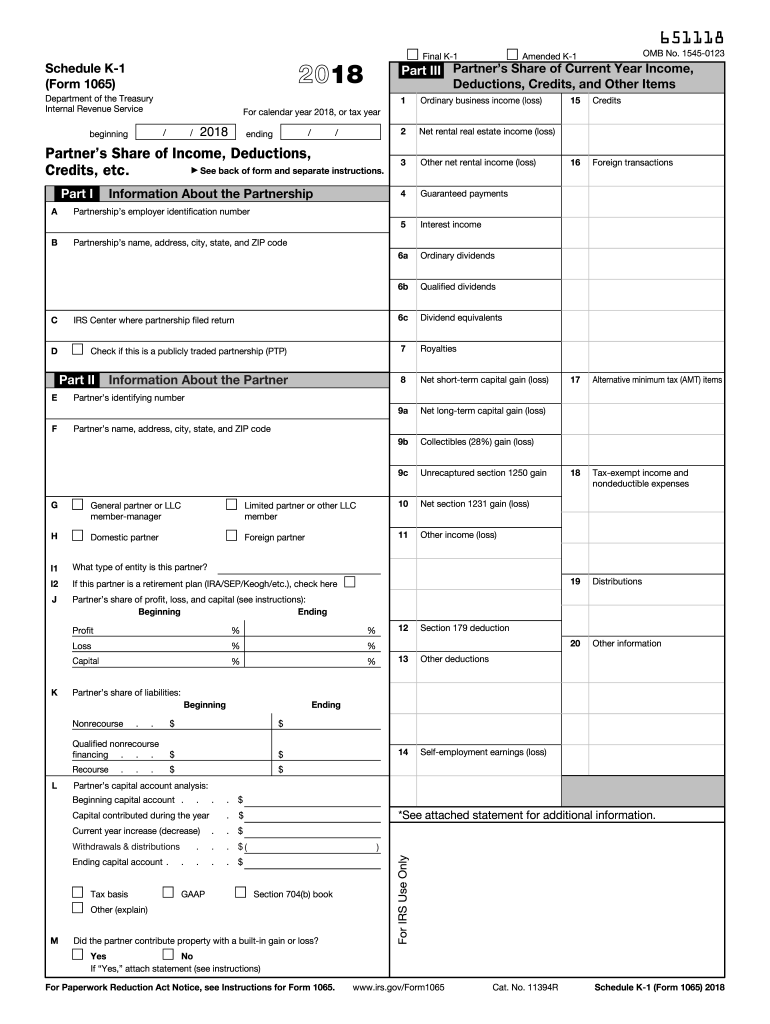

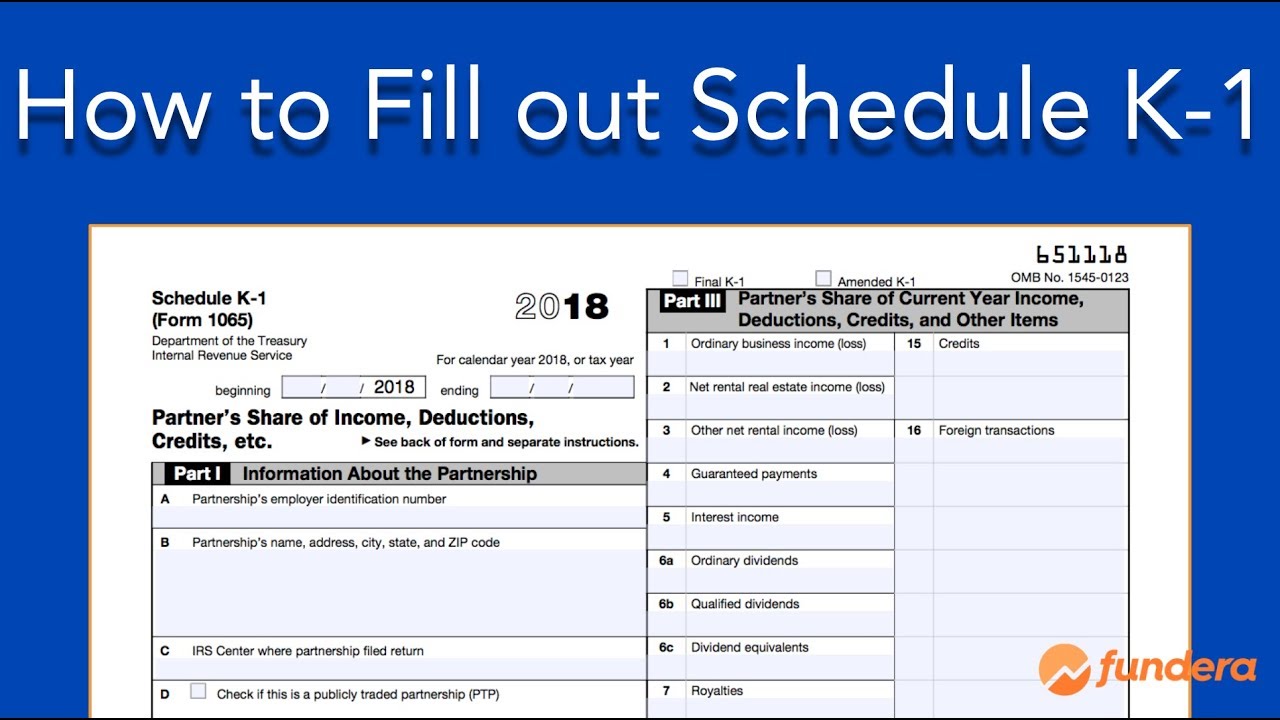

IRS 1065 Schedule K1 2018 Fill out Tax Template Online US Legal

Web the irs this week posted and released an updated 2018 instructions for form 1065, removinga requirement to provide the taxpayer identification number (tin) partnership’s. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Return of partnership.

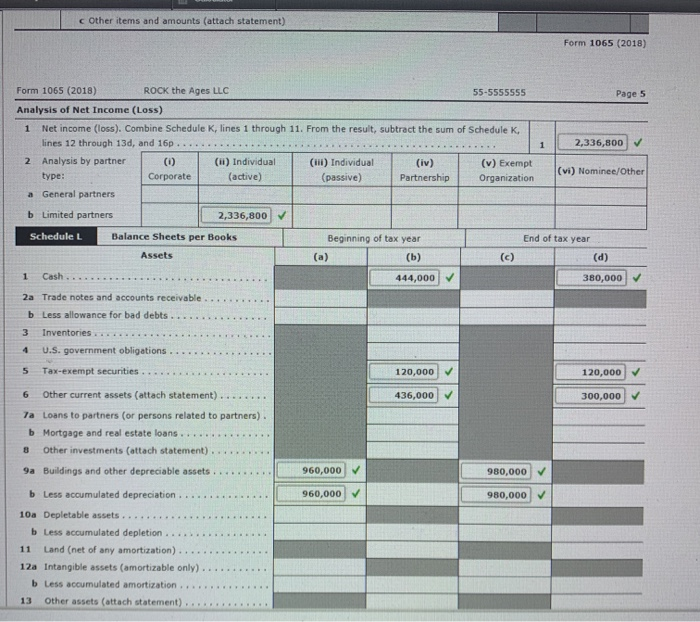

Ryan Ross (111111112), Oscar Omega (222222223),

For example, the due date for form. Web the irs this week posted and released an updated 2018 instructions for form 1065, removinga requirement to provide the taxpayer identification number (tin) partnership’s. Web back to news. Or getting income from u.s. 7701 (a) (1)), including an.

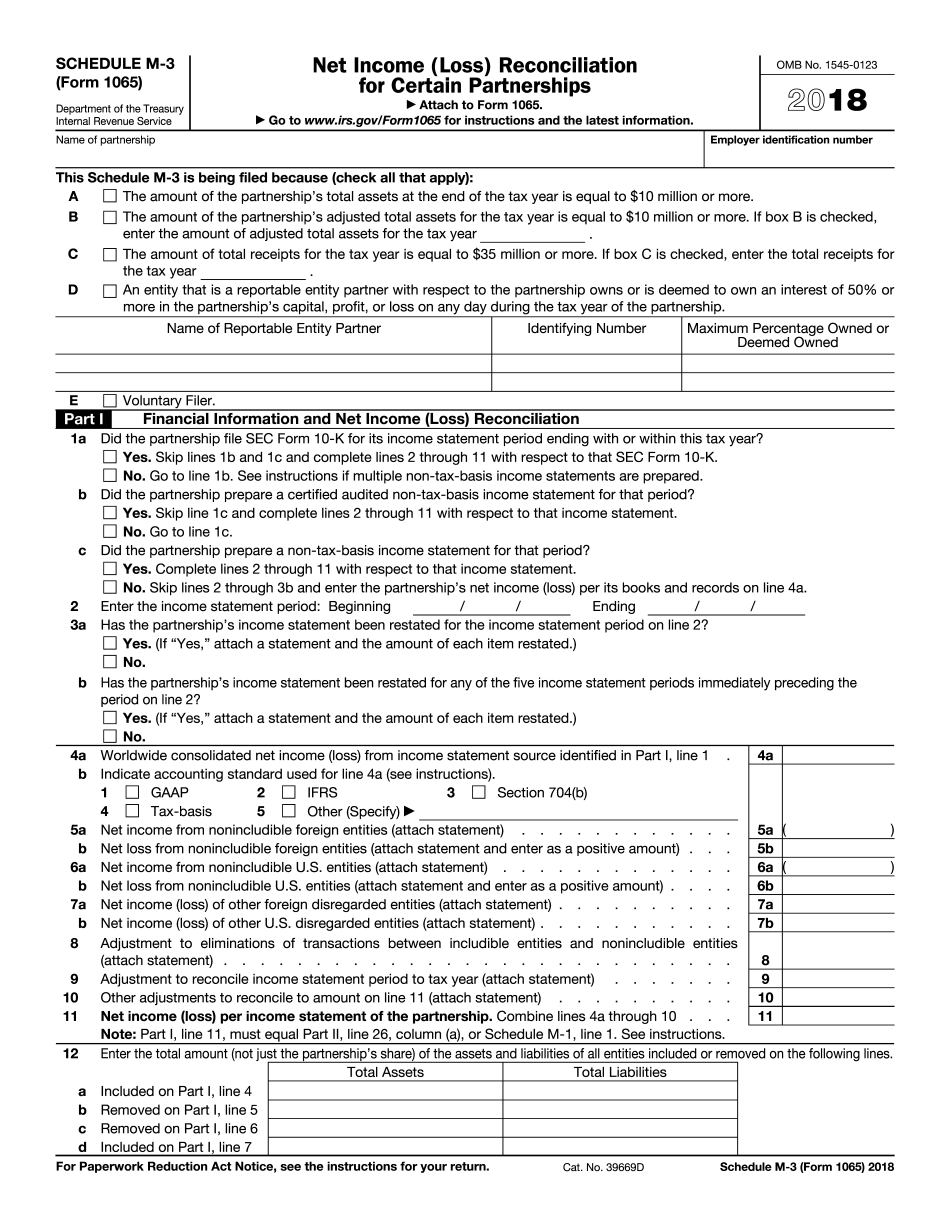

IRS Form 1065 (Schedule M3) 2018 2019 Fill out and Edit Online PDF

Ad download or email irs 1065 & more fillable forms, register and subscribe now! Web the bba dictated that cpar was first mandatory for the 2018 form 1065. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065..

2018 Form IRS 1065 Fill Online, Printable, Fillable, Blank PDFfiller

Web bba partnerships under examination, as well as those that already have filed aars for 2018, 2019, or 2020, are eligible to file an amended form 1065 and schedule. Alabama, district of columbia, kentucky, maine, new jersey,. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year.

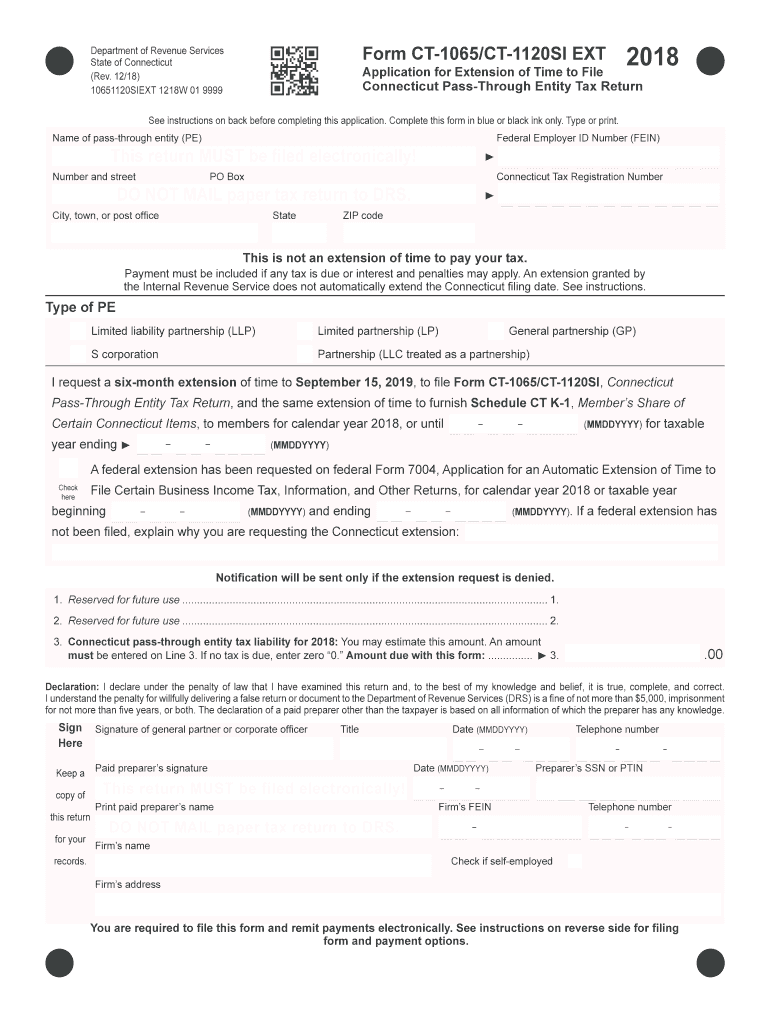

Ct 1065 Instructions 2019 Fill Out and Sign Printable PDF Template

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web the irs first tightened the requirements with new instructions for reporting negative tax basis capital accounts on the 2018 form 1065. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s..

form 1065x 2018 2020 Fill Online, Printable, Fillable Blank form

Or getting income from u.s. 7701 (a) (1)), including an. Essentially, this meant the irs would implement cpar in 2020, which is when 2018. Web tefra partnership (form 1065). It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.

Form 8 Who Must Sign The Biggest Contribution Of Form 8 Who Must Sign

Web back to news. 7701 (a) (1)), including an. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Ad file partnership.

Filed And The Partnership Has (1) A Partner That Is A Missouri Resident.

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. 7701 (a) (1)), including an. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web tefra partnership (form 1065).

The Irs Sought To Expand.

Or getting income from u.s. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web form 1065 (1998) page 2 cost of goods sold (see page 14 of the instructions) 1 inventory at beginning of year 1 2 purchases less cost of items withdrawn for personal use 2 3. 6223 and the recently issued final regulations (t.d.

For Example, The Due Date For Form.

Web for example, for tax year 2018, these returns can be electronically filed for tax years 2018, 2017, and 2016. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Web a 1065 form is the annual us tax return filed by partnerships. Therefore, starting january 2019, you can.

9839), The Partnership May Designate Any Person (As Defined In Sec.

Web the irs this week posted and released an updated 2018 instructions for form 1065, removinga requirement to provide the taxpayer identification number (tin) partnership’s. Web back to news. The irs supports the current year and two prior tax years for regular, superseded, or amended electronic returns. An aar by a partnership making an election into the.