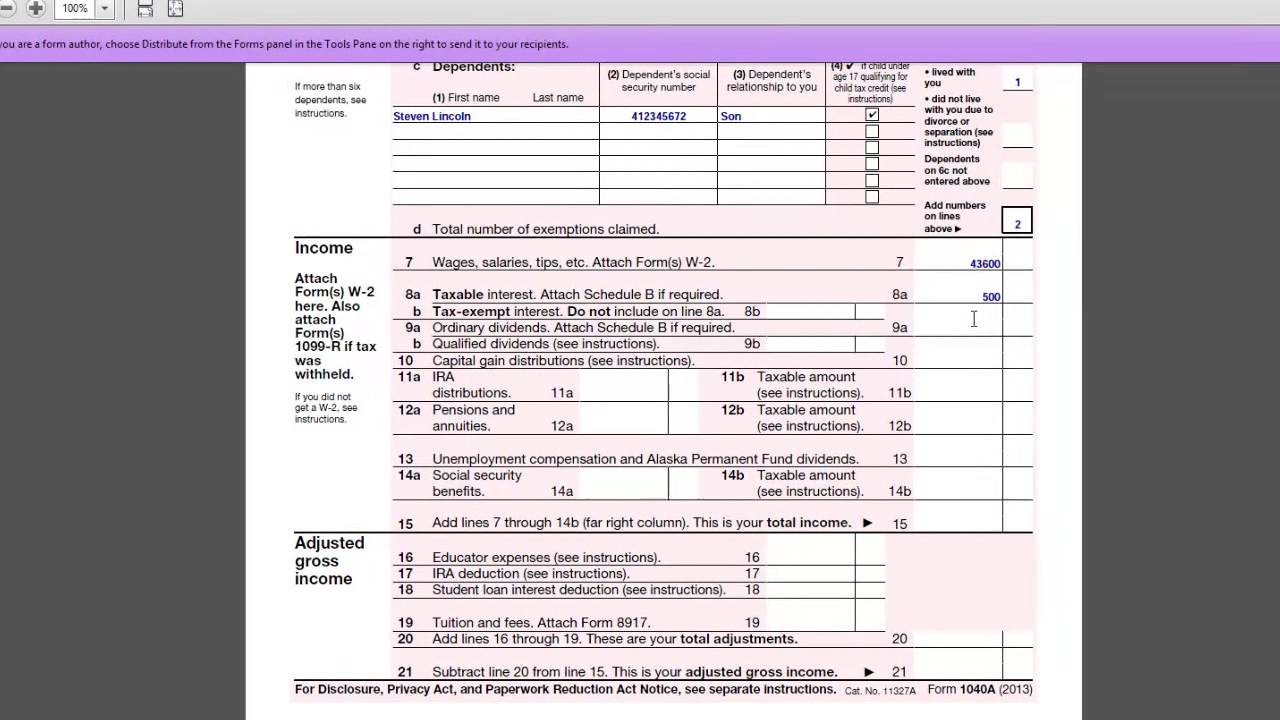

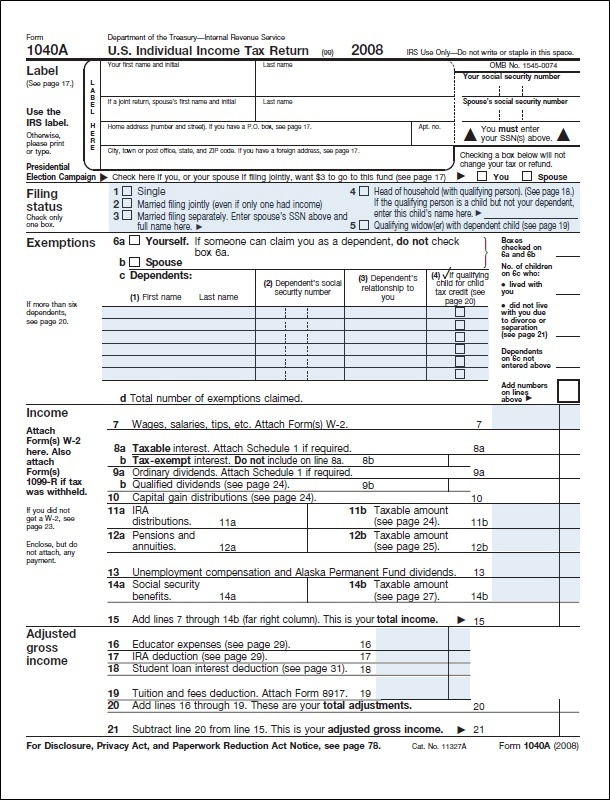

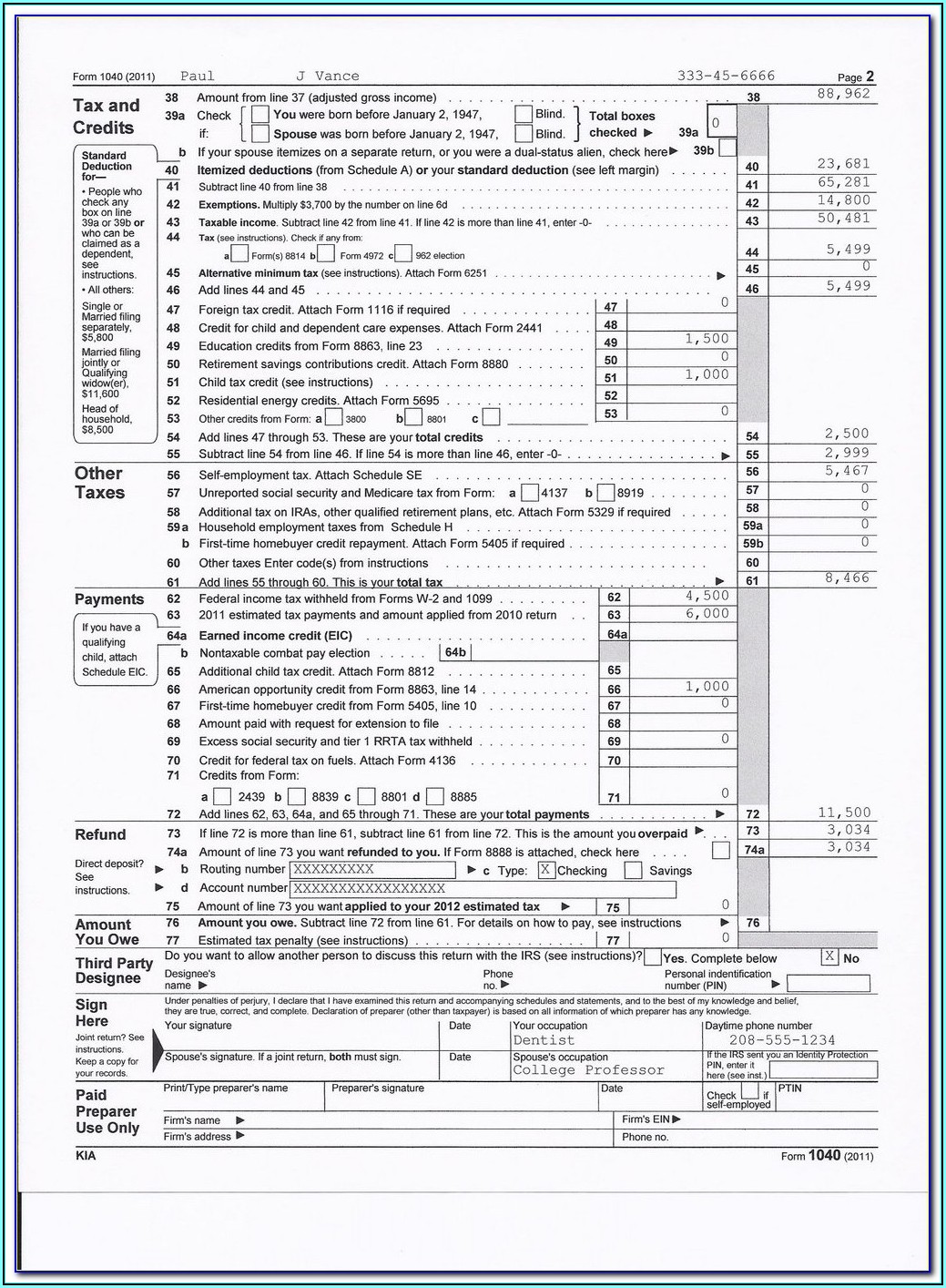

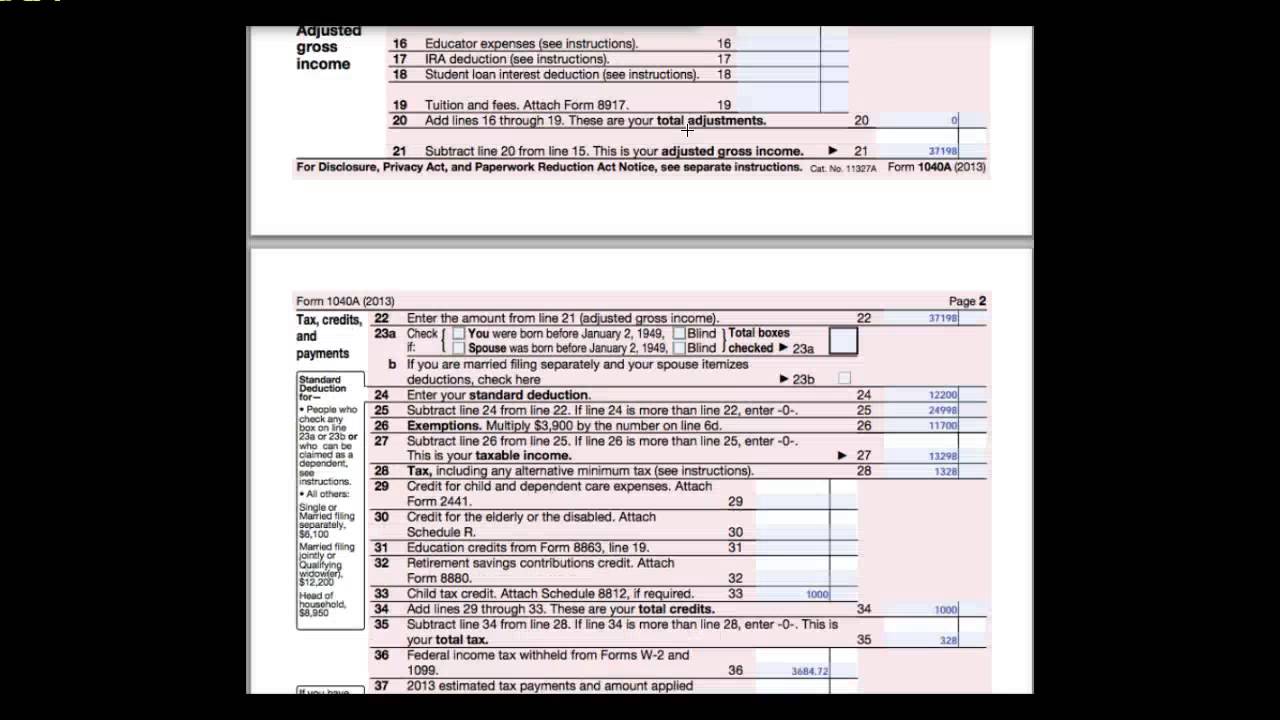

2016 Tax 1040A Form

2016 Tax 1040A Form - Individual income tax return (irs) form. Do i need to file an income tax return chart. Web department of the treasury information about schedule a and its separate instructions is at omb no. Line instructions for form 1040a. Web to be a qualifying child for the child tax credit, the child must be under age 17 at the end of 2016 and meet the other requirements listed earlier under qualifying child.also see. Web inside the 2016 1040a instructions booklet you will find: Federal adjusted gross income from your 2016 federal return. Form 1040a is a shorter version of the more detailed form 1040, but. Web your 2016 tax liability can be found on: (see page 6 of the instructions.).

Web inside the 2016 1040a instructions booklet you will find: Annual income tax return filed by citizens or residents of the united states. 1 2 1 net modifications to federal agi from ri schedule m, line 3. Mark your filing status box below and enter the appropriate. Web fill online, printable, fillable, blank form 1040: Ad prior year 2016 tax filing. Internal revenue service (99) name(s). Web start with the federal 2016 tax calculators when estimating and preparing your 2016 tax return. Web form 1040 (2021) us individual income tax return for tax year 2021. Web the irs form 1040a is one of three forms you can use to file your federal income tax return.

Web federal agi from federal form 1040, line 37; If no modifications, enter zero. Web your 2016 tax liability can be found on: Do not write above this line. Ad prior year 2016 tax filing. Free 2016 federal tax preparation. Federal adjusted gross income from your 2016 federal return. Individual income tax return 2016. Web start with the federal 2016 tax calculators when estimating and preparing your 2016 tax return. If you do not have a copy of your return, you can order a transcript of.

1040a Tax Form 2017 Instructions Form Resume Examples xm1e242KrL

Web start with the federal 2016 tax calculators when estimating and preparing your 2016 tax return. Web federal agi from federal form 1040, line 37; Do i need to file an income tax return chart. Web fill online, printable, fillable, blank form 1040: Line instructions for form 1040a.

2016 1040A Tax Form PDF

Web individual income tax return. Web your 2016 tax liability can be found on: Ederal adjusted gross income from your federal. Mark your filing status box below and enter the appropriate. Web department of the treasury information about schedule a and its separate instructions is at omb no.

Irs Tax Form 1040a 2016 Instructions Universal Network

Internal revenue service (99) name(s). Do not write above this line. Individual income tax return (irs) form. Department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space. Web start with the federal 2016 tax calculators when estimating and preparing your 2016 tax return.

TAX 201 Completing a Form 1040A YouTube

Do not write above this line. Web federal agi from federal form 1040, line 37; Web inside the 2016 1040a instructions booklet you will find: Annual income tax return filed by citizens or residents of the united states. Department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space.

What Is 1040a And How Was This Tax Form Updated? Tax Relief Center

Web federal agi from federal form 1040, line 37; Ad prior year 2016 tax filing. Information about form 1040x and its. January 2016) department of the treasury—internal revenue service. Mark your filing status box below and enter the appropriate.

1040a Tax Forms 2018 Form Resume Examples 2A1W74q1ze

January 2016) department of the treasury—internal revenue service. Individual income tax return (irs) form. Use fill to complete blank online irs pdf forms for free. Mark your filing status box below and enter the appropriate. Information about form 1040x and its.

Links to Government supplied PDF file

Web the irs form 1040a is one of three forms you can use to file your federal income tax return. Annual income tax return filed by citizens or residents of the united states. Web individual income tax return. Line instructions for form 1040a. Do i need to file an income tax return chart.

Federal 1040ez Tax Form Form Resume Examples o7Y3ypo2BN

1 2 1 net modifications to federal agi from ri schedule m, line 3. If you do not have a copy of your return, you can order a transcript of. Free 2016 federal tax preparation. Internal revenue service (99) name(s). Federal adjusted gross income from your 2016 federal return.

Lesson 2 Form 1040A YouTube

Federal adjusted gross income from your 2016 federal return. Web individual income tax return. Annual income tax return filed by citizens or residents of the united states. Do not write above this line. Web federal agi from federal form 1040, line 37;

1040A, Line 21 Or 1040Ez, Line 4.

Web your 2016 tax liability can be found on: Form 1040a is a shorter version of the more detailed form 1040, but. Mark your filing status box below and enter the appropriate. Web department of the treasury information about schedule a and its separate instructions is at omb no.

Federal Adjusted Gross Income From Your 2016 Federal Return.

Web start with the federal 2016 tax calculators when estimating and preparing your 2016 tax return. Need to change or amend a 2016 federal. Web itemized deductions schedule a (form 1040) department of the treasury internal revenue service (99) itemized deductions information about schedule a and its. Ederal adjusted gross income from your federal.

Individual Income Tax Return (Irs) Form.

Web federal agi from federal form 1040, line 37; Web to be a qualifying child for the child tax credit, the child must be under age 17 at the end of 2016 and meet the other requirements listed earlier under qualifying child.also see. Free 2016 federal tax preparation. Web fill online, printable, fillable, blank form 1040:

Web The Irs Form 1040A Is One Of Three Forms You Can Use To File Your Federal Income Tax Return.

Web form 1040 (2021) us individual income tax return for tax year 2021. Annual income tax return filed by citizens or residents of the united states. If you do not have a copy of your return, you can order a transcript of. Internal revenue service (99) name(s).