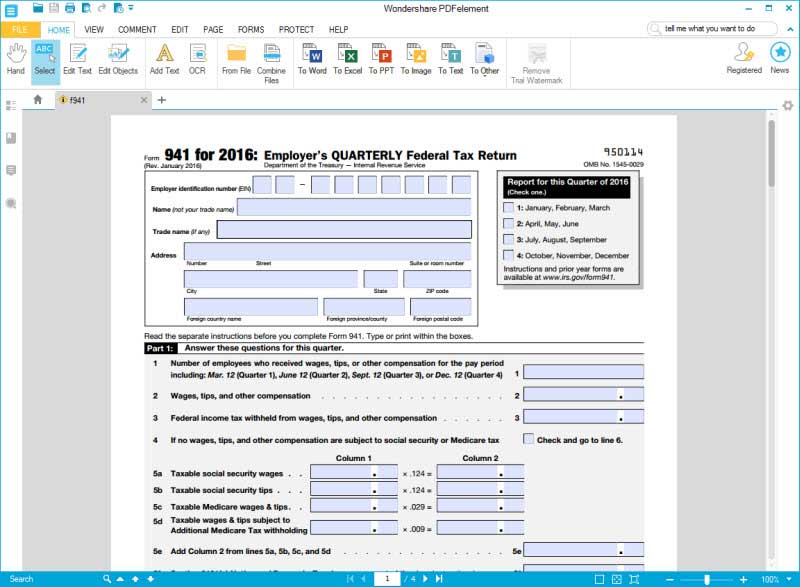

2016 Form 941

2016 Form 941 - Second quarter, july 31, 2016; Draw your signature, type it,. For optimal functionality, save the form to your computer before completing and utilize adobe reader.). Web fill out the { 941 2016 pdf} form for free? Type or print within the boxes. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31,. Complete irs tax forms online or print government tax documents. Web use a 2016 form 941 2020 template to make your document workflow more streamlined. Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Type text, add images, blackout confidential details, add comments, highlights and more.

For optimal functionality, save the form to your computer before completing and utilize adobe reader.). Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Second quarter, july 31, 2016; Do not mail this form if you file. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Type text, add images, blackout confidential details, add comments, highlights and more. Complete, edit or print tax forms instantly. Get form for the latest information about developments related to form 941 and its. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Web report for this quarter of 2016 (check one.) 1:

Sign it in a few clicks. You must complete all three pages. And fourth quarter, january 31,. Ad access irs tax forms. Web edit your 941 form 2016 online. Web report for this quarter of 2016 (check one.) 1: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Second quarter, july 31, 2016; For optimal functionality, save the form to your computer before completing and utilize adobe reader.). Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late.

IRS Form 941 Find the Instructions Here to Fill it Right

Draw your signature, type it,. For optimal functionality, save the form to your computer before completing and utilize adobe reader.). Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Complete irs tax forms online or.

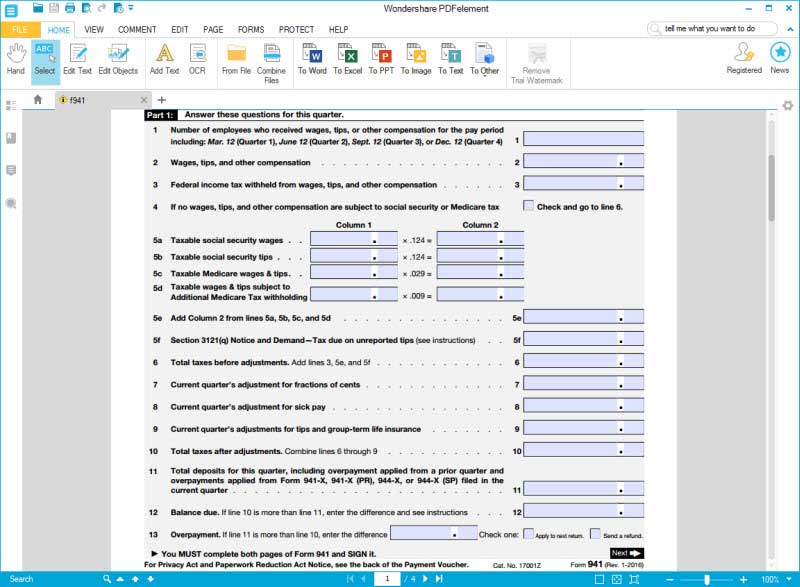

form 941 updated 2 Southland Data Processing

Web use a 2016 form 941 2020 template to make your document workflow more streamlined. Get form for the latest information about developments related to form 941 and its. Web edit your 941 form 2016 online. Type or print within the boxes. Keep it simple when filling out your { 941 2016 pdf} and use pdfsimpli, the simple solution to.

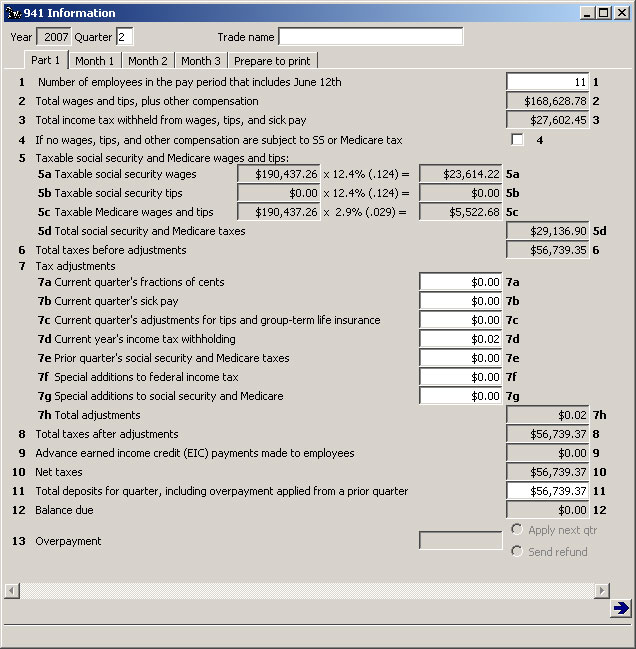

21st Century Accounting Print 941 Information

Type or print within the boxes. Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Get form for the latest information about developments related to form 941 and its. Employer’s quarterly federal tax return. For.

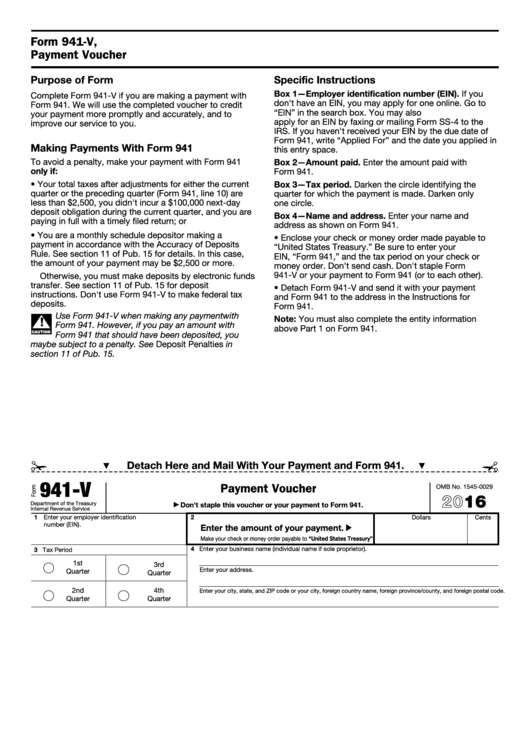

Fillable Form 941V Payment Voucher 2016 printable pdf download

Employer's return of income taxes withheld (note: Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Type or print within the boxes. For employers who withhold taxes from employee's paychecks or who must pay the.

IRS 941 Form 2022 Complete and Download PDF Template Online

Sign it in a few clicks. Employer's return of income taxes withheld (note: Ad access irs tax forms. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Type or print within the boxes.

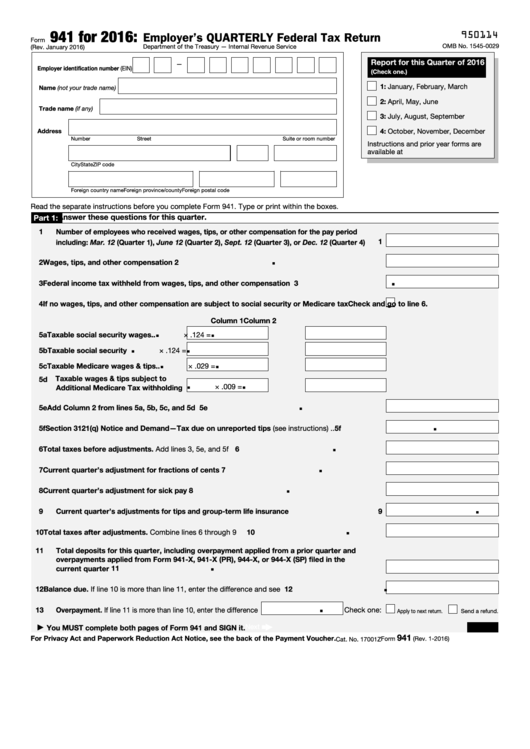

Fillable Form 941 Employer's Quarterly Federal Tax Return 2016

Second quarter, july 31, 2016; Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Get form for the latest information about developments related to form 941 and its. Sign it in a few clicks. January.

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

Sign it in a few clicks. Keep it simple when filling out your { 941 2016 pdf} and use pdfsimpli, the simple solution to editing,. Second quarter, july 31, 2016; Third quarter, october 31, 2016; Employer's return of income taxes withheld (note:

IRS Form 941 Payroll Taxes errors late payroll taxes

Web use a 2016 form 941 2020 template to make your document workflow more streamlined. Web edit your 941 form 2016 online. Employer's return of income taxes withheld (note: Sign it in a few clicks. Get form for the latest information about developments related to form 941 and its.

IRS Form 941 Find the Instructions Here to Fill it Right

Type text, add images, blackout confidential details, add comments, highlights and more. Third quarter, october 31, 2016; Ad access irs tax forms. Draw your signature, type it,. Complete, edit or print tax forms instantly.

How to Fill out Tax Form 941 Intro Video YouTube

Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Second quarter, july 31, 2016; And fourth quarter, january 31,. You must complete all three pages. Web the rate of social security tax on taxable wages,.

Draw Your Signature, Type It,.

Type or print within the boxes. January 2016) department of the treasury — internal revenue service. And fourth quarter, january 31,. Keep it simple when filling out your { 941 2016 pdf} and use pdfsimpli, the simple solution to editing,.

For Employers Who Withhold Taxes From Employee's Paychecks Or Who Must Pay The Employer's Portion Of.

Web report for this quarter of 2016 (check one.) 1: Web employer's quarterly federal tax return for 2021. Web form 941 for 2023: Ad access irs tax forms.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Get form for the latest information about developments related to form 941 and its. Complete irs tax forms online or print government tax documents. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Complete, edit or print tax forms instantly.

You Must Complete All Three Pages.

Web use a 2016 form 941 2020 template to make your document workflow more streamlined. Do not mail this form if you file. Employer's return of income taxes withheld (note: Third quarter, october 31, 2016;