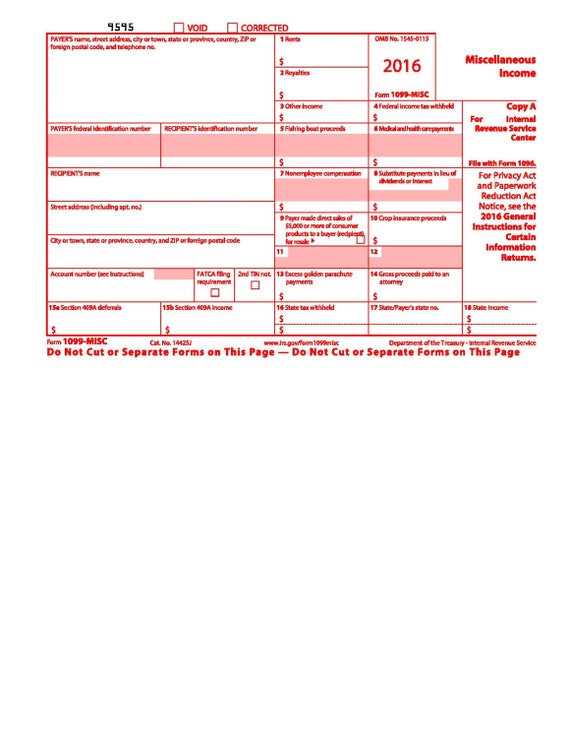

2016 1099 Misc Form

2016 1099 Misc Form - Web get ready for tax season by using our free online form builder to create online your own 1099 misc 2016 forms. Copy b report this income on your federal tax. Web schedule se (form 1040). Complete, edit or print tax forms instantly. If a taxpayer received more than $600 and it was. Click on the fields visible in the form & you. Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. Get ready for tax season deadlines by completing any required tax forms today. For your protection, this form may show only the last four digits of your social security number. Web get your 1099 misc form for 2016 from checkpaystub.com.

Do not miss the deadline Web instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven). Enter the income reported to you as if from. Go to www.irs.gov/freefile to see. File this form for each person to whom you made certain types of payment during the tax year. Web instructions for recipient recipient's taxpayer identification number (tin). Web get ready for tax season by using our free online form builder to create online your own 1099 misc 2016 forms. For your protection, this form may show only the last four digits of your social security number. Get ready for tax season deadlines by completing any required tax forms today. Click on the fields visible in the form & you.

Web fillable form 1099 misc. Web instructions for recipient recipient's taxpayer identification number (tin). Click on the fields visible in the form & you. At least $10 in royalties (see the instructions for box 2) or broker. File this form for each person to whom you made certain types of payment during the tax year. (see instructions for details.) note:. For your protection, this form may show only the last four digits of your social security number. This form is for the calendar year of 2016. Web instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven). Web schedule se (form 1040).

Form Fillable PDF for 2016 1099MISC Form.

1099 misc 2016 is an irs tax form used in the united states to prepare and file information return to report various type of income and other. File this form for each person to whom you made certain types of payment during the tax year. Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. Copy.

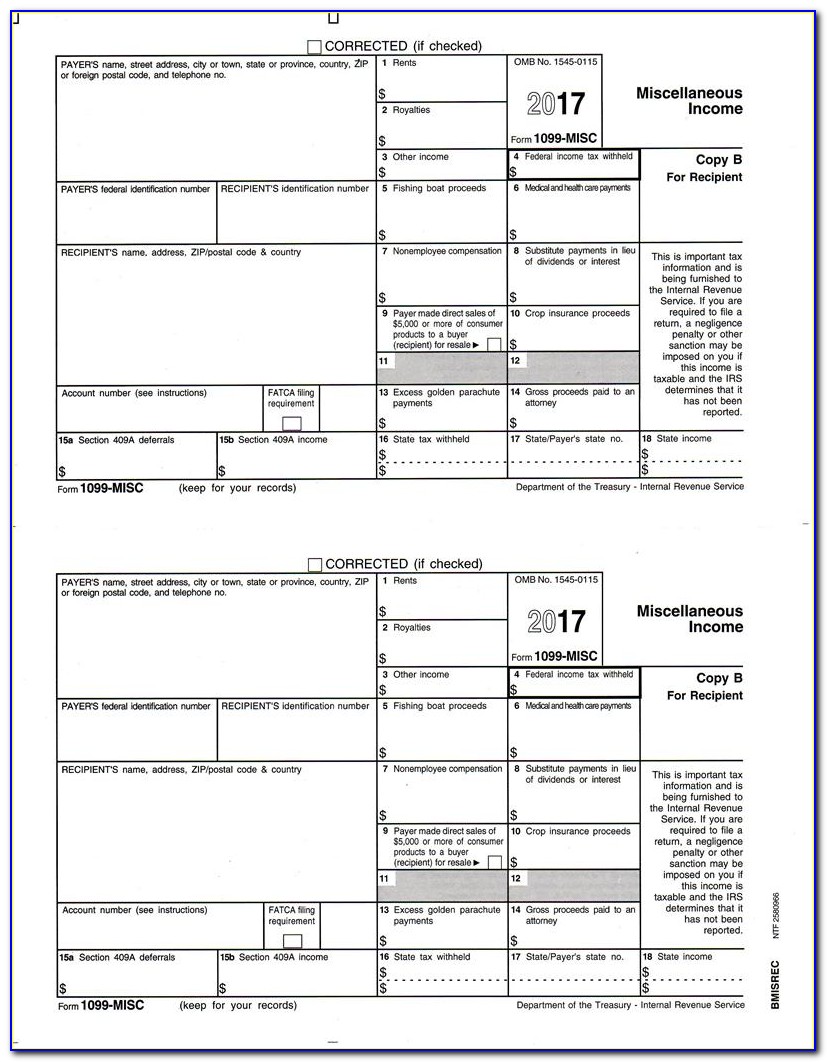

Free 1099 Misc Form 2016 amulette

For your protection, this form may show only the last four digits of your social security number. This form is for the calendar year of 2016. Go to www.irs.gov/freefile to see. If a taxpayer received more than $600 and it was. File this form for each person to whom you made certain types of payment during the tax year.

What is a 1099Misc Form? Financial Strategy Center

Web get your 1099 misc form for 2016 from checkpaystub.com. Go to www.irs.gov/freefile to see. Web instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven). This form is for the calendar year of 2016. Click on the fields visible in the form & you.

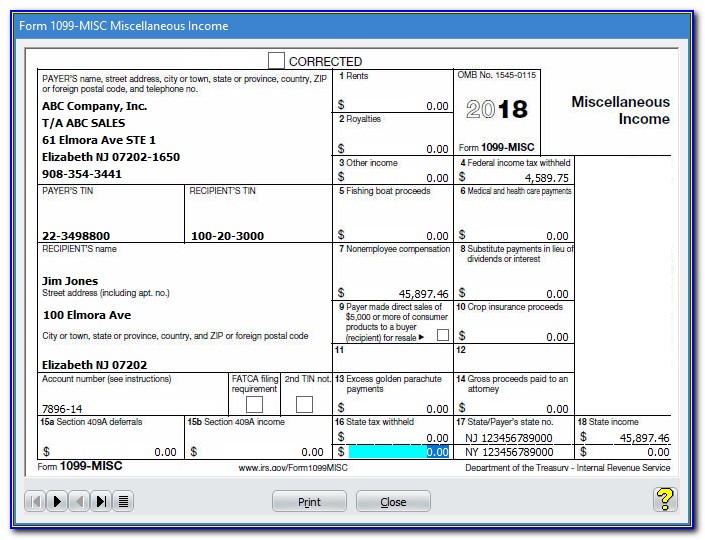

Free Downloadable 1099 Misc Form 2016 Universal Network

Web fillable form 1099 misc. Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. (see instructions for details.) note:. File this form for each person to whom you made certain types of payment during the tax year. Enter the income reported to you as if from.

Free Printable 1099 Misc Form 2016 Form Resume Examples eaZDYRb579

This form is for the calendar year of 2016. For your protection, this form may show only the last four digits of your social security number. Enter the income reported to you as if from. If a taxpayer received more than $600 and it was. Fill, edit, sign, download & print.

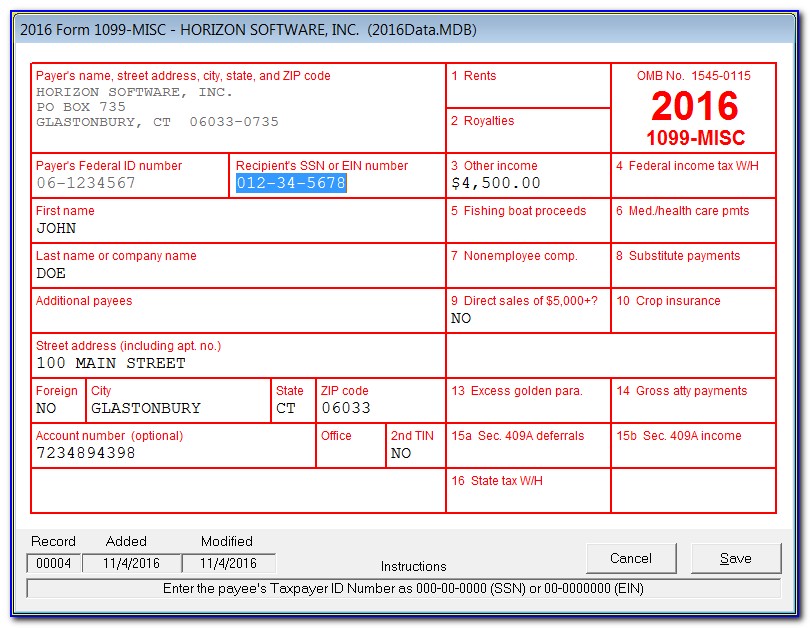

1099 Misc 2016 Fillable Form Free Universal Network

Copy b report this income on your federal tax. File this form for each person to whom you made certain types of payment during the tax year. Web instructions for recipient recipient's taxpayer identification number (tin). For your protection, this form may show only the last four digits of your social security number. (see instructions for details.) note:.

Ficial 1099 Form Printable 2016 Bing Images Design Free Printable 1099

Web instructions for recipient recipient's taxpayer identification number (tin). Web get your 1099 misc form for 2016 from checkpaystub.com. Do not miss the deadline Copy b report this income on your federal tax. Complete, edit or print tax forms instantly.

The Tax Times 2016 Form 1099's are FATCA Compliant

Web get your 1099 misc form for 2016 from checkpaystub.com. 1099 misc 2016 is an irs tax form used in the united states to prepare and file information return to report various type of income and other. At least $10 in royalties (see the instructions for box 2) or broker. For your protection, this form may show only the last.

Irs 1099 Template 2016 Beautiful Form 1099 R Instructions Awesome Form

Get ready for tax season deadlines by completing any required tax forms today. At least $10 in royalties (see the instructions for box 2) or broker. (see instructions for details.) note:. Web instructions for recipient recipient's taxpayer identification number (tin). Click on the fields visible in the form & you.

Ficial 1099 Form Printable 2016 Bing Images Design Free Printable 1099

1099 misc 2016 is an irs tax form used in the united states to prepare and file information return to report various type of income and other. Complete, edit or print tax forms instantly. Web get ready for tax season by using our free online form builder to create online your own 1099 misc 2016 forms. Copy b report this.

Complete, Edit Or Print Tax Forms Instantly.

Web instructions for recipient recipient's taxpayer identification number (tin). Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. Ad get the latest 1099 misc online. Do not miss the deadline

Copy B Report This Income On Your Federal Tax.

Fill, edit, sign, download & print. At least $10 in royalties (see the instructions for box 2) or broker. This form is for the calendar year of 2016. Go to www.irs.gov/freefile to see.

If A Taxpayer Received More Than $600 And It Was.

Web schedule se (form 1040). File this form for each person to whom you made certain types of payment during the tax year. 1099 misc 2016 is an irs tax form used in the united states to prepare and file information return to report various type of income and other. Web fillable form 1099 misc.

For Your Protection, This Form May Show Only The Last Four Digits Of Your Social Security Number.

(see instructions for details.) note:. Enter the income reported to you as if from. Click on the fields visible in the form & you. Web instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven).