15H Form Income Tax

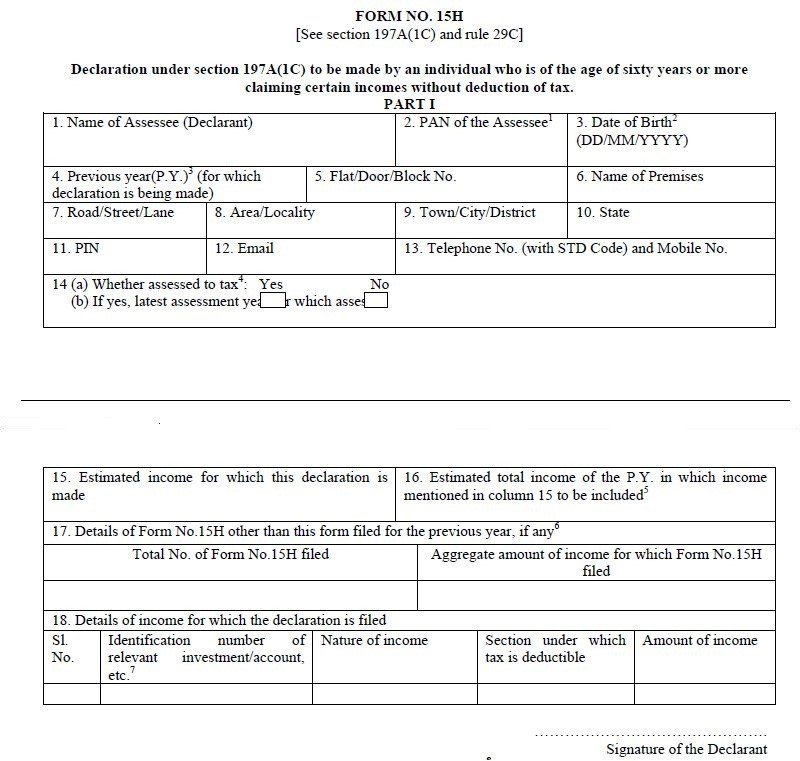

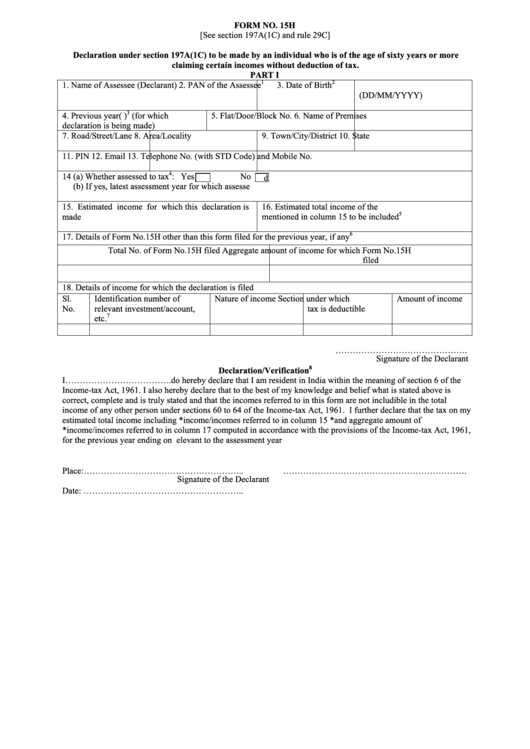

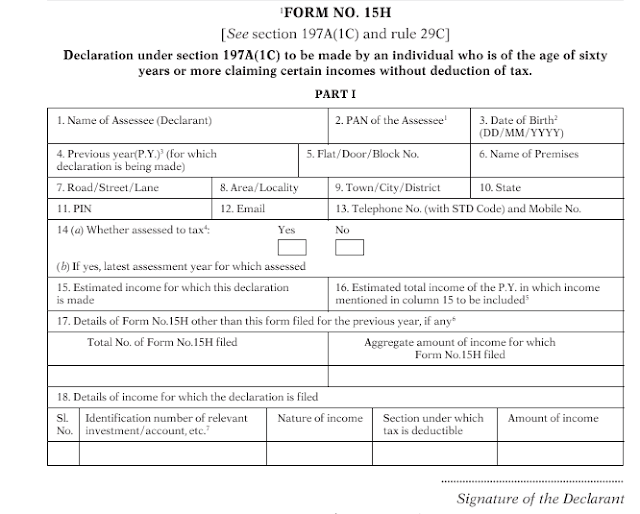

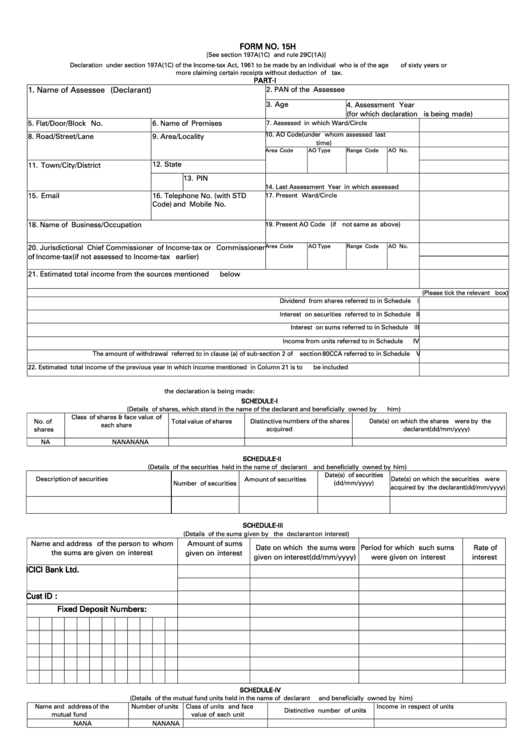

15H Form Income Tax - Web what is 15h form? Uses of form 15h how to use form 15h to prevent tds deduction eligibility for using form 15h components of form 15h factors. To avoid deduction of tds from your interest income you can surely opt. Skip line c and go to. Faqs what is form 15g/15h? 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by. Form 15g/ 15h is used to make sure that tds is not deducted. Web eligible for form 15h as age is more than 60 years and tax applicable on total income is zero. Web (form 1040) department of the treasury internal revenue service (99). 15h form is used for stating that the income earned in the preceding.

Web (form 1040) department of the treasury internal revenue service (99). Web details required when should form 15g / form 15h be submitted? Faqs what is form 15g/15h? Web include the amount from line 8d above on schedule 2 (form 1040), line 9. 15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or. Web eligible for form 15h as age is more than 60 years and tax applicable on total income is zero. 15h form is used for stating that the income earned in the preceding. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by. Web signature of the declarant form no. To avoid deduction of tds from your interest income you can surely opt.

Web details required when should form 15g / form 15h be submitted? Faqs what is form 15g/15h? Web what is 15h form? Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Web up to $40 cash back the 15h form is a declaration form used by senior citizens (over the age of 60) to exempt themselves from tax on the interest earned from their fixed deposits. Under the present article we would. Web it is a declaration form under sub section [1c] of section 197a of the income tax act,1961. Include the amounts, if any, from line 8e on schedule 3 (form 1040), line 13b, and line 8f on. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by. To avoid deduction of tds from your interest income you can surely opt.

How To Fill New Form 15G / Form 15H roy's Finance

15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by. Under the present article we would. Include the amounts, if any, from line 8e on schedule 3 (form 1040), line 13b, and line 8f on. Form 15g/ 15h is used to make sure that tds is not deducted. Uses of form 15h how to use.

Form 15H (Save TDS on Interest How to Fill & Download

Skip line c and go to. Web up to $40 cash back the 15h form is a declaration form used by senior citizens (over the age of 60) to exempt themselves from tax on the interest earned from their fixed deposits. Uses of form 15h how to use form 15h to prevent tds deduction eligibility for using form 15h components.

Form 15H Declaration Download and Fill to Save Tax

Web include the amount from line 8d above on schedule 2 (form 1040), line 9. Web signature of the declarant form no. Web updated on 30 sep, 2022 form 15h is a very popular form among investors and taxpayers. Web what is 15h form? To avoid deduction of tds from your interest income you can surely opt.

New FORM 15H Applicable PY 201617 Government Finances Payments

15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or. Web include the amount from line 8d above on schedule 2 (form 1040), line 9. 15h form is used for stating that the income earned in the preceding. Skip line c and go to..

Top 11 Indian Tax Form 15h Templates free to download in PDF format

Web (form 1040) department of the treasury internal revenue service (99). Form 15g/ 15h is used to make sure that tds is not deducted. Skip line c and go to. Web it is a declaration form under sub section [1c] of section 197a of the income tax act,1961. Web updated on 30 sep, 2022 form 15h is a very popular.

Form 15G and Form 15H in Tax

Web income section under which tax is deductible amount of income sl. 15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or. Web up to $40 cash back the 15h form is a declaration form used by senior citizens (over the age of 60).

Submission of Form 15G/ 15H to Tax Department Docest

Web it is a declaration form under sub section [1c] of section 197a of the income tax act,1961. Web updated on 30 sep, 2022 form 15h is a very popular form among investors and taxpayers. Form15h can be submitted by any eligible individual at the beginning of the. Web eligible for form 15h as age is more than 60 years.

Form No. 15h Declaration Under Section 197a(1c) Of The Act

Include the amounts, if any, from line 8e on schedule 3 (form 1040), line 13b, and line 8f on. 15h form is used for stating that the income earned in the preceding. Web what is 15h form? 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by. Web form 15h is a declaration form that.

15h Form Fill Online, Printable, Fillable, Blank pdfFiller

Did you withhold federal income tax during 2015 for any household employee? Web what is 15h form? Web include the amount from line 8d above on schedule 2 (form 1040), line 9. Web eligible for form 15h as age is more than 60 years and tax applicable on total income is zero. 15h [see section 197a(1c) and nile 29c] declaration.

What is Form 15G & How to Fill Form 15G for PF Withdrawal

Form 15h can be submitted despite the interest income being more than the basic. Web (form 1040) department of the treasury internal revenue service (99). Web signature of the declarant form no. Web details required when should form 15g / form 15h be submitted? Web form 15h is a declaration form that can be submitted to the income tax department.

15H [See Section 197A(1C) And Nile 29C] Declaration Under Section 197A(1C) To Be Made By An Individual Who Is Of The Age Of Sixty Years Or.

15h form is used for stating that the income earned in the preceding. Web up to $40 cash back the 15h form is a declaration form used by senior citizens (over the age of 60) to exempt themselves from tax on the interest earned from their fixed deposits. Include the amounts, if any, from line 8e on schedule 3 (form 1040), line 13b, and line 8f on. Web eligible for form 15h as age is more than 60 years and tax applicable on total income is zero.

Form15H Can Be Submitted By Any Eligible Individual At The Beginning Of The.

Skip line c and go to. Form 15h can be submitted despite the interest income being more than the basic. Web details required when should form 15g / form 15h be submitted? To avoid deduction of tds from your interest income you can surely opt.

Did You Withhold Federal Income Tax During 2015 For Any Household Employee?

Web (form 1040) department of the treasury internal revenue service (99). Web individuals need to furnish form 15h to a deductor before interest payment or applicable financial year. Web income section under which tax is deductible amount of income sl. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a.

Web It Is A Declaration Form Under Sub Section [1C] Of Section 197A Of The Income Tax Act,1961.

Web include the amount from line 8d above on schedule 2 (form 1040), line 9. Under the present article we would. Faqs what is form 15g/15h? Web updated on 30 sep, 2022 form 15h is a very popular form among investors and taxpayers.