1099 Employee Form Printable

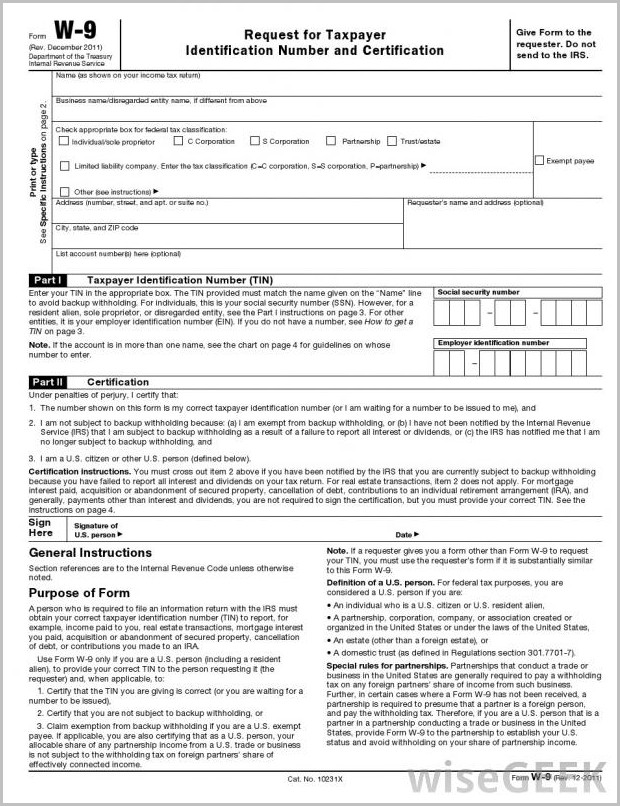

1099 Employee Form Printable - For internal revenue service center. Report wages, tips, and other compensation paid to an employee. Verify your printer settings, and click “print”. 12.4% goes to social security. Both the forms and instructions will be updated as needed. Web use the form to calculate your gross income on schedule c. Simple instructions and pdf download updated: It’s the contractor’s responsibility to report their income and pay their taxes. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Report the employee's income and social security taxes withheld and other information.

Report wages, tips, and other compensation paid to an employee. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web use the form to calculate your gross income on schedule c. Select each contractor you want to print 1099s for. Web a 1099 employee doesn’t receive benefits or have taxes deducted from their paycheck. Report the employee's income and social security taxes withheld and other information. Simple instructions and pdf download updated: Sandra akins expert review onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. It’s the contractor’s responsibility to report their income and pay their taxes. Verify your printer settings, and click “print”.

Simple instructions and pdf download updated: For internal revenue service center. Verify your printer settings, and click “print”. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Current general instructions for certain information returns. Web use the form to calculate your gross income on schedule c. Select each contractor you want to print 1099s for. Make sure you’ve got the right paper in your printer. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). It’s the contractor’s responsibility to report their income and pay their taxes.

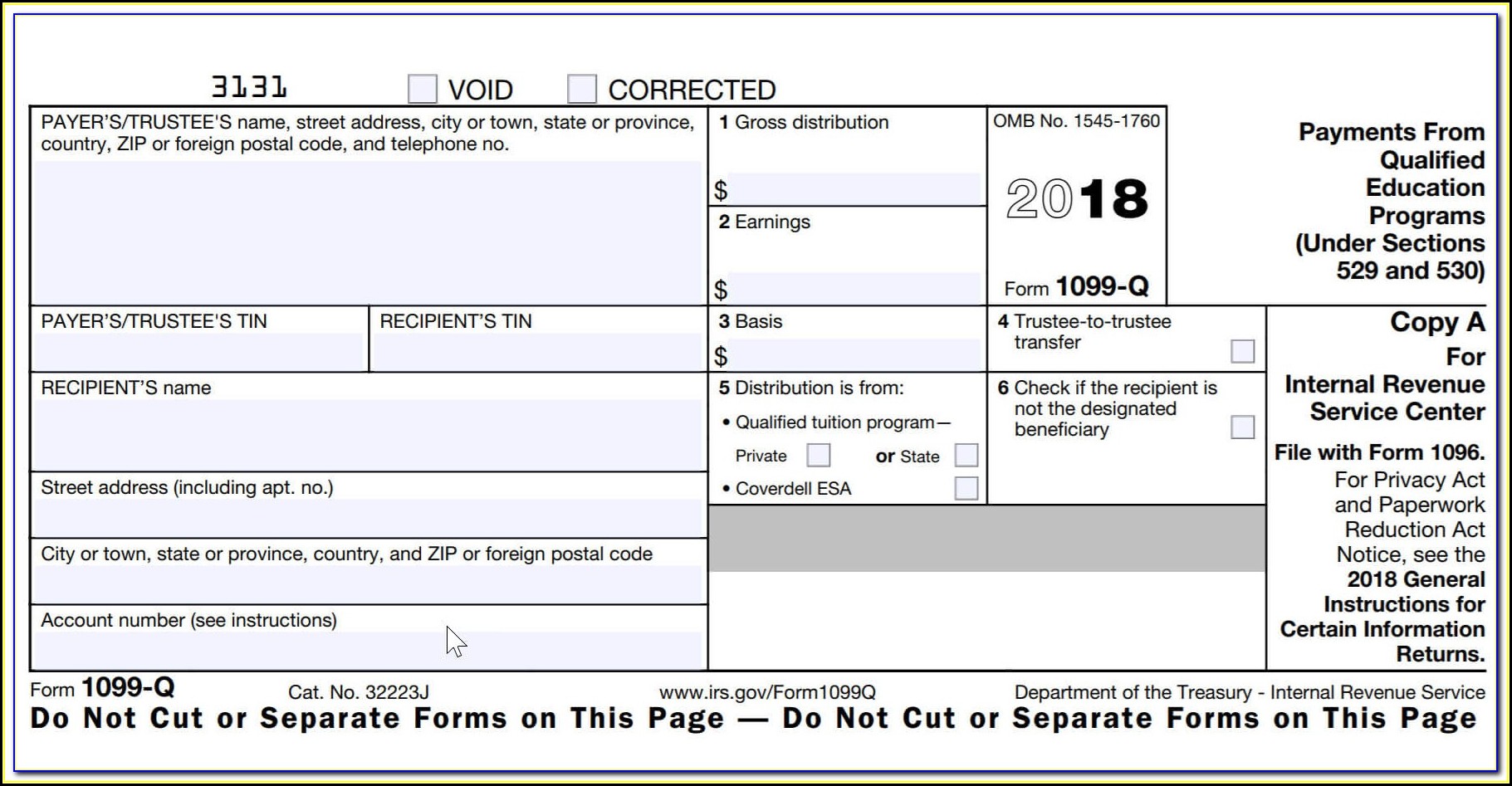

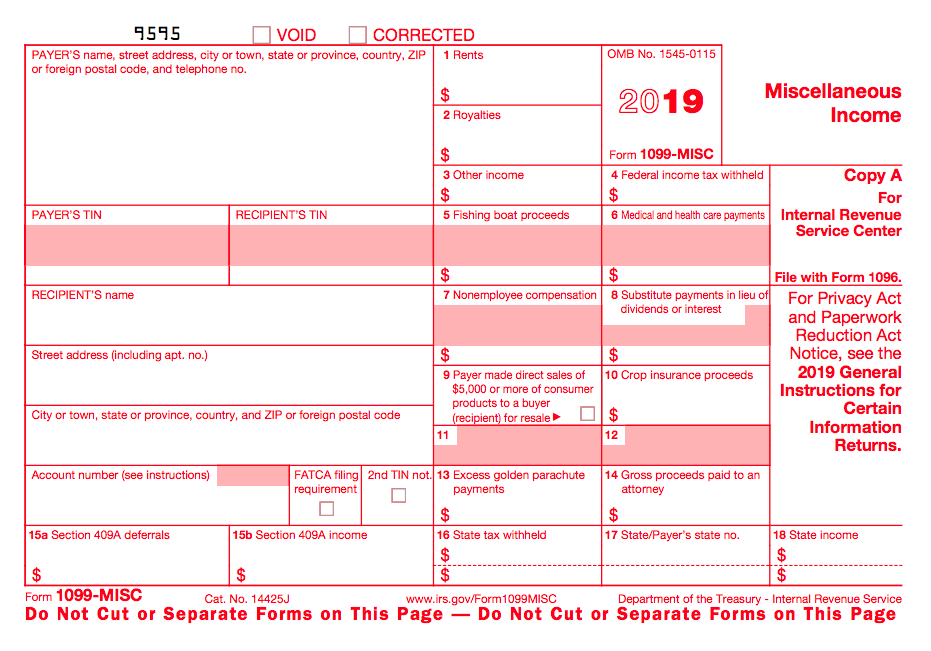

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Both the forms and instructions will be updated as needed. Verify your printer settings, and click “print”. Report wages, tips, and other compensation paid to an employee..

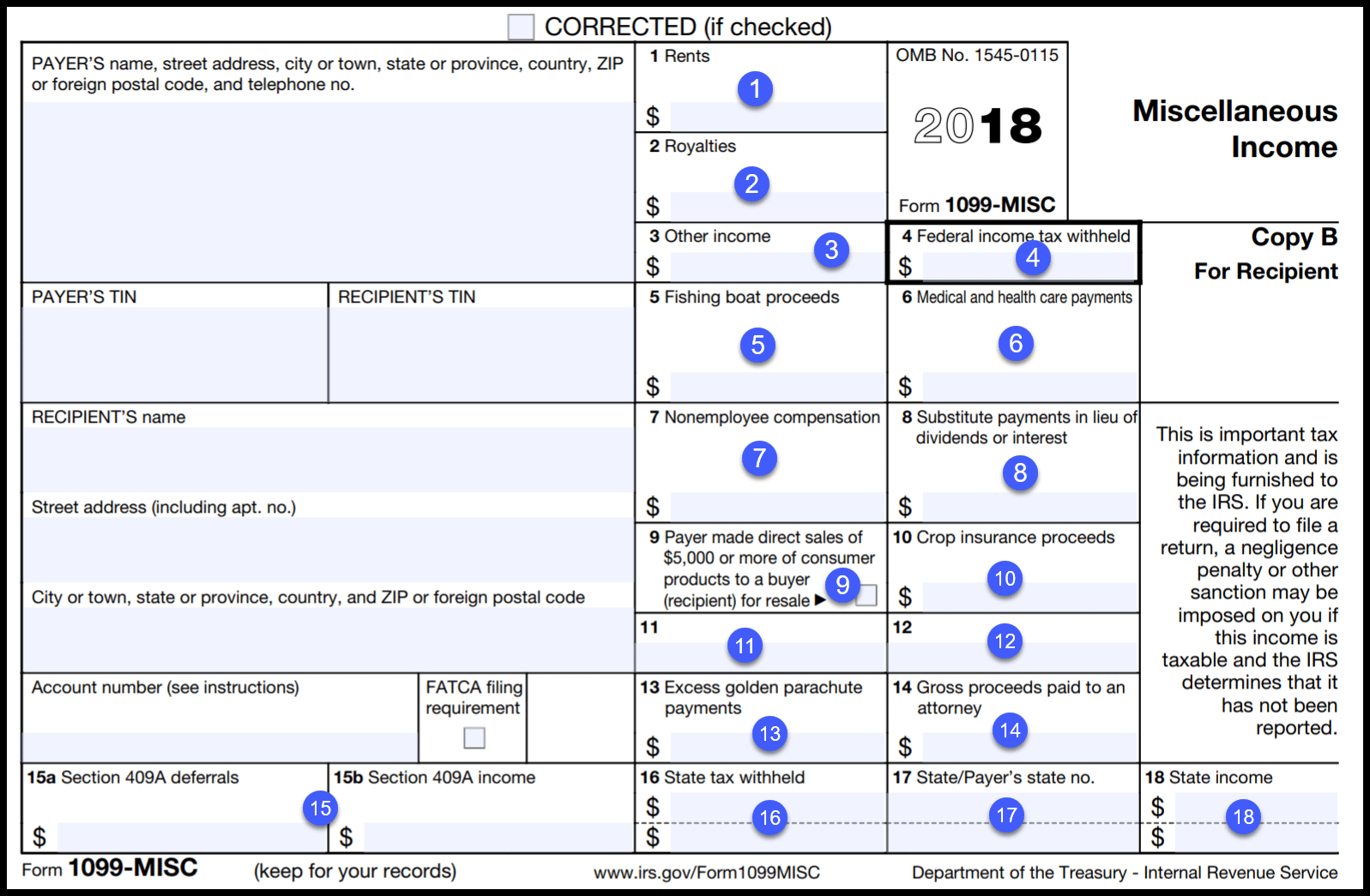

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

12.4% goes to social security. Make sure you’ve got the right paper in your printer. Click “print 1099” or “print 1096” if you only want that form. Sandra akins expert review onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Verify your printer settings, and click “print”.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

For internal revenue service center. Report the employee's income and social security taxes withheld and other information. Current general instructions for certain information returns. Report wages, tips, and other compensation paid to an employee. Web a 1099 employee doesn’t receive benefits or have taxes deducted from their paycheck.

1099 forms free download DriverLayer Search Engine

Report the employee's income and social security taxes withheld and other information. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For internal revenue service center. 12.4% goes to social security. Make sure you’ve got the right paper in your printer.

Where To Get Official 1099 Misc Forms Universal Network

Report wages, tips, and other compensation paid to an employee. Report the employee's income and social security taxes withheld and other information. 12.4% goes to social security. Web a 1099 employee doesn’t receive benefits or have taxes deducted from their paycheck. Both the forms and instructions will be updated as needed.

Free Printable 1099 Misc Forms Free Printable

Click “print 1099” or “print 1096” if you only want that form. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web instructions for recipient recipient’s taxpayer identification number (tin). 12.4% goes to social security. Make.

Free Printable 1099 Form 2018 Free Printable

Click “print 1099” or “print 1096” if you only want that form. Web use the form to calculate your gross income on schedule c. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Although these forms are called information returns, they serve different functions. Sandra akins expert review onpay’s goal is to make it easier for small business owners.

1099 Archives Deb Evans Tax Company

Web use the form to calculate your gross income on schedule c. Both the forms and instructions will be updated as needed. Click “print 1099” or “print 1096” if you only want that form. Make sure you’ve got the right paper in your printer. It’s the contractor’s responsibility to report their income and pay their taxes.

Printable 1099 Form For Employees Form Resume Examples

Click “print 1099” or “print 1096” if you only want that form. For internal revenue service center. Make sure you’ve got the right paper in your printer. Sandra akins expert review onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Report the employee's income and social security taxes withheld.

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

Although these forms are called information returns, they serve different functions. Web a 1099 employee doesn’t receive benefits or have taxes deducted from their paycheck. Report wages, tips, and other compensation paid to an employee. Current general instructions for certain information returns. Web instructions for recipient recipient’s taxpayer identification number (tin).

Verify Your Printer Settings, And Click “Print”.

Web instructions for recipient recipient’s taxpayer identification number (tin). For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). It’s the contractor’s responsibility to report their income and pay their taxes. For internal revenue service center.

Current General Instructions For Certain Information Returns.

Sandra akins expert review onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Select each contractor you want to print 1099s for. Web use the form to calculate your gross income on schedule c. Web a 1099 employee doesn’t receive benefits or have taxes deducted from their paycheck.

Both The Forms And Instructions Will Be Updated As Needed.

12.4% goes to social security. Click “print 1099” or “print 1096” if you only want that form. Although these forms are called information returns, they serve different functions. Simple instructions and pdf download updated:

Report Wages, Tips, And Other Compensation Paid To An Employee.

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Report the employee's income and social security taxes withheld and other information. Make sure you’ve got the right paper in your printer.