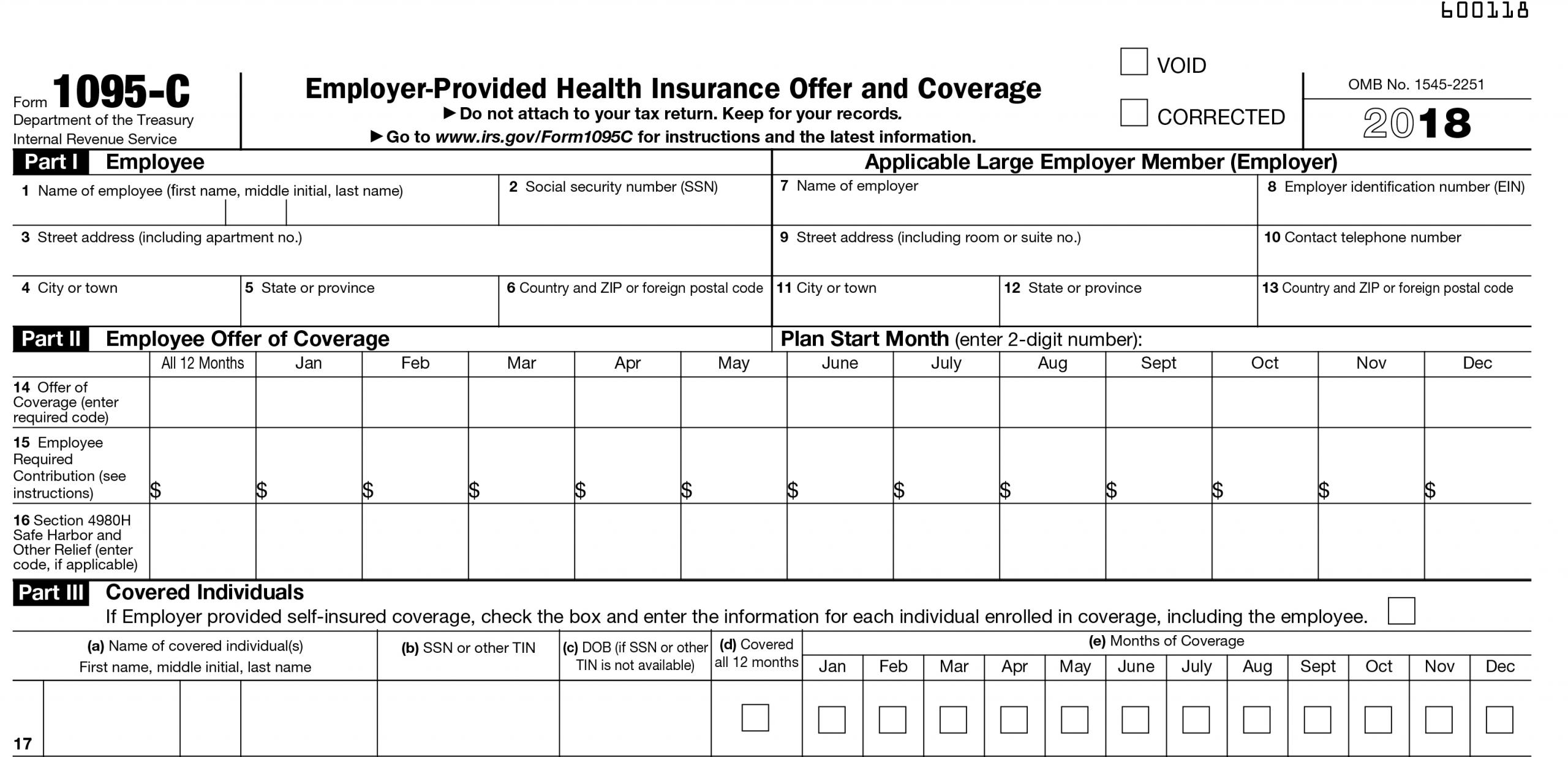

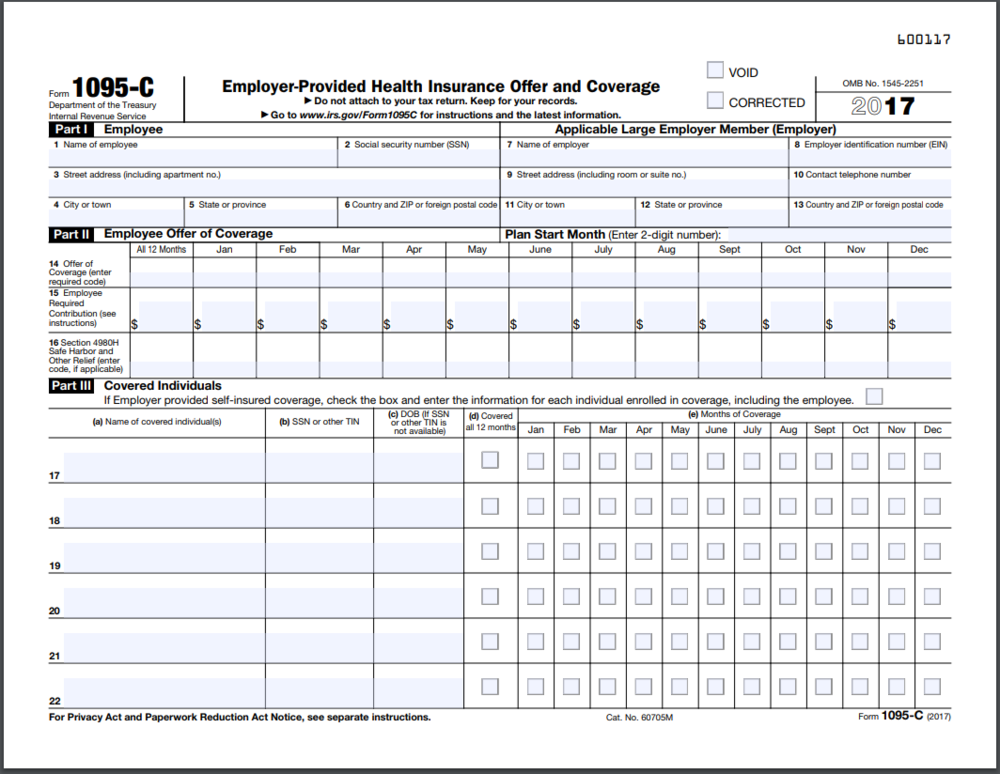

1095 C Form 1E Meaning

1095 C Form 1E Meaning - The 1e code confirms the employee, their dependents, and their spouse received an offer of health coverage that meets mec and mv. The code on line 14 may vary as to the quality of the coverage offering. This form must confirm minimum essential coverage and. Department of the treasury internal revenue service. The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll. Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). Your employer made a qualifying offer of healthcare coverage to you. This is a form that employers are required to send employees in accordance with the affordable care act. Web what information must an ale member furnish to its employees? Department of the treasury internal revenue service.

Additionally, it isn’t filed or attached to your individual tax return. Web what information must an ale member furnish to its employees? Do not attach to your tax return. It is used by the irs to determine offer and election of health. This is a form that employers are required to send employees in accordance with the affordable care act. This form must confirm minimum essential coverage and. Department of the treasury internal revenue service. The section 6056 reporting requirement relates to the employer shared responsibility/play or. Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). Keep it in your tax records, however.

Web what information must an ale member furnish to its employees? Department of the treasury internal revenue service. The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll. The code on line 14 may vary as to the quality of the coverage offering. The 1e code confirms the employee, their dependents, and their spouse received an offer of health coverage that meets mec and mv. This form must confirm minimum essential coverage and. Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). Department of the treasury internal revenue service. The section 6056 reporting requirement relates to the employer shared responsibility/play or. This is a form that employers are required to send employees in accordance with the affordable care act.

hr.ua.edu The University of Alabama

This is a form that employers are required to send employees in accordance with the affordable care act. The section 6056 reporting requirement relates to the employer shared responsibility/play or. Do not attach to your tax return. Additionally, it isn’t filed or attached to your individual tax return. Keep it in your tax records, however.

Affordable Care Act (ACA) forms mailed News Illinois State

It is used by the irs to determine offer and election of health. Do not attach to your tax return. Department of the treasury internal revenue service. Web what information must an ale member furnish to its employees? This form must confirm minimum essential coverage and.

IRS Form 1095C UVA HR

Department of the treasury internal revenue service. Your employer made a qualifying offer of healthcare coverage to you. Department of the treasury internal revenue service. This form must confirm minimum essential coverage and. This is a form that employers are required to send employees in accordance with the affordable care act.

1095A, 1095B and 1095C What are they and what do I do with them

The code on line 14 may vary as to the quality of the coverage offering. Web what information must an ale member furnish to its employees? Do not attach to your tax return. Your employer made a qualifying offer of healthcare coverage to you. The amount reported on line 15 may not be the amount you paid for coverage if,.

Form 1095C EmployerProvided Health Insurance Offer and Coverage

Additionally, it isn’t filed or attached to your individual tax return. Do not attach to your tax return. It is used by the irs to determine offer and election of health. Department of the treasury internal revenue service. This form must confirm minimum essential coverage and.

Form 1095C Adding Another Level of Complexity to Employee Education

Department of the treasury internal revenue service. The section 6056 reporting requirement relates to the employer shared responsibility/play or. Department of the treasury internal revenue service. Do not attach to your tax return. The 1e code confirms the employee, their dependents, and their spouse received an offer of health coverage that meets mec and mv.

1095C Information Kum & Go

The 1e code confirms the employee, their dependents, and their spouse received an offer of health coverage that meets mec and mv. Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). This form must confirm minimum essential coverage and. Department of the treasury internal revenue service. Your employer made a qualifying offer of healthcare.

Does Form 1095 C Have To Be Filed With Taxes Tax Walls

Department of the treasury internal revenue service. This is a form that employers are required to send employees in accordance with the affordable care act. It is used by the irs to determine offer and election of health. Do not attach to your tax return. Web what information must an ale member furnish to its employees?

Do You Need Your 1095 C To File Your Taxes Tax Walls

Do not attach to your tax return. This is a form that employers are required to send employees in accordance with the affordable care act. The section 6056 reporting requirement relates to the employer shared responsibility/play or. Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). Web what information must an ale member furnish.

1095C Form 2021 2022 IRS Forms

Do not attach to your tax return. Your employer made a qualifying offer of healthcare coverage to you. The section 6056 reporting requirement relates to the employer shared responsibility/play or. This is a form that employers are required to send employees in accordance with the affordable care act. Keep it in your tax records, however.

Your Employer Made A Qualifying Offer Of Healthcare Coverage To You And Your Dependent (S).

The code on line 14 may vary as to the quality of the coverage offering. This form must confirm minimum essential coverage and. The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll. It is used by the irs to determine offer and election of health.

Department Of The Treasury Internal Revenue Service.

Web what information must an ale member furnish to its employees? Additionally, it isn’t filed or attached to your individual tax return. The section 6056 reporting requirement relates to the employer shared responsibility/play or. Keep it in your tax records, however.

The 1E Code Confirms The Employee, Their Dependents, And Their Spouse Received An Offer Of Health Coverage That Meets Mec And Mv.

Do not attach to your tax return. Department of the treasury internal revenue service. Your employer made a qualifying offer of healthcare coverage to you. This is a form that employers are required to send employees in accordance with the affordable care act.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)