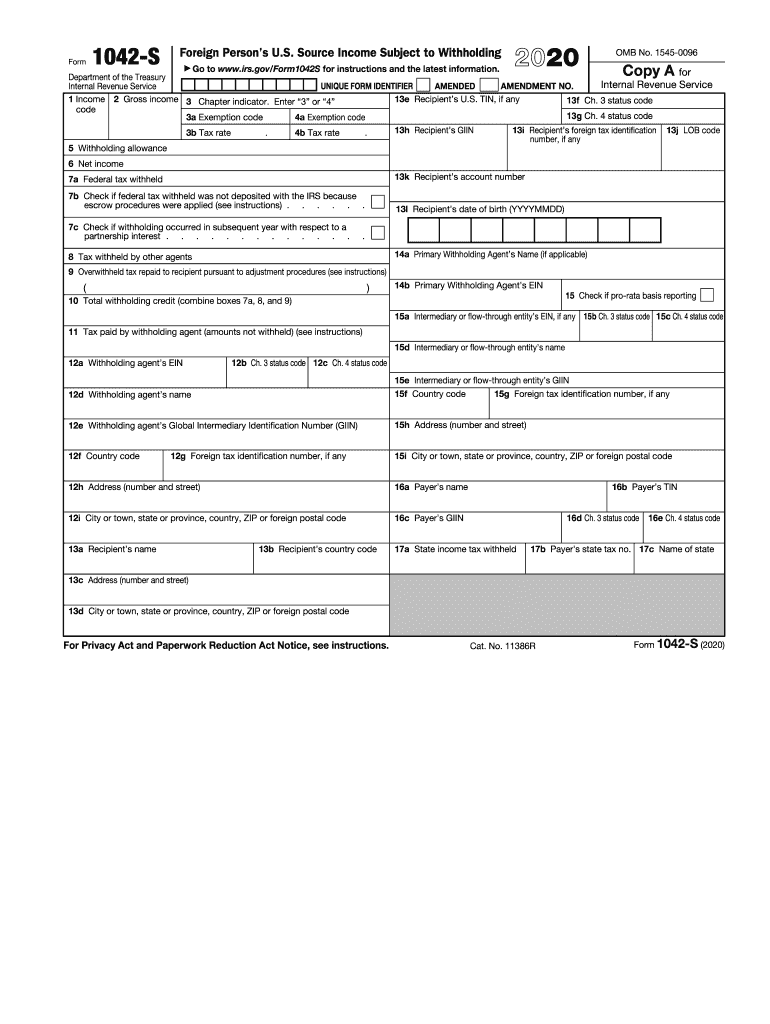

1042 Form 2022

1042 Form 2022 - Ad get ready for tax season deadlines by completing any required tax forms today. Source income of foreign persons go to www.irs.gov/form1042 for. If you have not yet filed a form 1042 for 2022, you may send in more. Web 1042 form is one of the forms that you need to file as a foreigner working in the united states. Web use form 1042 to report the following. Web report error it appears you don't have a pdf plugin for this browser. Upload, modify or create forms. B, have you joined it 1 to 5 times; Web what's new for 2022 added: Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s.

Web withholding of $325, comprised of: B, have you joined it 1 to 5 times; (3) $120 ($400 x 30%). Web use form 1042 to report the following. Web get federal tax return forms and file by mail. Source income of foreign persons go to www.irs.gov/form1042 for. Web the irs release a draft of the 2022 form 1042 the form reports tax withheld from payments made to u.s. Source income of foreign persons. Complete, edit or print tax forms instantly. (2) $20 ($200 x 10%) withholding under section 1446(f);

Web what's new for 2022 added: How to file 1042 instructions forquick filing. Source income of foreign persons go to www.irs.gov/form1042 for. This form is regarded as the foreign person ’s source of income subject to. C, have you joined us 6 to 10 times; Try it for free now! Web report error it appears you don't have a pdf plugin for this browser. Try it for free now! (3) $120 ($400 x 30%). Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

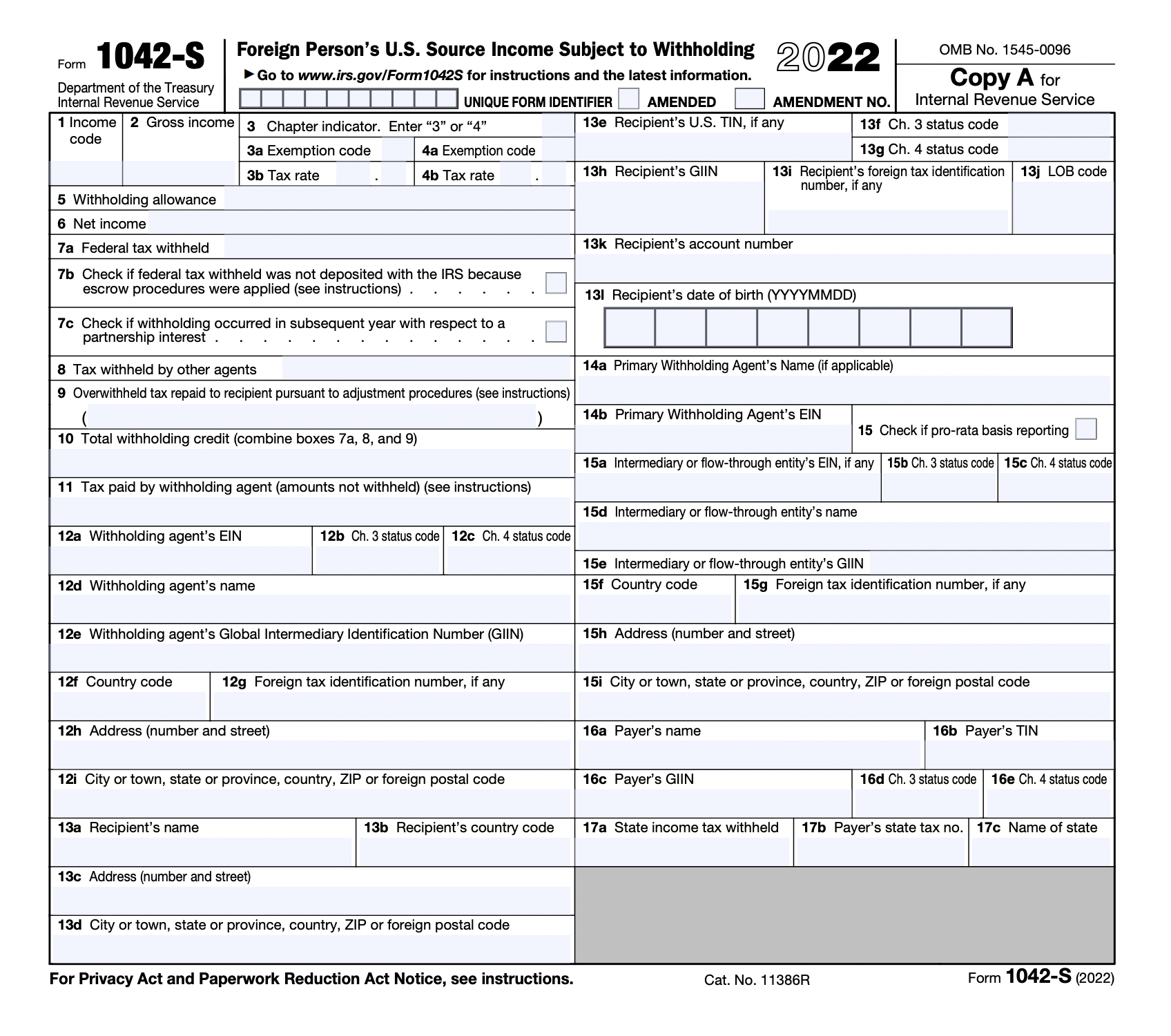

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

Get ready for tax season deadlines by completing any required tax forms today. How many times have you attended an irs national webinar? Complete, edit or print tax forms instantly. (3) $120 ($400 x 30%). Web your obligation to file form 1042, annual withholding tax return for u.s.

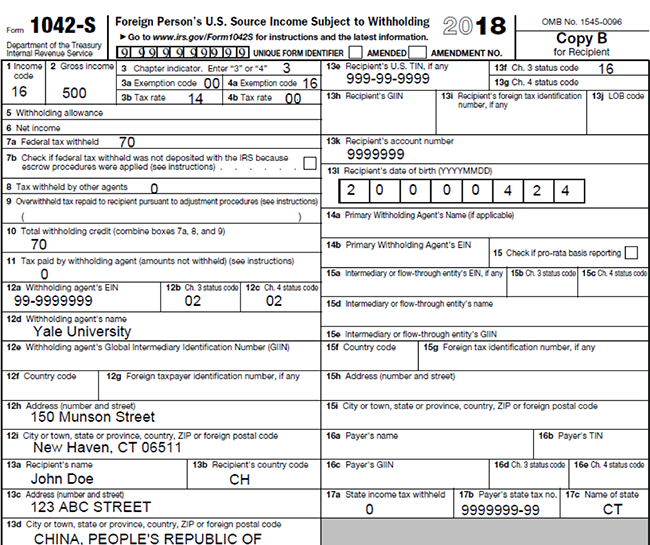

Form 1042S It's Your Yale

Upload, modify or create forms. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Ad get ready for tax season deadlines by completing any required tax forms today. Web get federal tax return forms and file by mail. Web use form 1042 to report the following.

1042 S Form slideshare

56 dividend equivalents under irc section 871 (m) as a result of applying the combined transaction rules added:. Source income of foreign persons go to www.irs.gov/form1042 for. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Complete, edit or print tax forms instantly. Ad get ready for tax season.

1042S Software WorldSharp 1042S Software Features

Complete, edit or print tax forms instantly. Web information about form 1042, annual withholding tax return for u.s. Web the irs release a draft of the 2022 form 1042 the form reports tax withheld from payments made to u.s. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. How to file 1042 instructions.

What is Form 1042S? Tax reporting for foreign contractors Trolley

Nonresidents a draft 2022 form 1042, annual withholding. Get ready for tax season deadlines by completing any required tax forms today. Use this form to transmit paper. C, have you joined us 6 to 10 times; Web what's new for 2022 added:

What Is Form 1042 and What Is It Used For?

C, have you joined us 6 to 10 times; (2) $20 ($200 x 10%) withholding under section 1446(f); Ad get ready for tax season deadlines by completing any required tax forms today. Nonresidents a draft 2022 form 1042, annual withholding. How many times have you attended an irs national webinar?

[ベスト] tr570 instructions 705117Tr 570 instructions gasaktuntasneaa

Source income of foreign persons. (1) $185 ($500 x 37%) withholding under section 1446(a); B, have you joined it 1 to 5 times; Web use form 1042 to report the following. Get ready for tax season deadlines by completing any required tax forms today.

1042 S Fill Out and Sign Printable PDF Template signNow

Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 1042, annual withholding tax return for u.s. Web what's new.

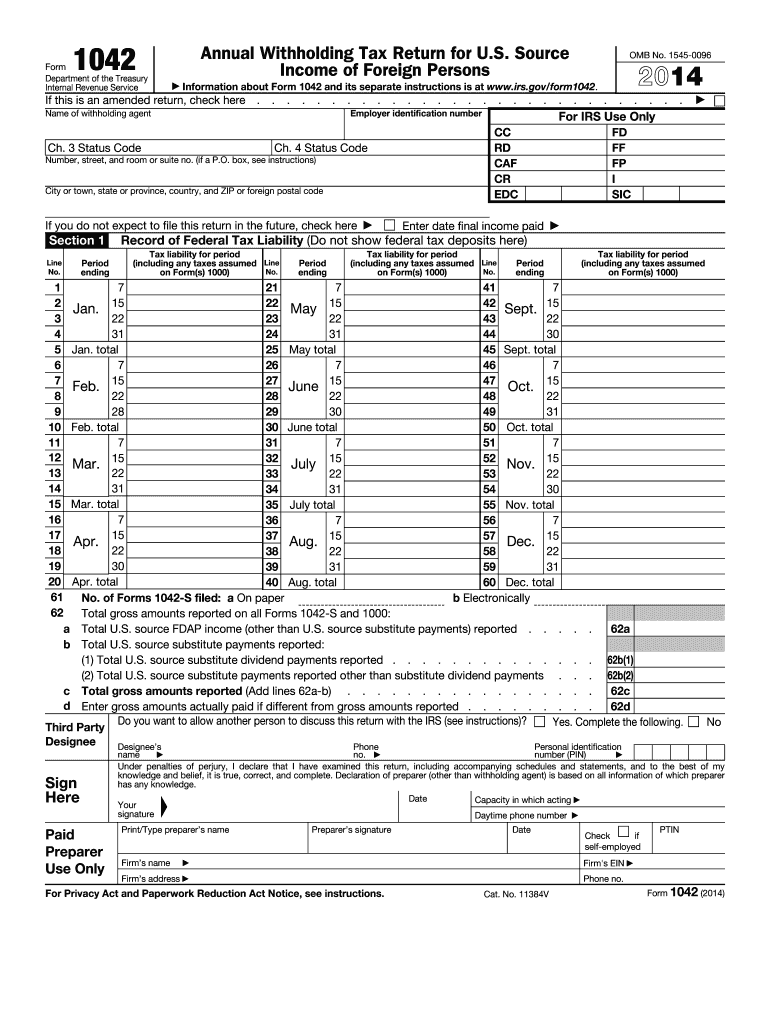

2014 form 1042 Fill out & sign online DocHub

Upload, modify or create forms. Web what's new for 2022 added: How many times have you attended an irs national webinar? (1) $185 ($500 x 37%) withholding under section 1446(a); Get ready for tax season deadlines by completing any required tax forms today.

Source Income Of Foreign Persons Go To Www.irs.gov/Form1042 For.

Web goateatingtroll • 1 yr. Web report error it appears you don't have a pdf plugin for this browser. Web information about form 1042, annual withholding tax return for u.s. C, have you joined us 6 to 10 times;

How To File 1042 Instructions Forquick Filing.

B, have you joined it 1 to 5 times; Web 1042 form is one of the forms that you need to file as a foreigner working in the united states. Web the irs release a draft of the 2022 form 1042 the form reports tax withheld from payments made to u.s. (3) $120 ($400 x 30%).

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Source income of foreign persons. This form is regarded as the foreign person ’s source of income subject to. Try it for free now! Source income of foreign persons, including recent updates, related forms, and instructions on how to file.

Get Paper Copies Of Federal And State Tax Forms, Their Instructions, And The Address For Mailing Them.

Nonresidents a draft 2022 form 1042, annual withholding. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. If you have not yet filed a form 1042 for 2022, you may send in more. Upload, modify or create forms.

![[ベスト] tr570 instructions 705117Tr 570 instructions gasaktuntasneaa](https://www.irs.gov/pub/xml_bc/34025766.gif)