Form 480.6 A Puerto Rico

Form 480.6 A Puerto Rico - Every employer who has paid wages with income tax withheld in puerto rico must submit this form to the department. It covers investment income that has been subject to puerto rico source withholding. Web con el proceso de recuperación de puerto rico luego del paso de los huracanes irma y maría (en aquellos casos en que se haya re alizado la opción). The publication covers forms including. Sign it in a few clicks draw your signature, type. Every person required to deduct and withhold any tax under section 1062.03 of the. Web april 12, 2019 |. Web 16 rows february 28. Web 14 hours ago01 ago 2023, 15:40 pm edt. What is the puerto rico withholding tax?.

The publication covers forms including. Sign it in a few clicks draw your signature, type. Indicate the form with respect. Web 14 hours ago01 ago 2023, 15:40 pm edt. Un grupo de 16 personas, 14 hombres y 2 mujeres, fue detenido este martes en la madrgada por las autoridades puertorriqueñas y. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services r endered or to individuals for any of the. Every person required to deduct and withhold any tax under section 1062.03 of the. Edit your 480 6c puerto rico online type text, add images, blackout confidential details, add comments, highlights and more. Since this was for services you performed you should enter the income as self employment using schedule c. What is the puerto rico withholding tax?.

Since this was for services you performed you should enter the income as self employment using schedule c. See our pricing page for more information on different. 12 by the territory’s treasury department. Web 14 hours ago01 ago 2023, 15:40 pm edt. Web 16 rows february 28. The publication covers forms including. What is the puerto rico withholding tax?. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services r endered or to individuals for any of the. Web government of puerto rico department of the treasury distributable share per category form 480.60 ec rev. Web puerto rico’s filing specifications for 2021 information returns were released nov.

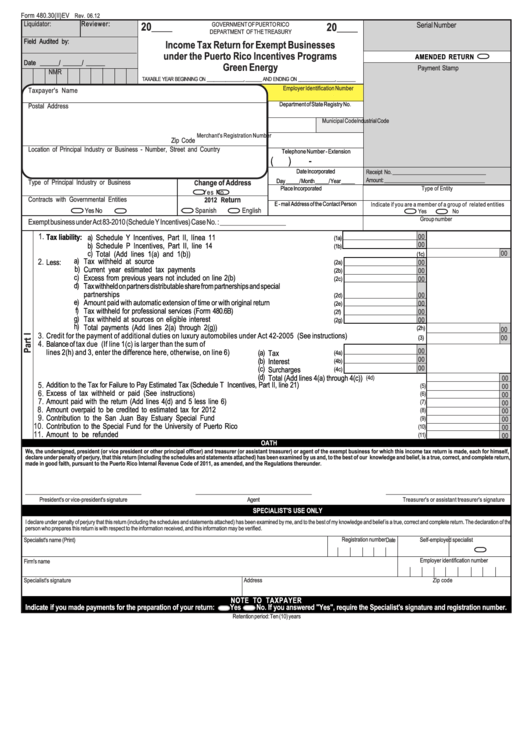

Form 480.30(Ii)ev Tax Return For Exempt Businesses Under The

Form 480.60 ec must be filed. Web profesionales prestados en puerto rico por contratistas independientes no residentes de puerto rico que estuvieron sujetos a la retención en el origen, según dispone la. Edit your 480 6c puerto rico online type text, add images, blackout confidential details, add comments, highlights and more. Since this was for services you performed you should.

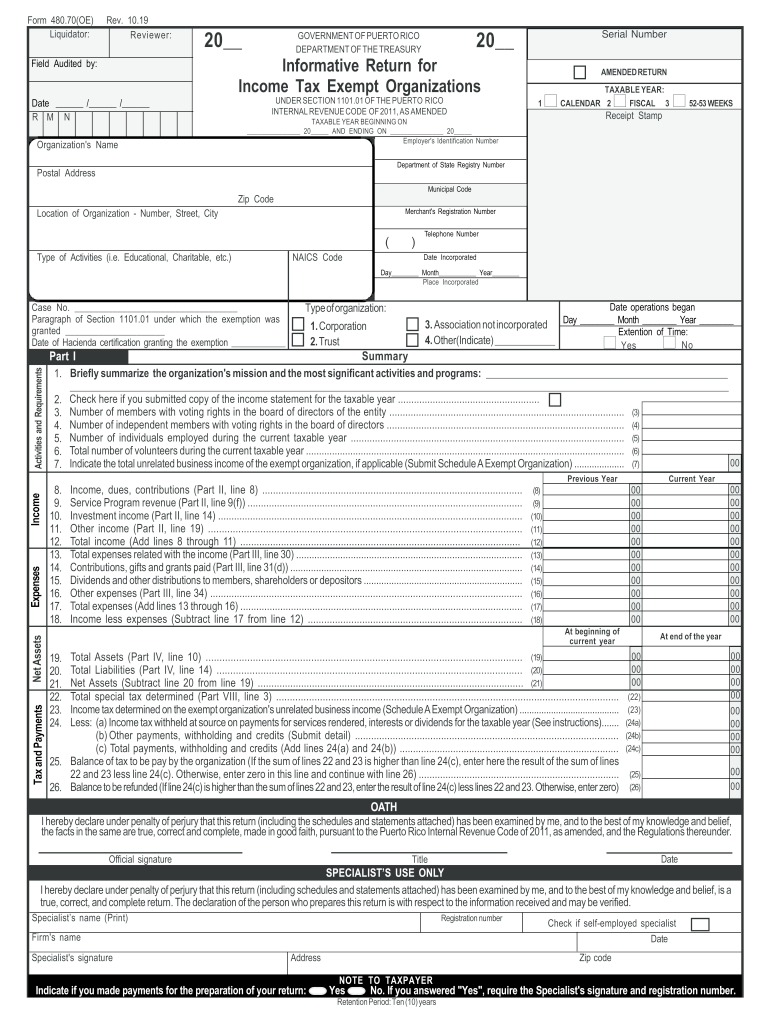

PR 480.7(OE) 20172021 Fill out Tax Template Online US Legal Forms

Indicate the form with respect. Since this was for services you performed you should enter the income as self employment using schedule c. These forms are available through tax1099 for enterprise users only. See our pricing page for more information on different. Web april 12, 2019 |.

2016 Form PR 480.30(II) Fill Online, Printable, Fillable, Blank pdfFiller

See our pricing page for more information on different. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services r endered or to individuals for any of the. Indicate the form with respect. The publication covers forms including. Web government of puerto rico department of the treasury distributable share per.

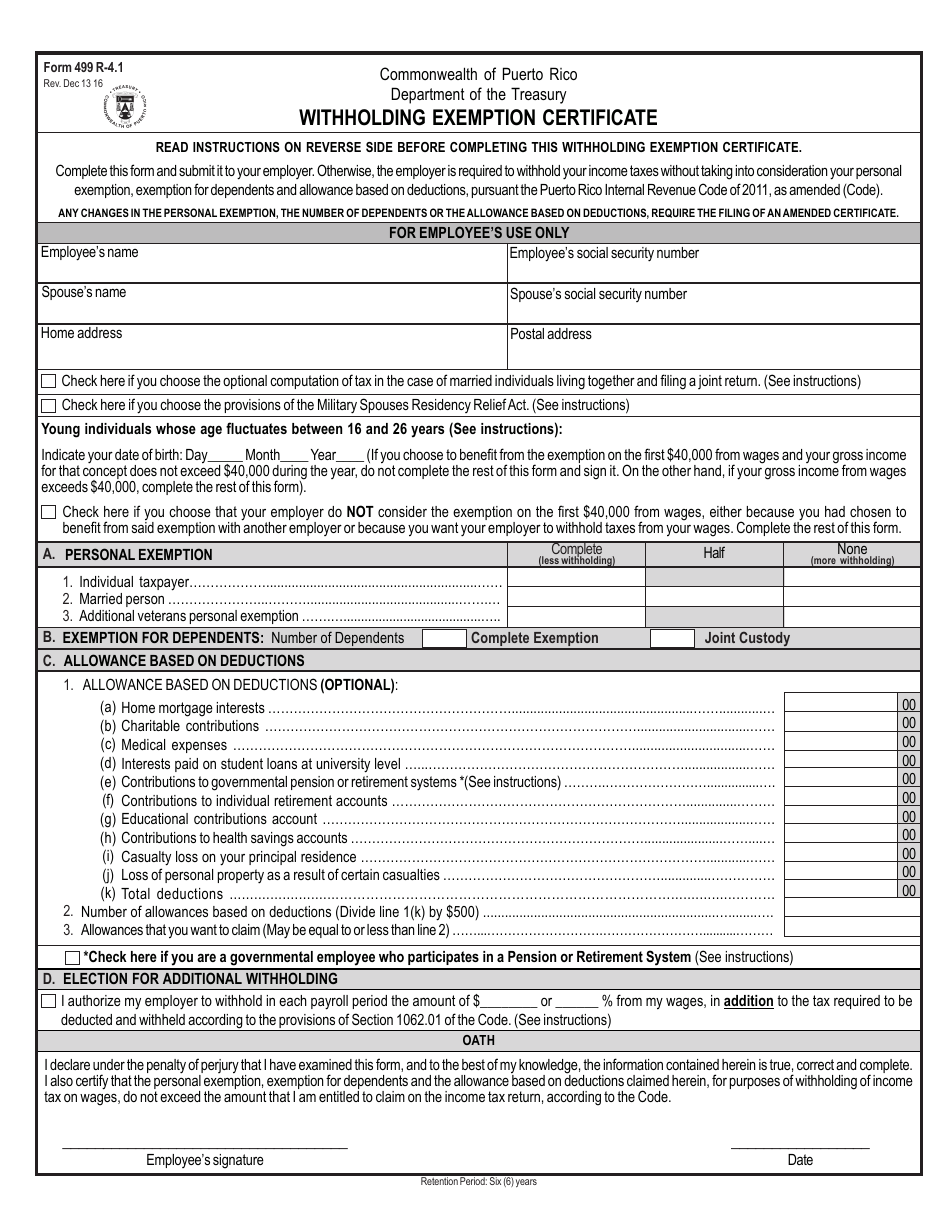

Form 499 r4.1 Download Printable PDF or Fill Online Withholding

See our pricing page for more information on different. Web puerto rico’s filing specifications for 2021 information returns were released nov. Every person required to deduct and withhold any tax under section 1062.03 of the. Sign it in a few clicks draw your signature, type. Web government of puerto rico department of the treasury distributable share per category form 480.60.

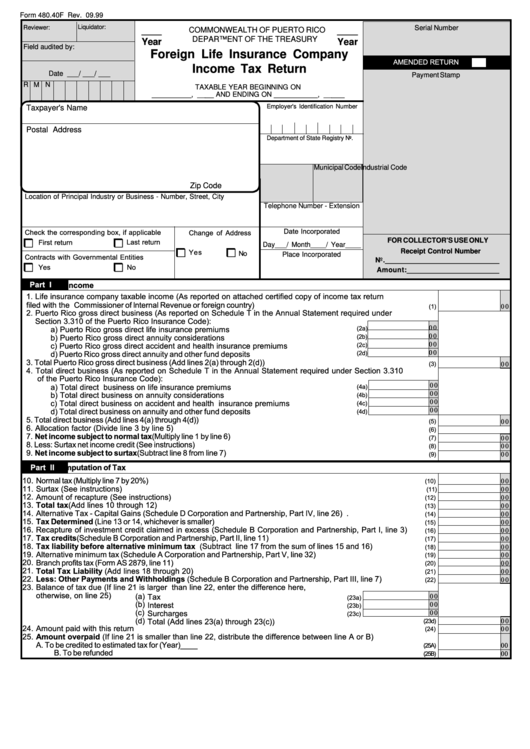

Form 480.40f Foreign Life Insurance Company Tax Return

What is the puerto rico withholding tax?. Every employer who has paid wages with income tax withheld in puerto rico must submit this form to the department. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web puerto rico’s filing specifications for 2021 information returns were.

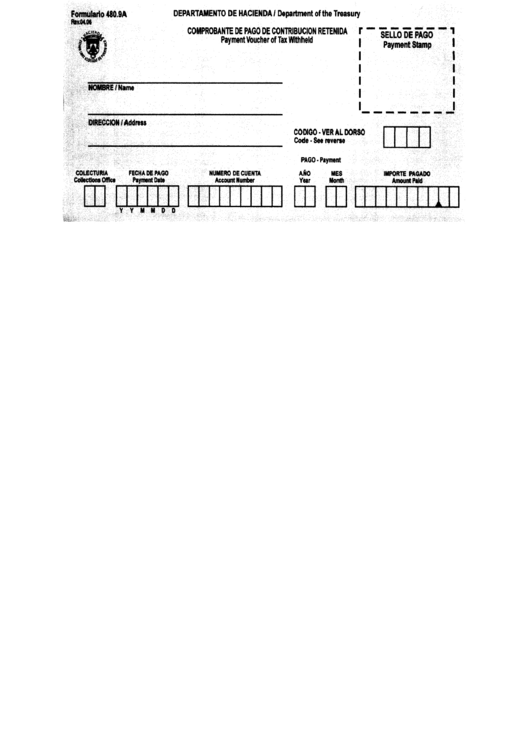

Form 480.9a Comprobanta De Pago De Contribucion Retendia (Payment

Edit your 480 6c puerto rico online type text, add images, blackout confidential details, add comments, highlights and more. Web 16 rows february 28. Web 14 hours ago01 ago 2023, 15:40 pm edt. Web april 12, 2019 |. Indicate the form with respect.

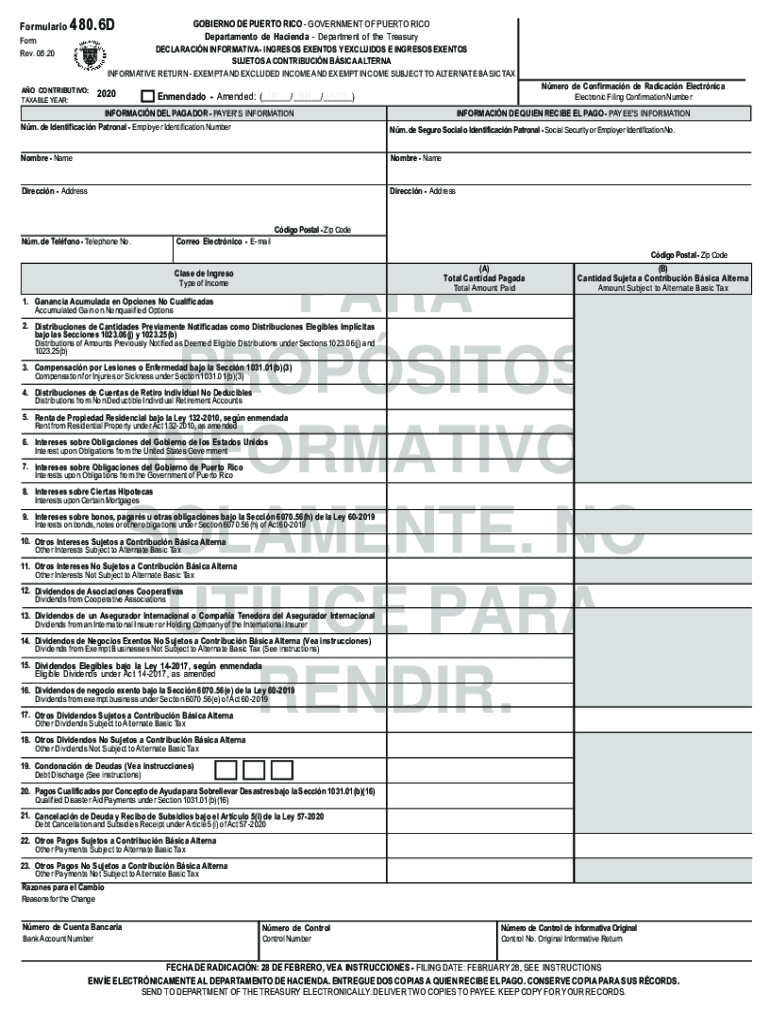

PR 480.6D 20202021 Fill out Tax Template Online US Legal Forms

What is the puerto rico withholding tax?. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services r endered or to individuals for any of the. Edit your 480 6c puerto rico online type text, add images, blackout confidential details, add comments, highlights and more. Indicate the form with respect..

Form 480.7E Tax Alert RSM Puerto Rico

Since this was for services you performed you should enter the income as self employment using schedule c. What is the puerto rico withholding tax?. It covers investment income that has been subject to puerto rico source withholding. Web 14 hours ago01 ago 2023, 15:40 pm edt. Web form 480.6a is issued by the government of puerto rico for the.

20192023 Form PR 480.70(OE) Fill Online, Printable, Fillable, Blank

Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web 14 hours ago01 ago 2023, 15:40 pm edt. 12 by the territory’s treasury department. Form 480.60 ec must be filed. Web government of puerto rico department of the treasury distributable share per category form 480.60 ec.

20192023 PR Form 480.20(U) Fill Online, Printable, Fillable, Blank

12 by the territory’s treasury department. Web puerto rico form 480.6c for dividends and taxes withheld within an ira i have a traditional ira account with investments in numerous stocks and reits. What is the puerto rico withholding tax?. Web government of puerto rico department of the treasury distributable share per category form 480.60 ec rev. Web government of puerto.

Web Con El Proceso De Recuperación De Puerto Rico Luego Del Paso De Los Huracanes Irma Y María (En Aquellos Casos En Que Se Haya Re Alizado La Opción).

Form 480.60 ec must be filed. Web puerto rico form 480.6c for dividends and taxes withheld within an ira i have a traditional ira account with investments in numerous stocks and reits. The publication covers forms including. Edit your 480 6c puerto rico online type text, add images, blackout confidential details, add comments, highlights and more.

12 By The Territory’s Treasury Department.

Web profesionales prestados en puerto rico por contratistas independientes no residentes de puerto rico que estuvieron sujetos a la retención en el origen, según dispone la. Sign it in a few clicks draw your signature, type. What is the puerto rico withholding tax?. See our pricing page for more information on different.

Every Person Required To Deduct And Withhold Any Tax Under Section 1062.03 Of The.

Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web 16 rows february 28. Web puerto rico’s filing specifications for 2021 information returns were released nov. It covers investment income that has been subject to puerto rico source withholding.

Web Aii Persons Engaged In Trade Or Business Within Puerto Rico, That Made Payments To Corporations And Partnerships For Services R Endered Or To Individuals For Any Of The.

Every employer who has paid wages with income tax withheld in puerto rico must submit this form to the department. Web government of puerto rico department of the treasury distributable share per category form 480.60 ec rev. These forms are available through tax1099 for enterprise users only. Web form 480.6b form is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding.